Global Asset Management is recognised as:- a major player on the emerging markets;- one of the world’s leading distributors of mutual funds, with a range of funds fromdeveloped to emerging markets and includes equity, fixed-income, diversified,alternative, cash and multi-management investment strategies;- an expert in employee savings solutions for companies.Commercial Banking: The Commercial Banking business offers a broad range ofdomestic and international products and services to support a diverse corporatecustomer base, from VSEs to multinational corporations. It draws on:- a local presence in 65 countries and renowned expertise in supporting companies’international development, particularly in emerging markets;- Cash management, trade services, factoring and leasing experts;- a domestic network specialised by customer sizes and profiles, including 10Corporate Banking Centres, 51 "Centres d’Affaires Entreprises" dedicated to SMEsand 15 dedicated "Pôles Entrepreneurs" to VSEs (very small enterprises);- direct branches for VSEs and Small and <strong>Medium</strong> Associations.Global Banking and Markets: <strong>HSBC</strong>’s global and local scale mean that it is areference in terms of supporting large companies and institutions in their projects andoperations in <strong>France</strong> and internationally, thanks to the presence in some 30 countries.<strong>HSBC</strong> offers a comprehensive range of solutions, including:- corporate finance: commercial banking, payment and cash management, leveragedacquisition finance, property and structured finance;- investment banking: mergers and acquisitions, initial public offering (IPO), capitalincreases;- markets: including Fixed-Income, Currencies and Equity activities. Paris is one ofthe <strong>HSBC</strong> Group’s four hubs (alongside London, Hong Kong and New York) and theGroup’s Centre of excellence for three activities: derivatives rates, euro rates andstructured equity.Private Banking: <strong>HSBC</strong> Private Bank offers its high-net-worth customers in <strong>France</strong>and abroad a range of tailored products and services, through:- the expertise of the discretionary and advisory management teams;- a vast international network operating in 37 countries and territories;- major synergies with other <strong>HSBC</strong> <strong>France</strong> businesses, particularly with CommercialBanking and Corporate and Investment Banking.B.16 Extent towhich theIssuer isdirectly orindirectlyowned orcontrolledB.17 Credit ratingsassigned to the<strong>HSBC</strong> Bank plc, headquartered in London, holds 99.99% of <strong>HSBC</strong> <strong>France</strong> sharecapital and voting rights. <strong>HSBC</strong> Bank plc is a 100% subsidiary of <strong>HSBC</strong> Holdingsplc, the holding company for the <strong>HSBC</strong> Group, one of the world's largest bankingand financial services organisations[Not applicable, the <strong>Note</strong>s have not been rated.] / [The <strong>Note</strong>s to be issued have beenrated [●] by [●] [and [●] by [●]].12

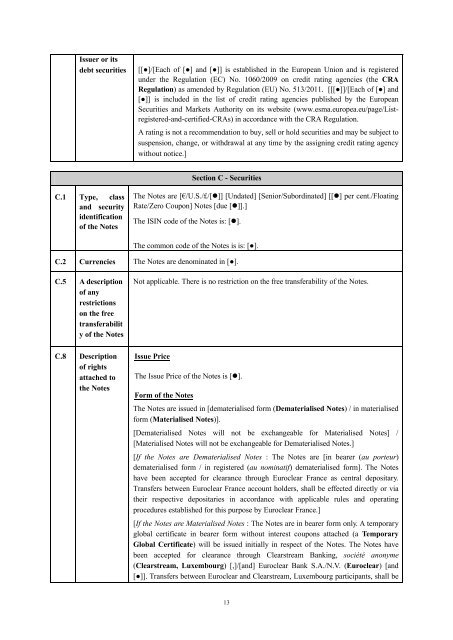

Issuer or itsdebt securities[[●]/[Each of [●] and [●]] is established in the <strong>Euro</strong>pean Union and is registeredunder the Regulation (EC) No. 1060/<strong>20</strong>09 on credit rating agencies (the CRARegulation) as amended by Regulation (EU) No. 513/<strong>20</strong>11. [[[●]]/[Each of [●] and[●]] is included in the list of credit rating agencies published by the <strong>Euro</strong>peanSecurities and Markets Authority on its website (www.esma.europea.eu/page/Listregistered-and-certified-CRAs)in accordance with the CRA Regulation.A rating is not a recommendation to buy, sell or hold securities and may be subject tosuspension, change, or withdrawal at any time by the assigning credit rating agencywithout notice.]Section C - SecuritiesC.1 Type, classand securityidentificationof the <strong>Note</strong>sThe <strong>Note</strong>s are [€/U.S./£/[•]] [Undated] [Senior/Subordinated] [[•] per cent./FloatingRate/Zero Coupon] <strong>Note</strong>s [due [•]].]The ISIN code of the <strong>Note</strong>s is: [•].The common code of the <strong>Note</strong>s is is: [●].C.2 Currencies The <strong>Note</strong>s are denominated in [●].C.5 A descriptionof anyrestrictionson the freetransferability of the <strong>Note</strong>sNot applicable. There is no restriction on the free transferability of the <strong>Note</strong>s.C.8 Descriptionof rightsattached tothe <strong>Note</strong>sIssue PriceThe Issue Price of the <strong>Note</strong>s is [•].Form of the <strong>Note</strong>sThe <strong>Note</strong>s are issued in [dematerialised form (Dematerialised <strong>Note</strong>s) / in materialisedform (Materialised <strong>Note</strong>s)].[Dematerialised <strong>Note</strong>s will not be exchangeable for Materialised <strong>Note</strong>s] /[Materialised <strong>Note</strong>s will not be exchangeable for Dematerialised <strong>Note</strong>s.][If the <strong>Note</strong>s are Dematerialised <strong>Note</strong>s : The <strong>Note</strong>s are [in bearer (au porteur)dematerialised form / in registered (au nominatif) dematerialised form]. The <strong>Note</strong>shave been accepted for clearance through <strong>Euro</strong>clear <strong>France</strong> as central depositary.Transfers between <strong>Euro</strong>clear <strong>France</strong> account holders, shall be effected directly or viatheir respective depositaries in accordance with applicable rules and operatingprocedures established for this purpose by <strong>Euro</strong>clear <strong>France</strong>.][If the <strong>Note</strong>s are Materialised <strong>Note</strong>s : The <strong>Note</strong>s are in bearer form only. A temporaryglobal certificate in bearer form without interest coupons attached (a TemporaryGlobal Certificate) will be issued initially in respect of the <strong>Note</strong>s. The <strong>Note</strong>s havebeen accepted for clearance through Clearstream Banking, société anonyme(Clearstream, Luxembourg) [,]/[and] <strong>Euro</strong>clear Bank S.A./N.V. (<strong>Euro</strong>clear) [and[●]]. Transfers between <strong>Euro</strong>clear and Clearstream, Luxembourg participants, shall be13

