2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

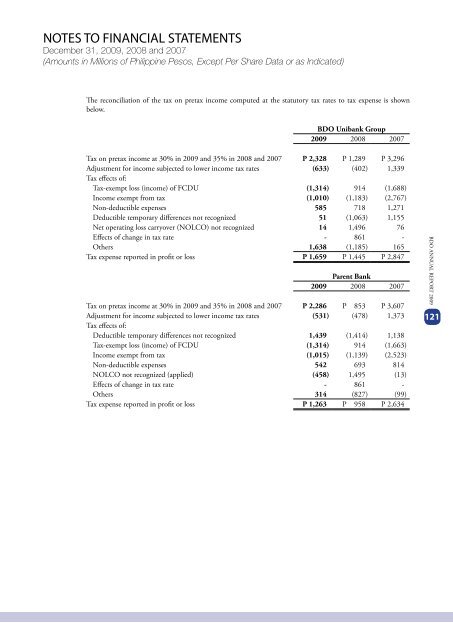

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)The reconciliation of the tax on pretax income computed at the statutory tax rates to tax expense is shownbelow.<strong>BDO</strong> Unibank Group<strong>2009</strong> 2008 2007Tax on pretax income at 30% in <strong>2009</strong> and 35% in 2008 and 2007 P 2,328 P 1,289 P 3,296Adjustment for income subjected to lower income tax rates (633) (402) 1,339Tax effects of:Tax-exempt loss (income) of FCDU (1,314) 914 (1,688)Income exempt from tax (1,010) (1,183) (2,767)Non-deductible expenses 585 718 1,271Deductible temporary differences not recognized 51 (1,063) 1,155Net operating loss carryover (NOLCO) not recognized 14 1,496 76Effects of change in tax rate - 861 -Others 1,638 (1,185) 165Tax expense reported in profit or loss P 1,659 P 1,445 P 2,847Parent Bank<strong>2009</strong> 2008 2007Tax on pretax income at 30% in <strong>2009</strong> and 35% in 2008 and 2007 P 2,286 P 853 P 3,607Adjustment for income subjected to lower income tax rates (531) (478) 1,373Tax effects of:Deductible temporary differences not recognized 1,439 (1,414) 1,138Tax-exempt loss (income) of FCDU (1,314) 914 (1,663)Income exempt from tax (1,015) (1,139) (2,523)Non-deductible expenses 542 693 814NOLCO not recognized (applied) (458) 1,495 (13)Effects of change in tax rate - 861 -Others 314 (827) (99)Tax expense reported in profit or loss P 1,263 P 958 P 2,634<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>121