Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

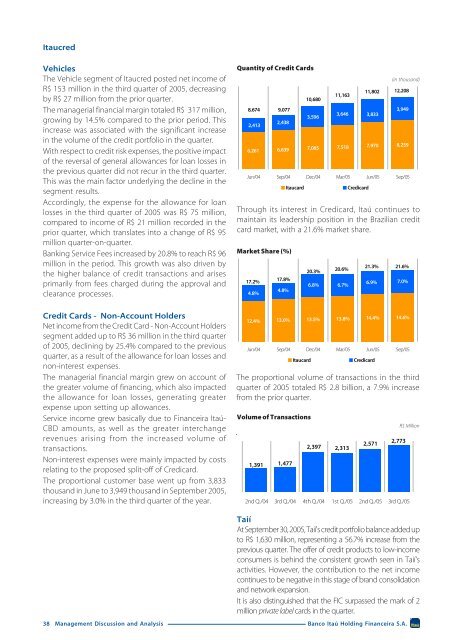

ItaucredVehiclesThe Vehicle segment of Itaucred posted net income ofR$ 153 million in the third quarter of 2005, decreasingby R$ 27 million from the prior quarter.The managerial financial margin totaled R$ 317 million,growing by 14.5% compared to the prior period. Thisincrease was associated with the significant increasein the volume of the credit portfolio in the quarter.With respect to credit risk expenses, the positive impactof the reversal of general allowances for loan losses inthe previous quarter did not recur in the third quarter.This was the main factor underlying the decline in thesegment results.Accordingly, the expense for the allowance for loanlosses in the third quarter of 2005 was R$ 75 million,compared to income of R$ 21 million recorded in theprior quarter, which translates into a change of R$ 95million quarter-on-quarter.Banking Service Fees increased by 20.8% to reach R$ 96million in the period. This growth was also driven bythe higher balance of credit transactions and arisesprimarily from fees charged during the approval andclearance processes.Quantity of Credit Cards8,674 9,0772,4132,4383,5963,646 3,8333,9496,261 6,639 7,085 7,518 7,970 8,259Jun/04 Sep/04 Dec/04 Mar/05 Jun/05 Sep/05Itaucard10,68011,163Credicard11,802 12,208Through its interest in Credicard, Itaú continues tomaintain its leadership position in the Brazilian creditcard market, with a 21.6% market share.Market Share (%)17.2%4.8%17.8%4.8%20.3%20.6%6.8% 6.7%(in thousand)21.3% 21.6%6.9% 7.0%Credit Cards - Non-Account HoldersNet income from the Credit Card - Non-Account Holderssegment added up to R$ 36 million in the third quarterof 2005, declining by 25.4% compared to the previousquarter, as a result of the allowance for loan losses andnon-interest expenses.The managerial financial margin grew on account ofthe greater volume of financing, which also impactedthe allowance for loan losses, generating greaterexpense upon setting up allowances.Service income grew basically due to Financeira Itaú-CBD amounts, as well as the greater interchangerevenues arising from the increased volume oftransactions.Non-interest expenses were mainly impacted by costsrelating to the proposed split-off of Credicard.The proportional customer base went up from 3,833thousand in June to 3,949 thousand in September 2005,increasing by 3.0% in the third quarter of the year.12.4% 13.0% 13.5% 13.8% 14.4% 14.6%Jun/04 Sep/04 Dec/04 Mar/05 Jun/05 Sep/05ItaucardThe proportional volume of transactions in the thirdquarter of 2005 totaled R$ 2.8 billion, a 7.9% increasefrom the prior quarter.Volume of Transactions1,391 1,4772,397 2,313Credicard2,5712,773R$ Million2nd Q./04 3rd Q./04 4th Q./04 1st Q./05 2nd Q./05 3rd Q./05TaiíAt September 30, 2005, Taií's credit portfolio balance added upto R$ 1,630 million, representing a 56.7% increase from theprevious quarter. The offer of credit products to low-incomeconsumers is behind the consistent growth seen in Taií'sactivities. However, the contribution to the net incomecontinues to be negative in this stage of brand consolidationand network expansion.It is also distinguished that the FIC surpassed the mark of 2million private label cards in the quarter.38 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.