HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

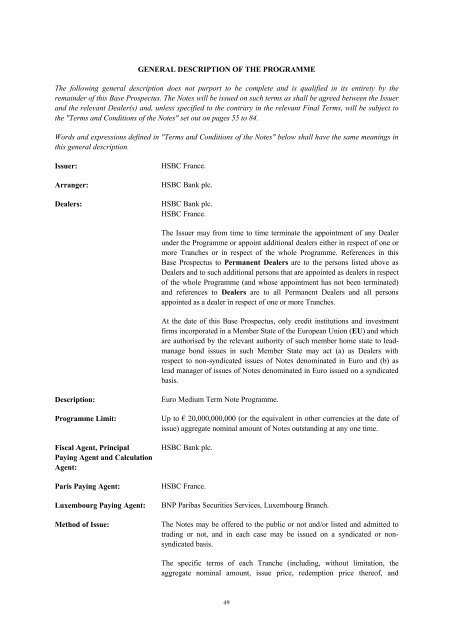

GENERAL DESCRIPTION OF THE PROGRAMMEThe following general description does not purport to be complete and is qualified in its entirety by theremainder of this Base Prospectus. The <strong>Note</strong>s will be issued on such terms as shall be agreed between the Issuerand the relevant Dealer(s) and, unless specified to the contrary in the relevant Final <strong>Term</strong>s, will be subject tothe "<strong>Term</strong>s and Conditions of the <strong>Note</strong>s" set out on pages 55 to 84.Words and expressions defined in "<strong>Term</strong>s and Conditions of the <strong>Note</strong>s" below shall have the same meanings inthis general description.Issuer:Arranger:Dealers:<strong>HSBC</strong> <strong>France</strong>.<strong>HSBC</strong> Bank plc.<strong>HSBC</strong> Bank plc.<strong>HSBC</strong> <strong>France</strong>.The Issuer may from time to time terminate the appointment of any Dealerunder the <strong>Programme</strong> or appoint additional dealers either in respect of one ormore Tranches or in respect of the whole <strong>Programme</strong>. References in thisBase Prospectus to Permanent Dealers are to the persons listed above asDealers and to such additional persons that are appointed as dealers in respectof the whole <strong>Programme</strong> (and whose appointment has not been terminated)and references to Dealers are to all Permanent Dealers and all personsappointed as a dealer in respect of one or more Tranches.At the date of this Base Prospectus, only credit institutions and investmentfirms incorporated in a Member State of the <strong>Euro</strong>pean Union (EU) and whichare authorised by the relevant authority of such member home state to leadmanagebond issues in such Member State may act (a) as Dealers withrespect to non-syndicated issues of <strong>Note</strong>s denominated in <strong>Euro</strong> and (b) aslead manager of issues of <strong>Note</strong>s denominated in <strong>Euro</strong> issued on a syndicatedbasis.Description:<strong>Programme</strong> Limit:Fiscal Agent, PrincipalPaying Agent and CalculationAgent:Paris Paying Agent:Luxembourg Paying Agent:Method of Issue:<strong>Euro</strong> <strong>Medium</strong> <strong>Term</strong> <strong>Note</strong> <strong>Programme</strong>.Up to € <strong>20</strong>,<strong>000</strong>,<strong>000</strong>,<strong>000</strong> (or the equivalent in other currencies at the date ofissue) aggregate nominal amount of <strong>Note</strong>s outstanding at any one time.<strong>HSBC</strong> Bank plc.<strong>HSBC</strong> <strong>France</strong>.BNP Paribas Securities Services, Luxembourg Branch.The <strong>Note</strong>s may be offered to the public or not and/or listed and admitted totrading or not, and in each case may be issued on a syndicated or nonsyndicatedbasis.The specific terms of each Tranche (including, without limitation, theaggregate nominal amount, issue price, redemption price thereof, and49