2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

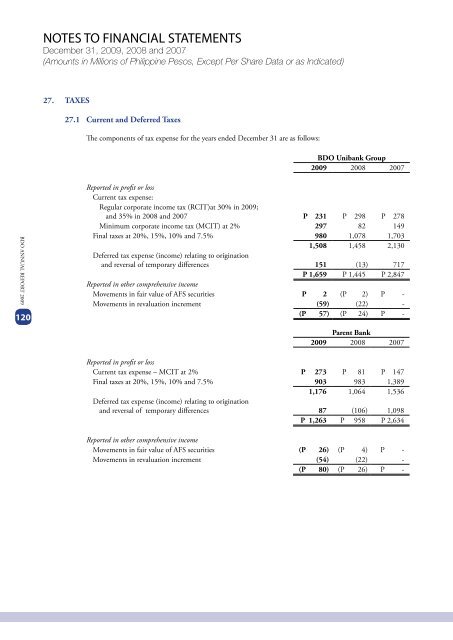

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)27. TAXES27.1 Current and Deferred TaxesThe components of tax expense for the years ended December 31 are as follows:<strong>BDO</strong> Unibank Group<strong>2009</strong> 2008 2007<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>120Reported in profit or lossCurrent tax expense:Regular corporate income tax (RCIT)at 30% in <strong>2009</strong>;and 35% in 2008 and 2007 P 231 P 298 P 278Minimum corporate income tax (MCIT) at 2% 297 82 149Final taxes at 20%, 15%, 10% and 7.5% 980 1,078 1,7031,508 1,458 2,130Deferred tax expense (income) relating to originationand reversal of temporary differences 151 (13) 717P 1,659 P 1,445 P 2,847Reported in other comprehensive incomeMovements in fair value of AFS securities P 2 (P 2) P -Movements in revaluation increment (59) (22) -(P 57) (P 24) P -Parent Bank<strong>2009</strong> 2008 2007Reported in profit or lossCurrent tax expense – MCIT at 2% P 273 P 81 P 147Final taxes at 20%, 15%, 10% and 7.5% 903 983 1,3891,176 1,064 1,536Deferred tax expense (income) relating to originationand reversal of temporary differences 87 (106) 1,098P 1,263 P 958 P 2,634Reported in other comprehensive incomeMovements in fair value of AFS securities (P 26) (P 4) P -Movements in revaluation increment (54) (22) -(P 80) (P 26) P -