Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

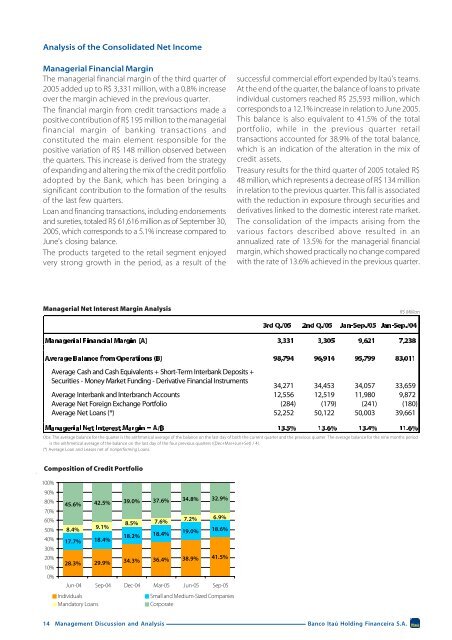

<strong>Analysis</strong> of the Consolidated Net IncomeManagerial Financial MarginThe managerial financial margin of the third quarter of2005 added up to R$ 3,331 million, with a 0.8% increaseover the margin achieved in the previous quarter.The financial margin from credit transactions made apositive contribution of R$ 195 million to the managerialfinancial margin of banking transactions andconstituted the main element responsible for thepositive variation of R$ 148 million observed betweenthe quarters. This increase is derived from the strategyof expanding and altering the mix of the credit portfolioadopted by the Bank, which has been bringing asignificant contribution to the formation of the resultsof the last few quarters.Loan and financing transactions, including endorsementsand sureties, totaled R$ 61,616 million as of September 30,2005, which corresponds to a 5.1% increase compared toJune's closing balance.The products targeted to the retail segment enjoyedvery strong growth in the period, as a result of thesuccessful commercial effort expended by Itaú's teams.At the end of the quarter, the balance of loans to privateindividual customers reached R$ 25,593 million, whichcorresponds to a 12.1% increase in relation to June 2005.This balance is also equivalent to 41.5% of the totalportfolio, while in the previous quarter retailtransactions accounted for 38.9% of the total balance,which is an indication of the alteration in the mix ofcredit assets.Treasury results for the third quarter of 2005 totaled R$48 million, which represents a decrease of R$ 134 millionin relation to the previous quarter. This fall is associatedwith the reduction in exposure through securities andderivatives linked to the domestic interest rate market.The consolidation of the impacts arising from thevarious factors described above resulted in anannualized rate of 13.5% for the managerial financialmargin, which showed practically no change comparedwith the rate of 13.6% achieved in the previous quarter.Managerial Net Interest Margin <strong>Analysis</strong>R$ MillionAverage Cash and Cash Equivalents + Short-Term Interbank Deposits +Securities - Money Market Funding - Derivative Financial Instruments34,271 34,453 34,057 33,659Average Interbank and Interbranch Accounts 12,556 12,519 11,980 9,872Average Net Foreign Exchange Portfolio (284) (179) (241) (180)Average Net Loans (*) 52,252 50,122 50,003 39,661Obs: The average balance for the quarter is the arithmetical average of the balance on the last day of both the current quarter and the previous quarter. The average balance for the nine months periodis the arithmetical average of the balance on the last day of the four previous quarters ((Dec+Mar+Jun+Set) / 4).(*) Average Loan and Leases net of nonperforming Loans.Composition of Credit Portfolio100%90%80%70%60%50%40%30%20%10%0%45.6% 42.5% 39.0% 37.6% 34.8% 32.9%7.2% 6.9%8.5% 7.6%8.4%9.1%18.2% 18.4%19.0% 18.6%17.7% 18.4%28.3% 29.9% 34.3% 36.4% 38.9% 41.5%Jun-04 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05IndividualsSmall and Medium-Sized CompaniesMandatory LoansCorporate14 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.