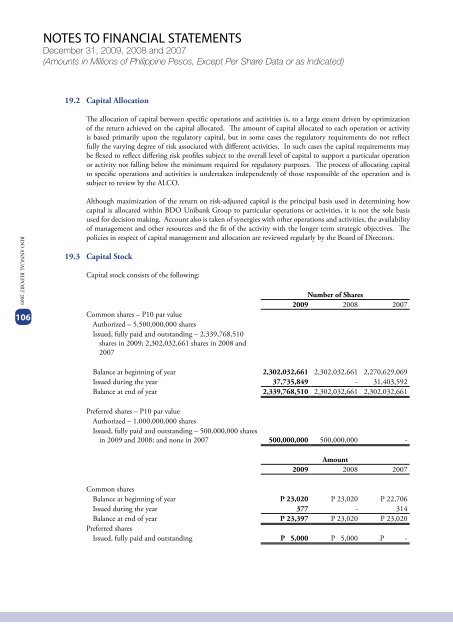

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)19.2 Capital AllocationThe allocation of capital between specific operations and activities is, to a large extent driven by optimizationof the return achieved on the capital allocated. The amount of capital allocated to each operation or activityis based primarily upon the regulatory capital, but in some cases the regulatory requirements do not reflectfully the varying degree of risk associated with different activities. In such cases the capital requirements maybe flexed to reflect differing risk profiles subject to the overall level of capital to support a particular operationor activity not falling below the minimum required for regulatory purposes. The process of allocating capitalto specific operations and activities is undertaken independently of those responsible of the operation and issubject to review by the ALCO.<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>106Although maximization of the return on risk-adjusted capital is the principal basis used in determining howcapital is allocated within <strong>BDO</strong> Unibank Group to particular operations or activities, it is not the sole basisused for decision making. Account also is taken of synergies with other operations and activities, the availabilityof management and other resources and the fit of the activity with the longer term strategic objectives. Thepolicies in respect of capital management and allocation are reviewed regularly by the Board of Directors.19.3 Capital StockCapital stock consists of the following:Common shares – P10 par valueAuthorized – 5,500,000,000 sharesIssued, fully paid and outstanding – 2,339,768,510shares in <strong>2009</strong>; 2,302,032,661 shares in 2008 and2007Number of Shares<strong>2009</strong> 2008 2007Balance at beginning of year 2,302,032,661 2,302,032,661 2,270,629,069Issued during the year 37,735,849 - 31,403,592Balance at end of year 2,339,768,510 2,302,032,661 2,302,032,661Preferred shares – P10 par valueAuthorized – 1,000,000,000 sharesIssued, fully paid and outstanding – 500,000,000 sharesin <strong>2009</strong> and 2008; and none in 2007 500,000,000 500,000,000 -Amount<strong>2009</strong> 2008 2007Common sharesBalance at beginning of year P 23,020 P 23,020 P 22,706Issued during the year 377 - 314Balance at end of year P 23,397 P 23,020 P 23,020Preferred sharesIssued, fully paid and outstanding P 5,000 P 5,000 P -

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)In <strong>2009</strong>, the Parent Bank issued to GE Capital International Holdings Corporation (GE Capital) 37,735,849common shares worth P377 in line with the latter’s strategic investment in the Parent Bank (see Note 26.3).On August 30, 2008, the Board of Directors approved the issuance of up to 500,000,000 perpetual, voting,non-cumulative, convertible, non-participating, peso-denominated Series A preferred shares qualifying asTier 1 capital of <strong>BDO</strong> Unibank Group. The conversion right is at the option of the holder after three yearsfrom the issue date or at the option of <strong>BDO</strong> Unibank Group at any time after issue date upon the occurrenceof certain trigger events such as: (i) a change in tax status of the preferred shares; or, (ii) the preferred shares donot qualify as Tier 1 capital of <strong>BDO</strong> Unibank Group as determined by the BSP or other applicable laws andregulations. Dividend rate is at 6.5% per annum of the par value. Subsequently, on September 30, 2008, theBank issued 500,000,000 preferred shares at P10 per share or a total value of P5,000.19.4 Increase in Authorized Capital StockOn November 6, 2006 and December 27, 2006, the Board of Directors and stockholders, respectively, approvedthe increase in the Parent Bank’s authorized capital stock from P15,000 divided into 1,015,000,000 commonshares with a par value of P10 per share and 485,000,000 preferred shares with a par value of P10 per shareto P65,000 divided into 5,500,000,000 common shares with a par value of P10 per share and 1,000,000,000preferred shares with a par value of P10 per share, subject to the approval of the BSP and the SEC. The increasein the Parent Bank’s authorized capital stock was filed with the BSP and SEC on January 8, 2007. Subsequently,this was approved by the BSP and the SEC on March 29, 2007 and May 25, 2007, respectively.19.5 Issuance of Global Depositary Receipts by PrimebridgeOn various dates in 2006, Primebridge Holdings, Inc. (Primebridge), a stockholder owning 22.1% of theParent Bank’s total outstanding shares as of December 31, 2005, offered and sold in aggregate 9,399,700 globaldepositary receipts (GDRs) with each GDR representing 20 shares of the Parent Bank’s common stock.<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>107The GDRs constitute an offering in the United States only to qualified institutional buyers in reliance onRule 144A under the US Securities Act of 1993 (the Securities Act) and an offering outside the UnitedStates in reliance on Regulation under the Securities Act. The offered price for each GDR was US$12.70 onJanuary 25, 2006 and February 14, 2006; and US$14.55 on May 15, 2006. The GDRs are listed and are beingtraded at the London Stock Exchange.As part of the offering, Primebridge, while remaining as the registered holder of the <strong>BDO</strong> Unibank Groupshares underlying the GDRs, transferred all rights and interests in the Bank’s shares underlying the GDRs tothe depository on behalf of the holders of the GDRs and the latter are entitled to receive dividends paid on theshares. However, GDR holders have no voting rights or other direct rights of a shareholder with respect to theParent Bank’s shares.As of December 31, 2006, 4,724,214 GDRs issued, covering shares originally held by Primebridge, wereconverted into 94,484,280 shares of the Parent Bank. As of December 31, <strong>2009</strong>, 699,382 GDRs equivalent to13,987,640 shares of the Parent Bank remained unconverted.