Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

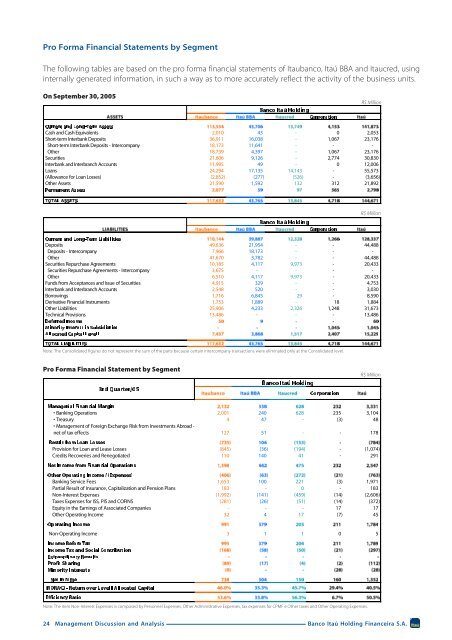

Pro Forma Financial Statements by SegmentThe following tables are based on the pro forma financial statements of Itaubanco, Itaú BBA and Itaucred, usinginternally generated information, in such a way as to more accurately reflect the activity of the business units.On September 30, 2005R$ MillionCash and Cash Equivalents 2,010 43 - 0 2,053Short-term Interbank Deposits 36,911 16,038 - 1,067 23,176Short-term Interbank Deposits - Intercompany 18,173 11,641 - - -Other 18,739 4,397 - 1,067 23,176Securities 21,606 9,126 - 2,774 30,830Interbank and Interbranch Accounts 11,995 49 - 0 12,006Loans 24,294 17,135 14,143 - 55,573(Allowance for Loan Losses) (2,852) (277) (526) - (3,656)Other Assets 21,590 1,592 132 312 21,892R$ MillionDeposits 49,636 21,954 - - 44,488Deposits - Intercompany 7,966 18,173 - - -Other 41,670 3,782 - - 44,488Securities Repurchase Agreements 10,185 4,117 9,973 - 20,433Securities Repurchase Agreements - Intercompany 3,675 - - - -Other 6,510 4,117 9,973 - 20,433Funds from Acceptances and Issue of Securities 4,915 329 - - 4,753Interbank and Interbranch Accounts 2,548 520 - - 3,030Borrowings 1,716 6,845 29 - 8,590Derivative Financial Instruments 1,753 1,889 - 18 1,884Other Liabilities 25,906 4,233 2,326 1,248 31,673Technical Provisions 13,486 - - - 13,486Note: The Consolidated figures do not represent the sum of the parts because certain intercompany transactions were eliminated only at the Consolidated level.Pro Forma Financial Statement by SegmentR$ Million• Banking Operations 2,001 240 628 235 3,104• Treasury 4 47 - (3) 48• <strong>Management</strong> of Foreign Exchange Risk from Investments Abroad -net of tax effects 127 51 - - 178Provision for Loan and Lease Losses (845) (36) (194) - (1,074)Credits Recoveries and Renegotiated 110 140 41 - 291Banking Service Fees 1,653 100 221 (3) 1,971Partial Result of Insurance, Capitalization and Pension Plans 183 - 0 - 183Non-Interest Expenses (1,992) (141) (459) (14) (2,606)Taxes Expenses for ISS, PIS and COFINS (281) (26) (51) (14) (372)Equity in the Earnings of Associated Companies - - - 17 17Other Operating Income 32 4 17 (7) 45Non-Operating Income 3 1 1 0 5Note: The item Non-Interest Expenses is composed by Personnel Expenses, Other Administrative Expenses, tax expenses for CPMF e Other taxes and Other Operating Expenses.24 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.