Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

Quarterly Management Discussion & Analysis (MDA300905.pdf)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

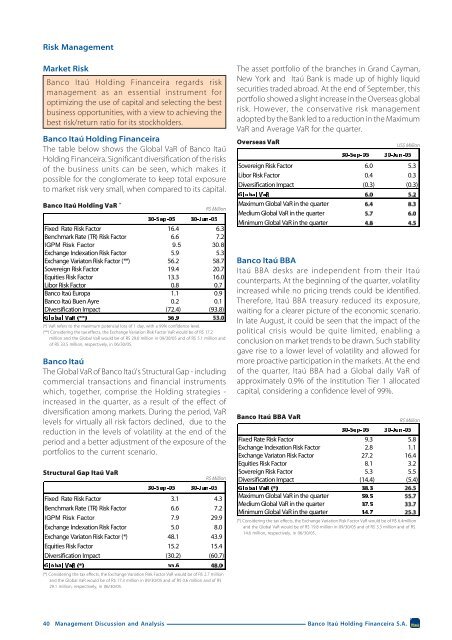

Risk <strong>Management</strong>Market RiskBanco Itaú Holding Financeira regards riskmanagement as an essential instrument foroptimizing the use of capital and selecting the bestbusiness opportunities, with a view to achieving thebest risk/return ratio for its stockholders.Banco Itaú Holding FinanceiraThe table below shows the Global VaR of Banco ItaúHolding Financeira. Significant diversification of the risksof the business units can be seen, which makes itpossible for the conglomerate to keep total exposureto market risk very small, when compared to its capital.Banco Itaú Holding VaR *(*) VaR refers to the maximum potencial loss of 1 day, with a 99% confidence level.(**) Considering the tax effects, the Exchange Variation Risk Factor VaR would be of R$ 17.2million and the Global VaR would be of R$ 29.6 million in 09/30/05 and of R$ 5.1 million andof R$ 33.5 million, respectively, in 06/30/05.Structural Gap Itaú VaRR$ MillionFixed Rate Risk Factor 16.4 6.3Benchmark Rate (TR) Risk Factor 6.6 7.2 Exchange Indexation Risk Factor 5.9 5.3Exchange Variaton Risk Factor (**) 56.2 58.7Sovereign Risk Factor 19.4 20.7Equities Risk Factor 13.3 16.0Libor Risk Factor 0.8 0.7Banco Itaú Europa 1.1 0.9Banco Itaú Buen Ayre 0.2 0.1Diversification Impact (72.4) (93.8)Banco ItaúThe Global VaR of Banco Itaú's Structural Gap - includingcommercial transactions and financial instrumentswhich, together, comprise the Holding strategies -increased in the quarter, as a result of the effect ofdiversification among markets. During the period, VaRlevels for virtually all risk factors declined, due to thereduction in the levels of volatility at the end of theperiod and a better adjustment of the exposure of theportfolios to the current scenario.R$ MillionFixed Rate Risk Factor 3.1 4.3Benchmark Rate (TR) Risk Factor 6.6 7.2 7.9 29.9Exchange Indexation Risk Factor 5.0 8.0Exchange Variaton Risk Factor (*) 48.1 43.9Equities Risk Factor 15.2 15.4Diversification Impact (30.2) (60.7)The asset portfolio of the branches in Grand Cayman,New York and Itaú Bank is made up of highly liquidsecurities traded abroad. At the end of September, thisportfolio showed a slight increase in the Overseas globalrisk. However, the conservative risk managementadopted by the Bank led to a reduction in the MaximumVaR and Average VaR for the quarter.Overseas VaRUS$ MillionSovereign Risk Factor 6.0 5.3Libor Risk Factor 0.4 0.3Diversification Impact (0.3) (0.3)Maximum Global VaR in the quarterMedium Global VaR in the quarterMinimum Global VaR in the quarterBanco Itaú BBAItaú BBA desks are independent from their Itaúcounterparts. At the beginning of the quarter, volatilityincreased while no pricing trends could be identified.Therefore, Itaú BBA treasury reduced its exposure,waiting for a clearer picture of the economic scenario.In late August, it could be seen that the impact of thepolitical crisis would be quite limited, enabling aconclusion on market trends to be drawn. Such stabilitygave rise to a lower level of volatility and allowed formore proactive participation in the markets. At the endof the quarter, Itaú BBA had a Global daily VaR ofapproximately 0.9% of the institution Tier 1 allocatedcapital, considering a confidence level of 99%.Banco Itaú BBA VaRR$ MillionFixed Rate Risk Factor 9.3 5.8Exchange Indexation Risk Factor 2.8 1.1Exchange Variaton Risk Factor 27.2 16.4Equities Risk Factor 8.1 3.2Sovereign Risk Factor 5.3 5.5Diversification Impact (14.4) (5.4)Maximum Global VaR in the quarterMedium Global VaR in the quarterMinimum Global VaR in the quarter(*) Considering the tax effects, the Exchange Variation Risk Factor VaR would be of R$ 6.4millionand the Global VaR would be of R$ 19.8 million in 09/30/05 and of R$ 3.3 million and of R$14.6 million, respectively, in 06/30/05.(*) Considering the tax effects, the Exchange Variation Risk Factor VaR would be of R$ 2.7 millionand the Global VaR would be of R$ 17.3 million in 09/30/05 and of R$ 0.6 million and of R$29.1 million, respectively, in 06/30/05.40 <strong>Management</strong> <strong>Discussion</strong> and <strong>Analysis</strong>Banco Itaú Holding Financeira S.A.