notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

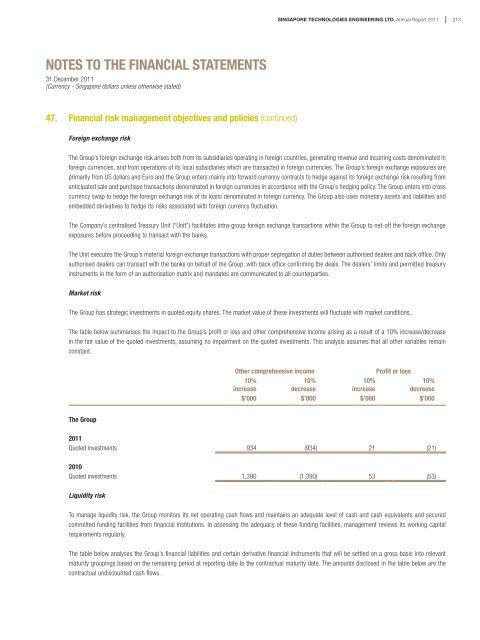

SINGAPORE TECHNOLOGIES ENGINEERING LTD Annual Report 2011213NOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)47. Financial risk management objectives and policies (continued)Foreign exchange riskThe Group’s foreign exchange risk arises both from its subsidiaries operating in foreign countries, generating revenue and incurring costs denominated inforeign currencies, and from operations of its local subsidiaries which are transacted in foreign currencies. The Group’s foreign exchange exposures areprimarily from US dollars and Euro and <strong>the</strong> Group enters mainly in<strong>to</strong> forward currency contracts <strong>to</strong> hedge against its foreign exchange risk resulting fromanticipated sale and purchase transactions denominated in foreign currencies in accordance with <strong>the</strong> Group’s hedging policy. The Group enters in<strong>to</strong> crosscurrency swap <strong>to</strong> hedge <strong>the</strong> foreign exchange risk of its loans denominated in foreign currency. The Group also uses monetary assets and liabilities andembedded derivatives <strong>to</strong> hedge its risks associated with foreign currency fluctuation.The Company’s centralised Treasury Unit (“Unit”) facilitates intra-group foreign exchange transactions within <strong>the</strong> Group <strong>to</strong> net-off <strong>the</strong> foreign exchangeexposures before proceeding <strong>to</strong> transact with <strong>the</strong> banks.The Unit executes <strong>the</strong> Group’s material foreign exchange transactions with proper segregation of duties between authorised dealers and back office. Onlyauthorised dealers can transact with <strong>the</strong> banks on behalf of <strong>the</strong> Group, with back office confirming <strong>the</strong> deals. The dealers’ limits and permitted treasuryinstruments in <strong>the</strong> form of an authorisation matrix and mandates are communicated <strong>to</strong> all counterparties.Market riskThe Group has strategic investments in quoted equity shares. The market value of <strong>the</strong>se investments will fluctuate with market conditions.The table below summarises <strong>the</strong> impact <strong>to</strong> <strong>the</strong> Group’s profit or loss and o<strong>the</strong>r comprehensive income arising as a result of a 10% increase/decreasein <strong>the</strong> fair value of <strong>the</strong> quoted investments, assuming no impairment on <strong>the</strong> quoted investments. This analysis assumes that all o<strong>the</strong>r variables remainconstant.O<strong>the</strong>r comprehensive incomeProfit or loss10%increase10%decrease10%increase10%decrease$’000 $’000 $’000 $’000The Group2011Quoted investments 934 (934) 21 (21)2010Quoted investments 1,390 (1,390) 53 (53)Liquidity riskTo manage liquidity risk, <strong>the</strong> Group moni<strong>to</strong>rs its net operating cash flows and maintains an adequate level of cash and cash equivalents and securedcommitted funding facilities from <strong>financial</strong> institutions. In assessing <strong>the</strong> adequacy of <strong>the</strong>se funding facilities, management reviews its working capitalrequirements regularly.The table below analyses <strong>the</strong> Group’s <strong>financial</strong> liabilities and certain derivative <strong>financial</strong> instruments that will be settled on a gross basis in<strong>to</strong> relevantmaturity groupings based on <strong>the</strong> remaining period at reporting date <strong>to</strong> <strong>the</strong> contractual maturity date. The amounts disclosed in <strong>the</strong> table below are <strong>the</strong>contractual undiscounted cash flows.