- Page 1 and 2: Base Prospectus dated 14 December 2

- Page 3 and 4: The Arranger and the Dealers have n

- Page 5: Other than as set out above, neithe

- Page 8 and 9: actions of any Authorised Offeror,

- Page 10 and 11: Notes 30 June 2012 30 June 2011(in

- Page 14 and 15: effected directly or via their resp

- Page 16 and 17: specifies “Contractual Masse”,

- Page 18 and 19: continuity of such market if one de

- Page 20 and 21: RESUME EN FRANÇAIS DU PROGRAMMELes

- Page 22 and 23: au sein duGroupeB.9 Prévision oues

- Page 24 and 25: à l’Emetteurprésentant unintér

- Page 26 and 27: titre du Règlement (CE) N° 1060/2

- Page 28 and 29: C.9 Intérêts,échéance etmodalit

- Page 30 and 31: · Le risque de liquidité : se dé

- Page 32 and 33: E.2bRaisons del’offre etutilisati

- Page 34 and 35: 2. Risks related to the structure o

- Page 36 and 37: The European Commission intends in

- Page 38 and 39: any Note as a result of the imposit

- Page 40 and 41: addition, certain proposals contain

- Page 42 and 43: Government and monetary authorities

- Page 44 and 45: DOCUMENTS INCORPORATED BY REFERENCE

- Page 46 and 47: INFORMATION INCORPORATED BY REFEREN

- Page 48 and 49: SUPPLEMENT TO THE BASE PROSPECTUSIf

- Page 50 and 51: interest, if any, payable thereunde

- Page 52 and 53: (i)(ii)(iii)on the same basis as th

- Page 54 and 55: circumstances in which the Notes wi

- Page 56 and 57: Noteholder or in fully registered f

- Page 58 and 59: accordance with Condition 15. Any b

- Page 60 and 61: For the purposes of these Condition

- Page 62 and 63:

The fraction is:If dd2 = 31and dd1

- Page 64 and 65:

Interest Period Date means each Int

- Page 66 and 67:

For the purposes of this sub-paragr

- Page 68 and 69:

Date shall be the Early Redemption

- Page 70 and 71:

Redemption Amount to be notified to

- Page 72 and 73:

To exercise such option or any othe

- Page 74 and 75:

(g)CancellationAll Notes purchased

- Page 76 and 77:

(including Luxembourg so long as th

- Page 78 and 79:

2000 on the taxation of savings inc

- Page 80 and 81:

The Masse alone, to the exclusion o

- Page 82 and 83:

In accordance with Article R.228-71

- Page 84 and 85:

(c)Any notice given by publication

- Page 86:

RECENT DEVELOPMENTSOn 11 December 2

- Page 89 and 90:

In the case of Materialised Notes w

- Page 91 and 92:

a bank account opened in a financia

- Page 93 and 94:

CorporationsThere is no withholding

- Page 95 and 96:

2012 [and the supplement[s] to the

- Page 97 and 98:

(ii) Interest Payment Date(s): [•

- Page 99 and 100:

(ii) Day Count Fraction: [Actual/Ac

- Page 101 and 102:

Masse) applies, insert below detail

- Page 103 and 104:

PART B - OTHER INFORMATION1. LISTIN

- Page 105 and 106:

5. Fixed Rate Notes only - YIELD[No

- Page 107 and 108:

the public the amount of the offer:

- Page 109 and 110:

[ANNEX -ISSUE SPECIFIC SUMMARY][ins

- Page 111 and 112:

SUBSCRIPTION AND SALESubject to the

- Page 113 and 114:

of the Issuer of any of its content

- Page 115 and 116:

For the purposes of this provision,

- Page 117 and 118:

AndorraAny investor purchasing the

- Page 119 and 120:

france/entreprises-institutionnels/