notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

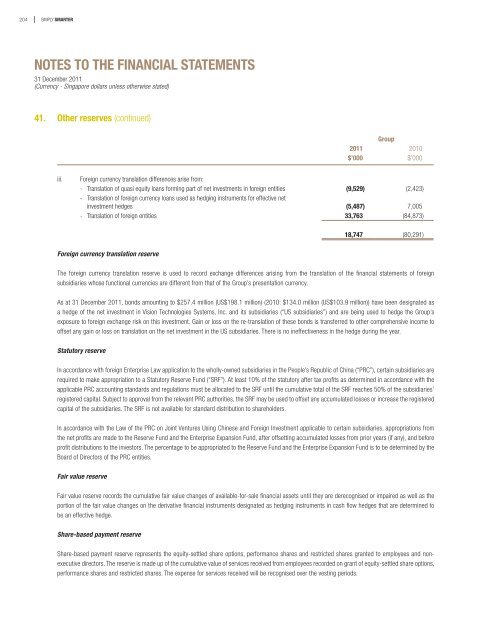

204 SIMPLY SMARTERNOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)41. O<strong>the</strong>r reserves (continued)Group2011 2010$’000 $’000iii.Foreign currency translation differences arise from:- Translation of quasi equity loans forming part of net investments in foreign entities (9,529) (2,423)- Translation of foreign currency loans used as hedging instruments for effective netinvestment hedges (5,487) 7,005- Translation of foreign entities 33,763 (84,873)18,747 (80,291)Foreign currency translation reserveThe foreign currency translation reserve is used <strong>to</strong> record exchange differences arising from <strong>the</strong> translation of <strong>the</strong> <strong>financial</strong> <strong>statements</strong> of foreignsubsidiaries whose functional currencies are different from that of <strong>the</strong> Group’s presentation currency.As at 31 December 2011, bonds amounting <strong>to</strong> $257.4 million (US$198.1 million) (2010: $134.0 million (US$103.9 million)) have been designated asa hedge of <strong>the</strong> net investment in Vision <strong>Technologies</strong> Systems, Inc. and its subsidiaries (“US subsidiaries”) and are being used <strong>to</strong> hedge <strong>the</strong> Group’sexposure <strong>to</strong> foreign exchange risk on this investment. Gain or loss on <strong>the</strong> re-translation of <strong>the</strong>se bonds is transferred <strong>to</strong> o<strong>the</strong>r comprehensive income <strong>to</strong>offset any gain or loss on translation on <strong>the</strong> net investment in <strong>the</strong> US subsidiaries. There is no ineffectiveness in <strong>the</strong> hedge during <strong>the</strong> year.Statu<strong>to</strong>ry reserveIn accordance with foreign Enterprise Law application <strong>to</strong> <strong>the</strong> wholly-owned subsidiaries in <strong>the</strong> People’s Republic of China (“PRC”), certain subsidiaries arerequired <strong>to</strong> make appropriation <strong>to</strong> a Statu<strong>to</strong>ry Reserve Fund (“SRF”). At least 10% of <strong>the</strong> statu<strong>to</strong>ry after tax profits as determined in accordance with <strong>the</strong>applicable PRC accounting standards and regulations must be allocated <strong>to</strong> <strong>the</strong> SRF until <strong>the</strong> cumulative <strong>to</strong>tal of <strong>the</strong> SRF reaches 50% of <strong>the</strong> subsidiaries’registered capital. Subject <strong>to</strong> approval from <strong>the</strong> relevant PRC authorities, <strong>the</strong> SRF may be used <strong>to</strong> offset any accumulated losses or increase <strong>the</strong> registeredcapital of <strong>the</strong> subsidiaries. The SRF is not available for standard distribution <strong>to</strong> shareholders.In accordance with <strong>the</strong> Law of <strong>the</strong> PRC on Joint Ventures Using Chinese and Foreign Investment applicable <strong>to</strong> certain subsidiaries, appropriations from<strong>the</strong> net profits are made <strong>to</strong> <strong>the</strong> Reserve Fund and <strong>the</strong> Enterprise Expansion Fund, after offsetting accumulated losses from prior years (if any), and beforeprofit distributions <strong>to</strong> <strong>the</strong> inves<strong>to</strong>rs. The percentage <strong>to</strong> be appropriated <strong>to</strong> <strong>the</strong> Reserve Fund and <strong>the</strong> Enterprise Expansion Fund is <strong>to</strong> be determined by <strong>the</strong>Board of Direc<strong>to</strong>rs of <strong>the</strong> PRC entities.Fair value reserveFair value reserve records <strong>the</strong> cumulative fair value changes of available-for-sale <strong>financial</strong> assets until <strong>the</strong>y are derecognised or impaired as well as <strong>the</strong>portion of <strong>the</strong> fair value changes on <strong>the</strong> derivative <strong>financial</strong> instruments designated as hedging instruments in cash flow hedges that are determined <strong>to</strong>be an effective hedge.Share-based payment reserveShare-based payment reserve represents <strong>the</strong> equity-settled share options, performance shares and restricted shares granted <strong>to</strong> employees and nonexecutivedirec<strong>to</strong>rs. The reserve is made up of <strong>the</strong> cumulative value of services received from employees recorded on grant of equity-settled share options,performance shares and restricted shares. The expense for services received will be recognised over <strong>the</strong> vesting periods.