Outlook for Air Transport to the Year 2025 - FILT CGIL Foggia

Outlook for Air Transport to the Year 2025 - FILT CGIL Foggia

Outlook for Air Transport to the Year 2025 - FILT CGIL Foggia

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

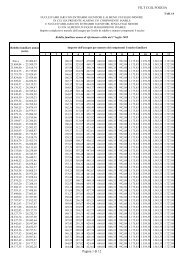

Chapter 4. <strong>Air</strong>line Financial Trends 2984<strong>Air</strong>line unit cost(left-hand scale)9060Change in cost/ATK (%)0–4300Change in fuel price (%)–8Fuel price(right-hand scale)–30–12–601975 78 81 84 87 90 93 96 99 2002 2005Source: ICAO Reporting Forms A and EF, US Department of Energy.Note.— Excluding domestic operations of airlines registered in <strong>the</strong> Russian Federation prior <strong>to</strong> 1996.Figure 4-4. Changes in unit operating costs ofscheduled airlines and fuel prices — World (1975–2005)(U.S. cents per ATK in real terms)6. <strong>Air</strong>line operating costs are heavily influenced by jet fuel prices. Due <strong>to</strong> large increases in oil prices in1979, unit costs rose sharply in 1980 with fuel costs accounting <strong>for</strong> almost 29 per cent of <strong>the</strong> <strong>to</strong>tal costs ofscheduled airlines. Unit costs declined during <strong>the</strong> period 1982–1985 partly as a result of declining fuel prices. Theshare of aircraft fuel and oil costs in <strong>to</strong>tal operating costs varies in tandem with fuel prices as illustrated inFigure 4-5, Following <strong>the</strong> sharp increases in oil prices in <strong>the</strong> years 2004 and 2005, <strong>the</strong> share of fuel and oil costsregained its 1985 level after remaining confined within <strong>the</strong> 10 <strong>to</strong> 15 per cent range over <strong>the</strong> period in between In<strong>the</strong> absence of hedging, short-term variations in fuel prices would have an immediate impact on unit costs <strong>for</strong>cing<strong>the</strong> airlines <strong>to</strong> look <strong>for</strong> alternative cost reduction measures or pass <strong>the</strong> costs <strong>to</strong> <strong>the</strong> passenger through higher fares.In <strong>the</strong> long term, fuel prices are expected <strong>to</strong> remain within <strong>the</strong> range of 40 <strong>to</strong> 60 dollars per barrel and <strong>the</strong>irpressure on costs is expected <strong>to</strong> remain at its current level. In addition <strong>to</strong> aircraft fuel costs, o<strong>the</strong>r fac<strong>to</strong>rs that havean important impact on unit costs include aircraft utilization and capacity.Operating revenues and expenses by category and region7. When comparing 1985 and 2005, as presented in Table 4-3, <strong>the</strong> share of revenues from scheduled servicesdeclined more than 3 percentage points and accounted <strong>for</strong> nearly 87 per cent of <strong>to</strong>tal operating revenues in 2005,while that of incidental revenues (which cover sales of services and maintenance, leasing of aircraft <strong>to</strong> o<strong>the</strong>r airlinesand o<strong>the</strong>r non-core transport-related activities) jumped <strong>to</strong> 10 per cent. But this distribution has broadly been about<strong>the</strong> same since <strong>the</strong> early 1990s.