Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

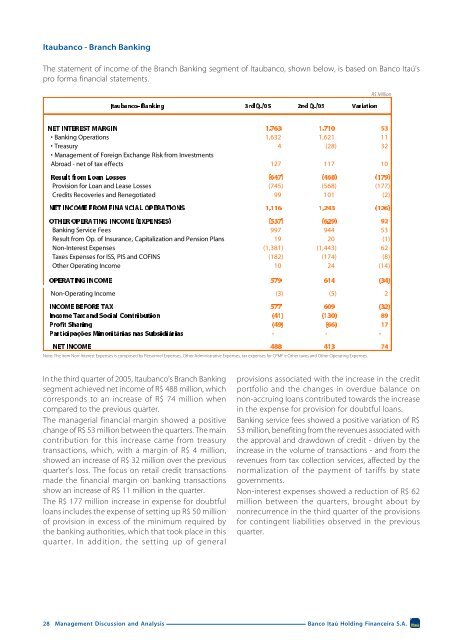

Itaubanco - Branch BankingThe statement of income of the Branch Banking segment of Itaubanco, shown below, is based on Banco Itaú'spro forma financial statements.R$ Million• Banking Operations 1,632 1,621 11• Treasury 4 (28) 32• <strong>Management</strong> of Foreign Exchange Risk from InvestmentsAbroad - net of tax effects 127 117 10Provision for Loan and Lease Losses (745) (568) (177)Credits Recoveries and Renegotiated 99 101 (2)Banking Service Fees 997 944 53Result from Op. of Insurance, Capitalization and Pension Plans 19 20 (1)Non-Interest Expenses (1,381) (1,443) 62Taxes Expenses for ISS, PIS and COFINS (182) (174) (8)Other Operating Income 10 24 (14)Non-Operating Income (3) (5) 2Note: The item Non-Interest Expenses is composed by Personnel Expenses, Other Administrative Expenses, tax expenses for CPMF e Other taxes and Other Operating Expenses.In the third quarter of 2005, Itaubanco's Branch Bankingsegment achieved net income of R$ 488 million, whichcorresponds to an increase of R$ 74 million whencompared to the previous quarter.The managerial financial margin showed a positivechange of R$ 53 million between the quarters. The maincontribution for this increase came from treasurytransactions, which, with a margin of R$ 4 million,showed an increase of R$ 32 million over the previousquarter's loss. The focus on retail credit transactionsmade the financial margin on banking transactionsshow an increase of R$ 11 million in the quarter.The R$ 177 million increase in expense for doubtfulloans includes the expense of setting up R$ 50 millionof provision in excess of the minimum required bythe banking authorities, which that took place in thisquarter. In addition, the setting up of generalprovisions associated with the increase in the creditportfolio and the changes in overdue balance onnon-accruing loans contributed towards the increasein the expense for provision for doubtful loans.Banking service fees showed a positive variation of R$53 million, benefiting from the revenues associated withthe approval and drawdown of credit - driven by theincrease in the volume of transactions - and from therevenues from tax collection services, affected by thenormalization of the payment of tariffs by stategovernments.Non-interest expenses showed a reduction of R$ 62million between the quarters, brought about bynonrecurrence in the third quarter of the provisionsfor contingent liabilities observed in the previousquarter.28 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.