notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

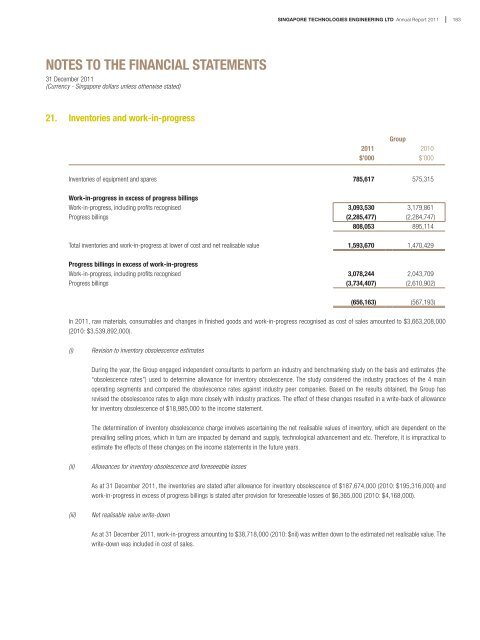

SINGAPORE TECHNOLOGIES ENGINEERING LTD Annual Report 2011183NOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)21. Inven<strong>to</strong>ries and work-in-progressGroup2011 2010$’000 $’000Inven<strong>to</strong>ries of equipment and spares 785,617 575,315Work-in-progress in excess of progress billingsWork-in-progress, including profits recognised 3,093,530 3,179,861Progress billings (2,285,477) (2,284,747)808,053 895,114Total inven<strong>to</strong>ries and work-in-progress at lower of cost and net realisable value 1,593,670 1,470,429Progress billings in excess of work-in-progressWork-in-progress, including profits recognised 3,078,244 2,043,709Progress billings (3,734,407) (2,610,902)(656,163) (567,193)In 2011, raw materials, consumables and changes in finished goods and work-in-progress recognised as cost of sales amounted <strong>to</strong> $3,663,208,000(2010: $3,539,892,000).(i)Revision <strong>to</strong> inven<strong>to</strong>ry obsolescence estimatesDuring <strong>the</strong> year, <strong>the</strong> Group engaged independent consultants <strong>to</strong> perform an industry and benchmarking study on <strong>the</strong> basis and estimates (<strong>the</strong>“obsolescence rates”) used <strong>to</strong> determine allowance for inven<strong>to</strong>ry obsolescence. The study considered <strong>the</strong> industry practices of <strong>the</strong> 4 mainoperating segments and compared <strong>the</strong> obsolescence rates against industry peer companies. Based on <strong>the</strong> results obtained, <strong>the</strong> Group hasrevised <strong>the</strong> obsolescence rates <strong>to</strong> align more closely with industry practices. The effect of <strong>the</strong>se changes resulted in a write-back of allowancefor inven<strong>to</strong>ry obsolescence of $18,985,000 <strong>to</strong> <strong>the</strong> income statement.The determination of inven<strong>to</strong>ry obsolescence charge involves ascertaining <strong>the</strong> net realisable values of inven<strong>to</strong>ry, which are dependent on <strong>the</strong>prevailing selling prices, which in turn are impacted by demand and supply, technological advancement and etc. Therefore, it is impractical <strong>to</strong>estimate <strong>the</strong> effects of <strong>the</strong>se changes on <strong>the</strong> income <strong>statements</strong> in <strong>the</strong> future years.(ii)Allowances for inven<strong>to</strong>ry obsolescence and foreseeable lossesAs at 31 December 2011, <strong>the</strong> inven<strong>to</strong>ries are stated after allowance for inven<strong>to</strong>ry obsolescence of $187,674,000 (2010: $195,316,000) andwork-in-progress in excess of progress billings is stated after provision for foreseeable losses of $6,365,000 (2010: $4,168,000).(iii)Net realisable value write-downAs at 31 December 2011, work-in-progress amounting <strong>to</strong> $38,718,000 (2010: $nil) was written down <strong>to</strong> <strong>the</strong> estimated net realisable value. Thewrite-down was included in cost of sales.