Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

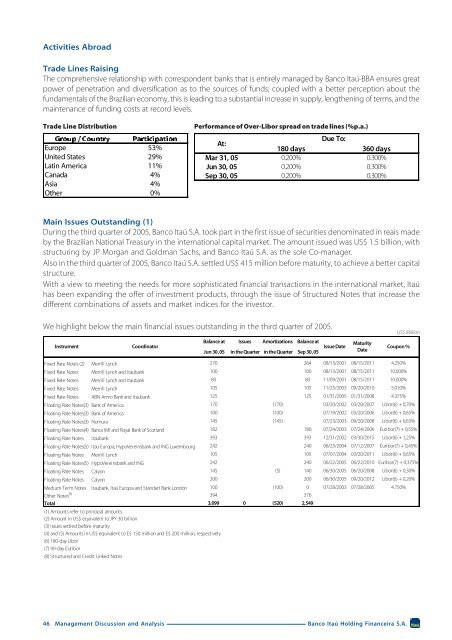

Activities AbroadTrade Lines RaisingThe comprehensive relationship with correspondent banks that is entirely managed by Banco Itaú-BBA ensures greatpower of penetration and diversification as to the sources of funds; coupled with a better perception about thefundamentals of the Brazilian economy, this is leading to a substantial increase in supply, lengthening of terms, and themaintenance of funding costs at record levels.Trade Line DistributionEurope 53%United States 29%Latin America 11%Canada 4%Asia 4%Other 0%Performance of Over-Libor spread on trade lines (%p.a.)At:Due To:180 days 360 daysMar 31, 05 0.200% 0.300%Jun 30, 05 0.200% 0.300%Sep 30, 05 0.200% 0.300%Main Issues Outstanding (1)During the third quarter of 2005, Banco Itaú S.A. took part in the first issue of securities denominated in reais madeby the Brazilian National Treasury in the international capital market. The amount issued was US$ 1.5 billion, withstructuring by JP Morgan and Goldman Sachs, and Banco Itaú S.A. as the sole Co-manager.Also in the third quarter of 2005, Banco Itaú S.A. settled US$ 415 million before maturity, to achieve a better capitalstructure.With a view to meeting the needs for more sophisticated financial transactions in the international market, Itaúhas been expanding the offer of investment products, through the issue of Structured Notes that increase thedifferent combinations of assets and market indices for the investor.We highlight below the main financial issues outstanding in the third quarter of 2005.Balance at Issues Amortizations Balance atInstrument Coordinator Issue DateJun 30 ,05 in the Quarter in the Quarter Sep 30 ,05MaturityDateUS$ MillionCoupon %Fixed Rate Notes (2) Merrill Lynch 270 264 08/13/2001 08/15/2011 4.250%Fixed Rate Notes Merrill Lynch and Itaubank 100 100 08/13/2001 08/15/2011 10.000%Fixed Rate Notes Merrill Lynch and Itaubank 80 80 11/09/2001 08/15/2011 10.000%Fixed Rate Notes Merrill Lynch 105 105 11/25/2003 09/20/2010 5.010%Fixed Rate Notes ABN Amro Bank and Itaubank 125 125 01/31/2005 01/31/2008 4.375%Floating Rate Notes(3) Bank of America 170 (170) 03/20/2002 03/20/2007 Libor(6) + 0,70%Floating Rate Notes(3) Bank of America 100 (100) 07/19/2002 03/20/2006 Libor(6) + 0,65%Floating Rate Notes(3) Nomura 145 (145) 07/23/2003 09/20/2008 Libor(6) + 0,63%Floating Rate Notes(4) Banca IMI and Royal Bank of Scotland 182 180 07/24/2003 07/24/2006 Euribor(7) + 0,55%Floating Rate Notes Itaubank 393 393 12/31/2002 03/30/2015 Libor(6) + 1,25%Floating Rate Notes(5) Itaú Europa, HypoVereinsbank and ING Luxembourg 242 240 06/25/2004 07/12/2007 Euribor(7) + 0,45%Floating Rate Notes Merrill Lynch 105 105 07/07/2004 03/20/2011 Libor(6) + 0,65%Floating Rate Notes(5) HypoVereinsbank and ING 242 240 06/22/2005 06/22/2010 Euribor(7) + 0,375%Floating Rate Notes Calyon 145 (5) 140 06/30/2005 06/20/2008 Libor(6) + 0,30%Floating Rate Notes Calyon 200 200 06/30/2005 09/20/2012 Libor(6) + 0,20%Medium Term Notes Itaubank, Itaú Europa and Standart Bank London 100 (100) 0 07/28/2003 07/28/2005 4.750%Other Notes (8) 394 376Total 3,099 0 (520) 2,549(1) Amounts refer to principal amounts.(2) Amount in US$ equivalent to JPY 30 billion(3) Issues settled before maturity(4) and (5) Amounts in US$ equivalent to E$ 150 million and E$ 200 million, respectively(6) 180-day Libor(7) 90-day Euribor(8) Structured and Credit Linked Notes46 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.