- Page 1 and 2:

FinancialGuide for SMEs

- Page 3 and 4:

Financial Guide for SMEsAbout the G

- Page 5 and 6:

Financial Guide for SMEsChapter6 :

- Page 7 and 8:

Financial Guide for SMEsIntroductio

- Page 9 and 10:

Financial Guide for SMEsCreditorsCu

- Page 11 and 12:

Section I : Business Finance Basics

- Page 13 and 14:

Financial Guide for SMEsUnderstandi

- Page 15 and 16:

Financial Guide for SMEsCase Study

- Page 17 and 18:

Financial Guide for SMEsTowards the

- Page 19 and 20:

Financial Guide for SMEsBalance She

- Page 21 and 22:

Financial Guide for SMEsStatement o

- Page 23 and 24:

Financial Guide for SMEsHere is an

- Page 25 and 26:

Financial Guide for SMEsAssessing t

- Page 27 and 28:

Financial Guide for SMEsSolvency Ra

- Page 29 and 30:

Financial Guide for SMEsManagement

- Page 31 and 32:

Financial Guide for SMEs29Chapter 2

- Page 33 and 34:

BudgetingBudgeting is the tool that

- Page 35 and 36:

Financial Guide for SMEsAn annual b

- Page 37 and 38:

Financial Guide for SMEsWe can see

- Page 39 and 40:

Financial Guide for SMEsSection II

- Page 41 and 42:

Financial Guide for SMEsMaintaining

- Page 43 and 44:

Financial Guide for SMEsMark-upMark

- Page 45 and 46:

Financial Guide for SMEsDiscounting

- Page 47 and 48:

Financial Guide for SMEsExpense Man

- Page 49 and 50:

Financial Guide for SMEsImproving C

- Page 51 and 52:

Financial Guide for SMEsManaging In

- Page 53 and 54:

Financial Guide for SMEsChecklist f

- Page 55 and 56:

Financial Guide for SMEsUsing Numbe

- Page 57 and 58:

Financial Guide for SMEsChecklist f

- Page 59 and 60:

Financial Guide for SMEsTIPS FOR IM

- Page 61 and 62:

Financial Guide for SMEsChecklist f

- Page 63 and 64:

Financial Guide for SMEsChecklist f

- Page 65 and 66: Financial Guide for SMEsTIPS FOR IM

- Page 67 and 68: Financial Guide for SMEsCash Conver

- Page 69 and 70: Financial Guide for SMEsManaging Ca

- Page 71 and 72: Financial Guide for SMEsIn month 1,

- Page 73 and 74: Financial Guide for SMEsCash Flow F

- Page 75 and 76: Financial Guide for SMEsFinancial G

- Page 77 and 78: Financial Guide for SMEsStep 3: Oth

- Page 79 and 80: Financial Guide for SMEsAdam will h

- Page 81 and 82: Section III : Financing Your Busine

- Page 83 and 84: Financial Guide for SMEsDebt, Equit

- Page 85 and 86: Financial Guide for SMEsDefinitions

- Page 87 and 88: Financial Guide for SMEsTypes of Se

- Page 89 and 90: Repayment of Debt Finance/ Investme

- Page 91 and 92: Financial Guide for SMEsAdvantagesD

- Page 93 and 94: Financial Guide for SMEsDeciding Be

- Page 95 and 96: Financial Guide for SMEsUnderstandi

- Page 97 and 98: Financial Guide for SMEsProducts fo

- Page 99 and 100: Financial Guide for SMEsPurpose Pro

- Page 101 and 102: Financial Guide for SMEsPurpose Pro

- Page 103 and 104: Financial Guide for SMEsPurpose Pro

- Page 105 and 106: Financial Guide for SMEsTransaction

- Page 107 and 108: Financial Guide for SMEs• Do you

- Page 109 and 110: Financial Guide for SMEs107chapter

- Page 111 and 112: Financial Guide for SMEsTrade Finan

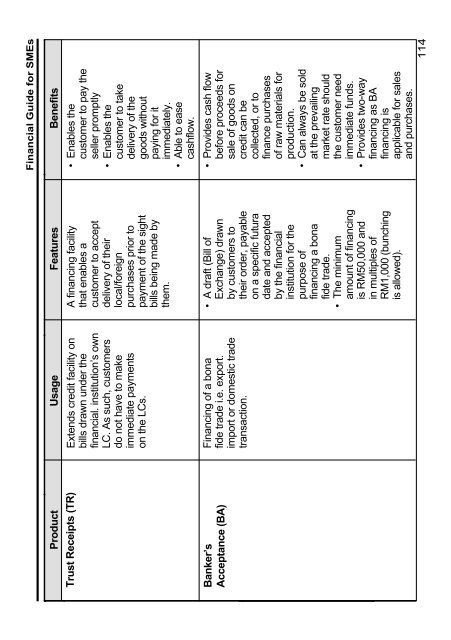

- Page 113 and 114: Financial Guide for SMEsThe option

- Page 115: Financial Guide for SMEsInternation

- Page 119 and 120: Financial Guide for SMEsFinancial G

- Page 121 and 122: Section IV : Managing LendersBanker

- Page 123 and 124: Financial Guide for SMEsApplying Fo

- Page 125 and 126: Financial Guide for SMEsSME FINANCI

- Page 127 and 128: Financial Guide for SMEs2.3.4.5.Sec

- Page 129 and 130: Financial Guide for SMEs3.4.Section

- Page 131 and 132: Financial Guide for SMEsType of Doc

- Page 133 and 134: Financial Guide for SMEs3.4.5.6.7.8

- Page 135 and 136: Financial Guide for SMEsLoan Applic

- Page 137 and 138: Financial Guide for SMEsExample of

- Page 139 and 140: Financial Guide for SMEssheet will

- Page 141 and 142: Financial Guide for SMEsTo gain an

- Page 143 and 144: Financial Guide for SMEs141chapter

- Page 145 and 146: Financial Guide for SMEsRefinancing

- Page 147 and 148: Financial Guide for SMEsBenefits of

- Page 149 and 150: Financial Guide for SMEsChange in v

- Page 151 and 152: Financial Guide for SMEsBanking Rev

- Page 153 and 154: Financial Guide for SMEsYou should

- Page 155 and 156: Financial Guide for SMEsManaging Yo

- Page 157 and 158: Financial Guide for SMEsManaging Di

- Page 159 and 160: Section V : Better Business Financi

- Page 161 and 162: Financial Guide for SMEsFinancial C

- Page 163 and 164: Financial Guide for SMEsProcedureAc

- Page 165 and 166: Financial Guide for SMEsSalesIs the

- Page 167 and 168:

Financial Guide for SMEsBank Reconc

- Page 169 and 170:

Financial Guide for SMEsEmployeesAr

- Page 171 and 172:

Financial Guide for SMEsFinancial G

- Page 173 and 174:

Financial Guide for SMEsFinancial G

- Page 175 and 176:

ChapterSix-Cash and ProfitCashYouro

- Page 177 and 178:

Financial Guide for SMEsFinancial G

- Page 179 and 180:

Financial Guide for SMEsFinancial G

- Page 181 and 182:

Financial Guide for SMEsFinancial G

- Page 183 and 184:

Financial Guide for SMEsACKNOWLEDGE