notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

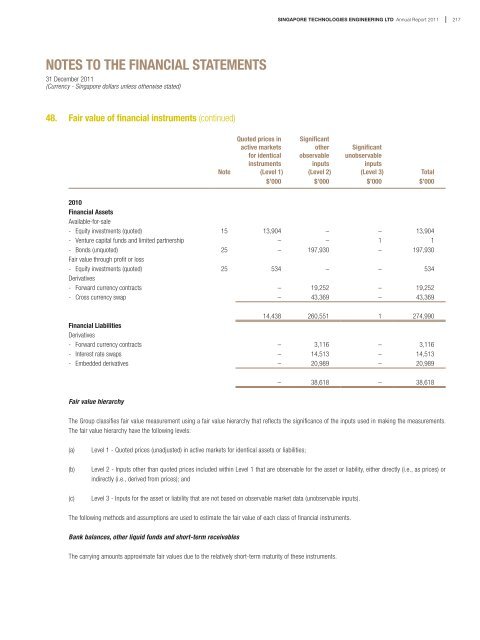

SINGAPORE TECHNOLOGIES ENGINEERING LTD Annual Report 2011217NOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)48. Fair value of <strong>financial</strong> instruments (continued)NoteQuoted prices inactive marketsfor identicalinstruments(Level 1)Significan<strong>to</strong><strong>the</strong>robservableinputs(Level 2)Significantunobservableinputs(Level 3)Total$’000 $’000 $’000 $’0002010Financial AssetsAvailable-for-sale- Equity investments (quoted) 15 13,904 – – 13,904- Venture capital funds and limited partnership – – 1 1- Bonds (unquoted) 25 – 197,930 – 197,930Fair value through profit or loss- Equity investments (quoted) 25 534 – – 534Derivatives- Forward currency contracts – 19,252 – 19,252- Cross currency swap – 43,369 – 43,36914,438 260,551 1 274,990Financial LiabilitiesDerivatives- Forward currency contracts – 3,116 – 3,116- Interest rate swaps – 14,513 – 14,513- Embedded derivatives – 20,989 – 20,989– 38,618 – 38,618Fair value hierarchyThe Group classifies fair value measurement using a fair value hierarchy that reflects <strong>the</strong> significance of <strong>the</strong> inputs used in making <strong>the</strong> measurements.The fair value hierarchy have <strong>the</strong> following levels:(a)(b)(c)Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities;Level 2 - Inputs o<strong>the</strong>r than quoted prices included within Level 1 that are observable for <strong>the</strong> asset or liability, ei<strong>the</strong>r directly (i.e., as prices) orindirectly (i.e., derived from prices); andLevel 3 - Inputs for <strong>the</strong> asset or liability that are not based on observable market data (unobservable inputs).The following methods and assumptions are used <strong>to</strong> estimate <strong>the</strong> fair value of each class of <strong>financial</strong> instruments.Bank balances, o<strong>the</strong>r liquid funds and short-term receivablesThe carrying amounts approximate fair values due <strong>to</strong> <strong>the</strong> relatively short-term maturity of <strong>the</strong>se instruments.