effected directly or via their respective depositaries in accordance with applicable rulesand operating procedures established for this purpose by <strong>Euro</strong>clear and Clearstream,Luxembourg,]Status of the <strong>Note</strong>s[(Insert if the <strong>Note</strong>s constitute Unsubordinated <strong>Note</strong>s) The <strong>Note</strong>s and, whereapplicable, any relative Coupons, will constitute direct, unconditional, unsubordinatedand unsecured obligations of the Issuer and will rank pari passu without anypreference among themselves and (subject to such exceptions as are from time to timemandatory under French law) pari passu with all other present or future unsecuredand unsubordinated obligations of the Issuer.][(Insert if the <strong>Note</strong>s constitute Subordinated <strong>Note</strong>s) The <strong>Note</strong>s will constitute direct,unconditional, unsecured [(Insert if the <strong>Note</strong>s are Undated Subordinated <strong>Note</strong>s)undated] and subordinated obligations of the Issuer and will rank pari passu withoutany preference among themselves and pari passu with all other present or futureunsecured and subordinated obligations of the Issuer with the exceptions of the prêtsparticipatifs granted to the Issuer and titres participatifs issued by the Issuer.The relevant Final <strong>Term</strong>s may state that Subordinated <strong>Note</strong>s will be eligible as [UpperTier 2] / [Lower Tier 2] / [Tier 3 Capital].[(Insert in the case of Undated Subordinated <strong>Note</strong>s) The payment of interest in respectof <strong>Note</strong>s may be deferred in accordance with the provisions of Condition 6(f).]]Negative pledgeThere is no negative pledge.Event of DefaultThe <strong>Note</strong>s may become due and payable at their principal amount together with anyaccrued interest thereon if the Issuer [(in case of Unsubordinated <strong>Note</strong>s), (a) is indefault in the payment of the principal or interest of the <strong>Note</strong>s (under certainconditions), (b) is in default of performance of any of its obligations under the <strong>Note</strong>s(under certain conditions), (c) sells, transfers or otherwise disposes of directly orindirectly, the whole or a substantial part of its assets, or the Issuer enters intovoluntary liquidation, subject to certain exceptions and (d) applies for or is subjectapplies for or is subject to the appointment of an ad hoc representative (mandataire adhoc) or has applied to enter into a conciliation procedure (procédure de conciliation)or into an accelerated financial safeguard procedure (procédure de sauvegardefinancière accélérée) or into a safeguard procedure (procédure de sauvegarde) or ajudgement is rendered for its judicial liquidation (liquidation judiciaire) or for atransfer of the whole of the business (cession totale de l'entreprise) or makes anyconveyance for the benefit of, or enters into any agreement with, its creditors] / [(incase of Subordinated <strong>Note</strong>s), if any judgment shall be used for the judicial liquidation(liquidation judiciaire) of the Issuer or if the Issuer is liquidated for any other reason.]Withholding taxAll payments of principal and interest by or on behalf of the Issuer in respect of the<strong>Note</strong>s will be made free and clear of, and without withholding or deduction for, anytaxes, duties, assessments or governmental charges of whatever nature imposed,levied, collected, withheld or assessed by or within <strong>France</strong> or any authority therein orthereof having power to tax, unless such withholding or deduction is required by law.14

