Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

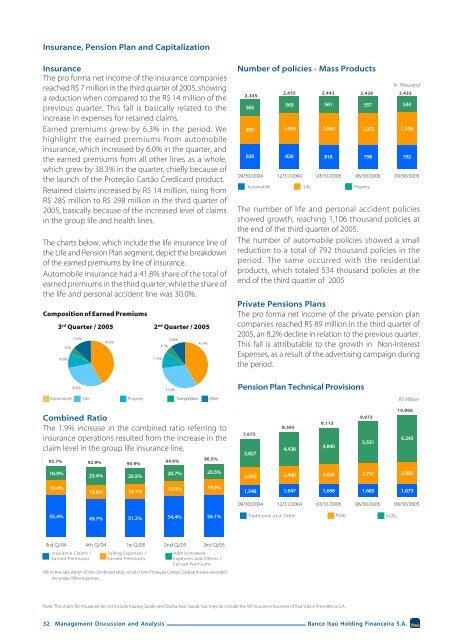

Insurance, Pension Plan and CapitalizationInsuranceThe pro forma net income of the insurance companiesreached R$ 7 million in the third quarter of 2005, showinga reduction when compared to the R$ 14 million of theprevious quarter. This fall is basically related to theincrease in expenses for retained claims.Earned premiums grew by 6.3% in the period. Wehighlight the earned premiums from automobileinsurance, which increased by 6.0% in the quarter, andthe earned premiums from all other lines as a whole,which grew by 38.3% in the quarter, chiefly because ofthe launch of the Proteção Cartão Credicard product.Retained claims increased by R$ 14 million, rising fromR$ 285 million to R$ 298 million in the third quarter of2005, basically because of the increased level of claimsin the group life and health lines.The charts below, which include the life insurance line ofthe Life and Pension Plan segment, depict the breakdownof the earned premiums by line of insurance.Automobile insurance had a 41.8% share of the total ofearned premiums in the third quarter, while the share ofthe life and personal accident line was 30.0%.Composition of Earned Premiums3 rd Quarter / 200510.9%3.9%13.4%41.8%2 nd Quarter / 200511.9%4.7%10.6%41.4%Number of policies - Mass Products2,345565569In Thousand561 557 534953 1,039 1,063 1,072 1,106828 826 818 798 79209/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/2005Automobile2,435Life2,4432,428 2,433PropertyThe number of life and personal accident policiesshowed growth, reaching 1,106 thousand policies atthe end of the third quarter of 2005.The number of automobile policies showed a smallreduction to a total of 792 thousand policies in theperiod. The same occurred with the residentialproducts, which totaled 534 thousand policies at theend of the third quarter of 2005Private Pensions PlansThe pro forma net income of the private pension plancompanies reached R$ 89 million in the third quarter of2005, an 8.2% decline in relation to the previous quarter.This fall is attributable to the growth in Non-InterestExpenses, as a result of the advertising campaign duringthe period.30.0%31.4%Pension Plan Technical ProvisionsAutomobile Life Property Transportation OtherCombined RatioThe 1.9% increase in the combined ratio referring toinsurance operations resulted from the increase in theclaim level in the group life insurance line.93.7%18.9%92.9%90.9%23.4% 20.5%94.6%96.5%20.7% 20.5%R$ Million10,8669,9739,1138,5657,6756,2435,5314,8404,4383,8272,300 2,480 2,606 2,757 2,95019.4%19.8% 19.1%19.4% 19.9%1,548 1,647 1,668 1,685 1,67309/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/200555.4%49.7% 51.2% 54.4% 56.1%Traditional and OtherPGBLVGBL3rd Q./04 4th Q./04 1st Q./05 2nd Q./05 3rd Q./05Insurance Claims /Earned PremiumsSelling Expenses /Earned PremiumsAdministrativeExpenses and Others /Earned PremiumsNB: In the calculation of the combined ratio, results from Proteção Cartão Credicard were recordednet under Other Expenses.Note: The charts for Insurance do not include Itauseg Saúde and Gralha Azul Saúde, but they do include the life insurance business of Itaú Vida e Previdência S.A.32 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.