HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

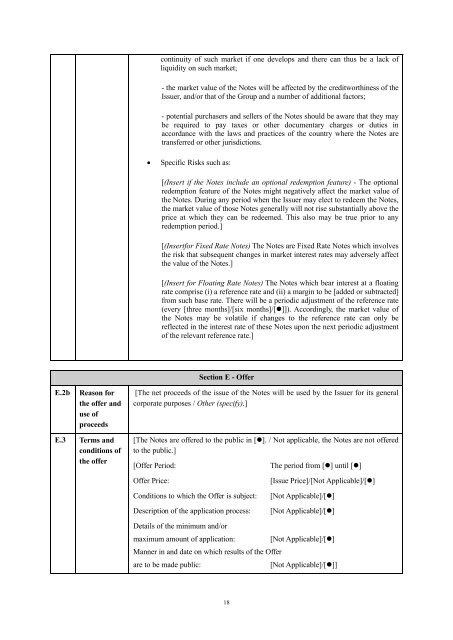

continuity of such market if one develops and there can thus be a lack ofliquidity on such market;- the market value of the <strong>Note</strong>s will be affected by the creditworthiness of theIssuer, and/or that of the Group and a number of additional factors;- potential purchasers and sellers of the <strong>Note</strong>s should be aware that they maybe required to pay taxes or other documentary charges or duties inaccordance with the laws and practices of the country where the <strong>Note</strong>s aretransferred or other jurisdictions.· Specific Risks such as:[(Insert if the <strong>Note</strong>s include an optional redemption feature) - The optionalredemption feature of the <strong>Note</strong>s might negatively affect the market value ofthe <strong>Note</strong>s. During any period when the Issuer may elect to redeem the <strong>Note</strong>s,the market value of those <strong>Note</strong>s generally will not rise substantially above theprice at which they can be redeemed. This also may be true prior to anyredemption period.][(Insertfor Fixed Rate <strong>Note</strong>s) The <strong>Note</strong>s are Fixed Rate <strong>Note</strong>s which involvesthe risk that subsequent changes in market interest rates may adversely affectthe value of the <strong>Note</strong>s.][(Insert for Floating Rate <strong>Note</strong>s) The <strong>Note</strong>s which bear interest at a floatingrate comprise (i) a reference rate and (ii) a margin to be [added or subtracted]from such base rate. There will be a periodic adjustment of the reference rate(every [three months]/[six months]/[•]]). Accordingly, the market value ofthe <strong>Note</strong>s may be volatile if changes to the reference rate can only bereflected in the interest rate of these <strong>Note</strong>s upon the next periodic adjustmentof the relevant reference rate.]E.2bReason forthe offer anduse ofproceedsSection E - Offer[The net proceeds of the issue of the <strong>Note</strong>s will be used by the Issuer for its generalcorporate purposes / Other (specify).]E.3 <strong>Term</strong>s andconditions ofthe offer[The <strong>Note</strong>s are offered to the public in [•]. / Not applicable, the <strong>Note</strong>s are not offeredto the public.][Offer Period:The period from [•] until [•]Offer Price:Conditions to which the Offer is subject:Description of the application process:[Issue Price]/[Not Applicable]/[•][Not Applicable]/[•][Not Applicable]/[•]Details of the minimum and/ormaximum amount of application: [Not Applicable]/[•]Manner in and date on which results of the Offerare to be made public:[Not Applicable]/[•]]18