notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

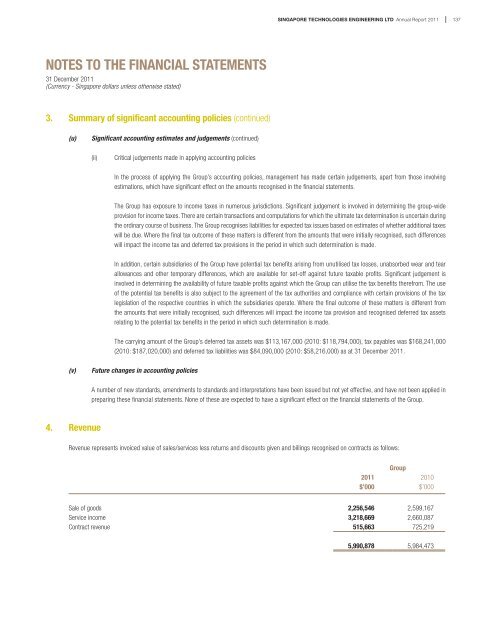

SINGAPORE TECHNOLOGIES ENGINEERING LTD Annual Report 2011137NOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)3. Summary of significant accounting policies (continued)(u)Significant accounting estimates and judgements (continued)(ii)Critical judgements made in applying accounting policiesIn <strong>the</strong> process of applying <strong>the</strong> Group’s accounting policies, management has made certain judgements, apart from those involvingestimations, which have significant effect on <strong>the</strong> amounts recognised in <strong>the</strong> <strong>financial</strong> <strong>statements</strong>.The Group has exposure <strong>to</strong> income taxes in numerous jurisdictions. Significant judgement is involved in determining <strong>the</strong> group-wideprovision for income taxes. There are certain transactions and computations for which <strong>the</strong> ultimate tax determination is uncertain during<strong>the</strong> ordinary course of business. The Group recognises liabilities for expected tax issues based on estimates of whe<strong>the</strong>r additional taxeswill be due. Where <strong>the</strong> final tax outcome of <strong>the</strong>se matters is different from <strong>the</strong> amounts that were initially recognised, such differenceswill impact <strong>the</strong> income tax and deferred tax provisions in <strong>the</strong> period in which such determination is made.In addition, certain subsidiaries of <strong>the</strong> Group have potential tax benefits arising from unutilised tax losses, unabsorbed wear and tearallowances and o<strong>the</strong>r temporary differences, which are available for set-off against future taxable profits. Significant judgement isinvolved in determining <strong>the</strong> availability of future taxable profits against which <strong>the</strong> Group can utilise <strong>the</strong> tax benefits <strong>the</strong>refrom. The useof <strong>the</strong> potential tax benefits is also subject <strong>to</strong> <strong>the</strong> agreement of <strong>the</strong> tax authorities and compliance with certain provisions of <strong>the</strong> taxlegislation of <strong>the</strong> respective countries in which <strong>the</strong> subsidiaries operate. Where <strong>the</strong> final outcome of <strong>the</strong>se matters is different from<strong>the</strong> amounts that were initially recognised, such differences will impact <strong>the</strong> income tax provision and recognised deferred tax assetsrelating <strong>to</strong> <strong>the</strong> potential tax benefits in <strong>the</strong> period in which such determination is made.The carrying amount of <strong>the</strong> Group’s deferred tax assets was $113,167,000 (2010: $118,794,000), tax payables was $168,241,000(2010: $187,020,000) and deferred tax liabilities was $84,090,000 (2010: $58,216,000) as at 31 December 2011.(v)Future changes in accounting policiesA number of new standards, amendments <strong>to</strong> standards and interpretations have been issued but not yet effective, and have not been applied inpreparing <strong>the</strong>se <strong>financial</strong> <strong>statements</strong>. None of <strong>the</strong>se are expected <strong>to</strong> have a significant effect on <strong>the</strong> <strong>financial</strong> <strong>statements</strong> of <strong>the</strong> Group.4. RevenueRevenue represents invoiced value of sales/services less returns and discounts given and billings recognised on contracts as follows:Group2011 2010$’000 $’000Sale of goods 2,256,546 2,599,167Service income 3,218,669 2,660,087Contract revenue 515,663 725,2195,990,878 5,984,473