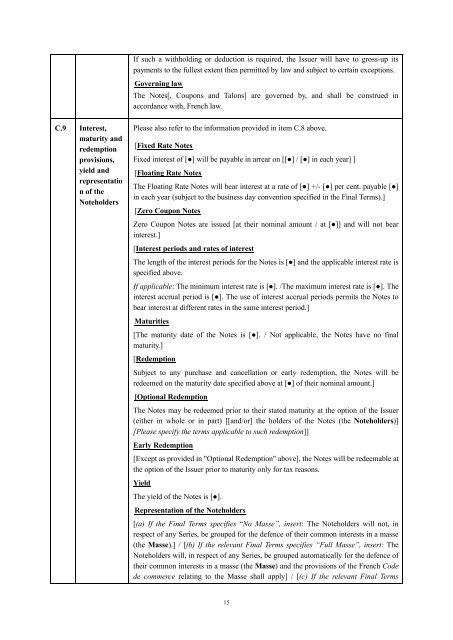

If such a withholding or deduction is required, the Issuer will have to gross-up itspayments to the fullest extent then permitted by law and subject to certain exceptions.Governing lawThe <strong>Note</strong>s[, Coupons and Talons] are governed by, and shall be construed inaccordance with, French law.C.9 Interest,maturity andredemptionprovisions,yield andrepresentation of the<strong>Note</strong>holdersPlease also refer to the information provided in item C.8 above.[Fixed Rate <strong>Note</strong>sFixed interest of [●] will be payable in arrear on [[●] / [●] in each year] ][Floating Rate <strong>Note</strong>sThe Floating Rate <strong>Note</strong>s will bear interest at a rate of [●] +/- [●] per cent. payable [●]in each year (subject to the business day convention specified in the Final <strong>Term</strong>s).][Zero Coupon <strong>Note</strong>sZero Coupon <strong>Note</strong>s are issued [at their nominal amount / at [●]] and will not bearinterest.][Interest periods and rates of interestThe length of the interest periods for the <strong>Note</strong>s is [●] and the applicable interest rate isspecified above.If applicable: The minimum interest rate is [●]. /The maximum interest rate is [●]. Theinterest accrual period is [●]. The use of interest accrual periods permits the <strong>Note</strong>s tobear interest at different rates in the same interest period.]Maturities[The maturity date of the <strong>Note</strong>s is [●]. / Not applicable, the <strong>Note</strong>s have no finalmaturity.][RedemptionSubject to any purchase and cancellation or early redemption, the <strong>Note</strong>s will beredeemed on the maturity date specified above at [●] of their nominal amount.][Optional RedemptionThe <strong>Note</strong>s may be redeemed prior to their stated maturity at the option of the Issuer(either in whole or in part) [[and/or] the holders of the <strong>Note</strong>s (the <strong>Note</strong>holders)][Please specify the terms applicable to such redemption]]Early Redemption[Except as provided in "Optional Redemption" above], the <strong>Note</strong>s will be redeemable atthe option of the Issuer prior to maturity only for tax reasons.YieldThe yield of the <strong>Note</strong>s is [●].Representation of the <strong>Note</strong>holders[(a) If the Final <strong>Term</strong>s specifies “No Masse”, insert: The <strong>Note</strong>holders will not, inrespect of any Series, be grouped for the defence of their common interests in a masse(the Masse).] / [(b) If the relevant Final <strong>Term</strong>s specifies “Full Masse”, insert: The<strong>Note</strong>holders will, in respect of any Series, be grouped automatically for the defence oftheir common interests in a masse (the Masse) and the provisions of the French Codede commerce relating to the Masse shall apply] / [(c) If the relevant Final <strong>Term</strong>s15

- Page 1 and 2: Base Prospectus dated 14 December 2

- Page 3 and 4: The Arranger and the Dealers have n

- Page 5: Other than as set out above, neithe

- Page 8 and 9: actions of any Authorised Offeror,

- Page 10 and 11: Notes 30 June 2012 30 June 2011(in

- Page 12 and 13: Global Asset Management is recognis

- Page 16 and 17: specifies “Contractual Masse”,

- Page 18 and 19: continuity of such market if one de

- Page 20 and 21: RESUME EN FRANÇAIS DU PROGRAMMELes

- Page 22 and 23: au sein duGroupeB.9 Prévision oues

- Page 24 and 25: à l’Emetteurprésentant unintér

- Page 26 and 27: titre du Règlement (CE) N° 1060/2

- Page 28 and 29: C.9 Intérêts,échéance etmodalit

- Page 30 and 31: · Le risque de liquidité : se dé

- Page 32 and 33: E.2bRaisons del’offre etutilisati

- Page 34 and 35: 2. Risks related to the structure o

- Page 36 and 37: The European Commission intends in

- Page 38 and 39: any Note as a result of the imposit

- Page 40 and 41: addition, certain proposals contain

- Page 42 and 43: Government and monetary authorities

- Page 44 and 45: DOCUMENTS INCORPORATED BY REFERENCE

- Page 46 and 47: INFORMATION INCORPORATED BY REFEREN

- Page 48 and 49: SUPPLEMENT TO THE BASE PROSPECTUSIf

- Page 50 and 51: interest, if any, payable thereunde

- Page 52 and 53: (i)(ii)(iii)on the same basis as th

- Page 54 and 55: circumstances in which the Notes wi

- Page 56 and 57: Noteholder or in fully registered f

- Page 58 and 59: accordance with Condition 15. Any b

- Page 60 and 61: For the purposes of these Condition

- Page 62 and 63: The fraction is:If dd2 = 31and dd1

- Page 64 and 65:

Interest Period Date means each Int

- Page 66 and 67:

For the purposes of this sub-paragr

- Page 68 and 69:

Date shall be the Early Redemption

- Page 70 and 71:

Redemption Amount to be notified to

- Page 72 and 73:

To exercise such option or any othe

- Page 74 and 75:

(g)CancellationAll Notes purchased

- Page 76 and 77:

(including Luxembourg so long as th

- Page 78 and 79:

2000 on the taxation of savings inc

- Page 80 and 81:

The Masse alone, to the exclusion o

- Page 82 and 83:

In accordance with Article R.228-71

- Page 84 and 85:

(c)Any notice given by publication

- Page 86:

RECENT DEVELOPMENTSOn 11 December 2

- Page 89 and 90:

In the case of Materialised Notes w

- Page 91 and 92:

a bank account opened in a financia

- Page 93 and 94:

CorporationsThere is no withholding

- Page 95 and 96:

2012 [and the supplement[s] to the

- Page 97 and 98:

(ii) Interest Payment Date(s): [•

- Page 99 and 100:

(ii) Day Count Fraction: [Actual/Ac

- Page 101 and 102:

Masse) applies, insert below detail

- Page 103 and 104:

PART B - OTHER INFORMATION1. LISTIN

- Page 105 and 106:

5. Fixed Rate Notes only - YIELD[No

- Page 107 and 108:

the public the amount of the offer:

- Page 109 and 110:

[ANNEX -ISSUE SPECIFIC SUMMARY][ins

- Page 111 and 112:

SUBSCRIPTION AND SALESubject to the

- Page 113 and 114:

of the Issuer of any of its content

- Page 115 and 116:

For the purposes of this provision,

- Page 117 and 118:

AndorraAny investor purchasing the

- Page 119 and 120:

france/entreprises-institutionnels/