notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

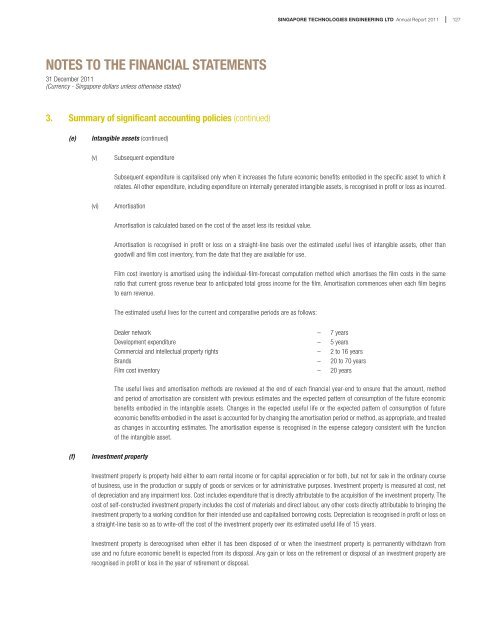

SINGAPORE TECHNOLOGIES ENGINEERING LTD Annual Report 2011127NOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)3. Summary of significant accounting policies (continued)(e)Intangible assets (continued)(v)Subsequent expenditureSubsequent expenditure is capitalised only when it increases <strong>the</strong> future economic benefits embodied in <strong>the</strong> specific asset <strong>to</strong> which itrelates. All o<strong>the</strong>r expenditure, including expenditure on internally generated intangible assets, is recognised in profit or loss as incurred.(vi)AmortisationAmortisation is calculated based on <strong>the</strong> cost of <strong>the</strong> asset less its residual value.Amortisation is recognised in profit or loss on a straight-line basis over <strong>the</strong> estimated useful lives of intangible assets, o<strong>the</strong>r thangoodwill and film cost inven<strong>to</strong>ry, from <strong>the</strong> date that <strong>the</strong>y are available for use.Film cost inven<strong>to</strong>ry is amortised using <strong>the</strong> individual-film-forecast computation method which amortises <strong>the</strong> film costs in <strong>the</strong> sameratio that current gross revenue bear <strong>to</strong> anticipated <strong>to</strong>tal gross income for <strong>the</strong> film. Amortisation commences when each film begins<strong>to</strong> earn revenue.The estimated useful lives for <strong>the</strong> current and comparative periods are as follows:Dealer network – 7 yearsDevelopment expenditure – 5 yearsCommercial and intellectual property rights – 2 <strong>to</strong> 16 yearsBrands – 20 <strong>to</strong> 70 yearsFilm cost inven<strong>to</strong>ry – 20 yearsThe useful lives and amortisation methods are reviewed at <strong>the</strong> end of each <strong>financial</strong> year-end <strong>to</strong> ensure that <strong>the</strong> amount, methodand period of amortisation are consistent with previous estimates and <strong>the</strong> expected pattern of consumption of <strong>the</strong> future economicbenefits embodied in <strong>the</strong> intangible assets. Changes in <strong>the</strong> expected useful life or <strong>the</strong> expected pattern of consumption of futureeconomic benefits embodied in <strong>the</strong> asset is accounted for by changing <strong>the</strong> amortisation period or method, as appropriate, and treatedas changes in accounting estimates. The amortisation expense is recognised in <strong>the</strong> expense category consistent with <strong>the</strong> functionof <strong>the</strong> intangible asset.(f)Investment propertyInvestment property is property held ei<strong>the</strong>r <strong>to</strong> earn rental income or for capital appreciation or for both, but not for sale in <strong>the</strong> ordinary courseof business, use in <strong>the</strong> production or supply of goods or services or for administrative purposes. Investment property is measured at cost, ne<strong>to</strong>f depreciation and any impairment loss. Cost includes expenditure that is directly attributable <strong>to</strong> <strong>the</strong> acquisition of <strong>the</strong> investment property. Thecost of self-constructed investment property includes <strong>the</strong> cost of materials and direct labour, any o<strong>the</strong>r costs directly attributable <strong>to</strong> bringing <strong>the</strong>investment property <strong>to</strong> a working condition for <strong>the</strong>ir intended use and capitalised borrowing costs. Depreciation is recognised in profit or loss ona straight-line basis so as <strong>to</strong> write-off <strong>the</strong> cost of <strong>the</strong> investment property over its estimated useful life of 15 years.Investment property is derecognised when ei<strong>the</strong>r it has been disposed of or when <strong>the</strong> investment property is permanently withdrawn fromuse and no future economic benefit is expected from its disposal. Any gain or loss on <strong>the</strong> retirement or disposal of an investment property arerecognised in profit or loss in <strong>the</strong> year of retirement or disposal.