notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

notes to the financial statements - Singapore Technologies ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

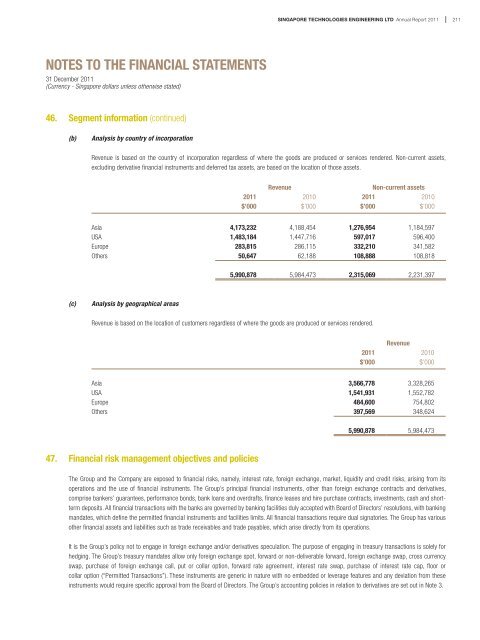

SINGAPORE TECHNOLOGIES ENGINEERING LTD Annual Report 2011211NOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless o<strong>the</strong>rwise stated)46. Segment information (continued)(b)Analysis by country of incorporationRevenue is based on <strong>the</strong> country of incorporation regardless of where <strong>the</strong> goods are produced or services rendered. Non-current assets,excluding derivative <strong>financial</strong> instruments and deferred tax assets, are based on <strong>the</strong> location of those assets.RevenueNon-current assets2011 2010 2011 2010$’000 $’000 $’000 $’000Asia 4,173,232 4,188,454 1,276,954 1,184,597USA 1,483,184 1,447,716 597,017 596,400Europe 283,815 286,115 332,210 341,582O<strong>the</strong>rs 50,647 62,188 108,888 108,8185,990,878 5,984,473 2,315,069 2,231,397(c)Analysis by geographical areasRevenue is based on <strong>the</strong> location of cus<strong>to</strong>mers regardless of where <strong>the</strong> goods are produced or services rendered.Revenue2011 2010$’000 $’000Asia 3,566,778 3,328,265USA 1,541,931 1,552,782Europe 484,600 754,802O<strong>the</strong>rs 397,569 348,6245,990,878 5,984,47347. Financial risk management objectives and policiesThe Group and <strong>the</strong> Company are exposed <strong>to</strong> <strong>financial</strong> risks, namely, interest rate, foreign exchange, market, liquidity and credit risks, arising from itsoperations and <strong>the</strong> use of <strong>financial</strong> instruments. The Group’s principal <strong>financial</strong> instruments, o<strong>the</strong>r than foreign exchange contracts and derivatives,comprise bankers’ guarantees, performance bonds, bank loans and overdrafts, finance leases and hire purchase contracts, investments, cash and shorttermdeposits. All <strong>financial</strong> transactions with <strong>the</strong> banks are governed by banking facilities duly accepted with Board of Direc<strong>to</strong>rs’ resolutions, with bankingmandates, which define <strong>the</strong> permitted <strong>financial</strong> instruments and facilities limits. All <strong>financial</strong> transactions require dual signa<strong>to</strong>ries. The Group has variouso<strong>the</strong>r <strong>financial</strong> assets and liabilities such as trade receivables and trade payables, which arise directly from its operations.It is <strong>the</strong> Group’s policy not <strong>to</strong> engage in foreign exchange and/or derivatives speculation. The purpose of engaging in treasury transactions is solely forhedging. The Group’s treasury mandates allow only foreign exchange spot, forward or non-deliverable forward, foreign exchange swap, cross currencyswap, purchase of foreign exchange call, put or collar option, forward rate agreement, interest rate swap, purchase of interest rate cap, floor orcollar option (“Permitted Transactions”). These instruments are generic in nature with no embedded or leverage features and any deviation from <strong>the</strong>seinstruments would require specific approval from <strong>the</strong> Board of Direc<strong>to</strong>rs. The Group’s accounting policies in relation <strong>to</strong> derivatives are set out in Note 3.