Financial Guide for SMEs - SME Corporation Malaysia

Financial Guide for SMEs - SME Corporation Malaysia

Financial Guide for SMEs - SME Corporation Malaysia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

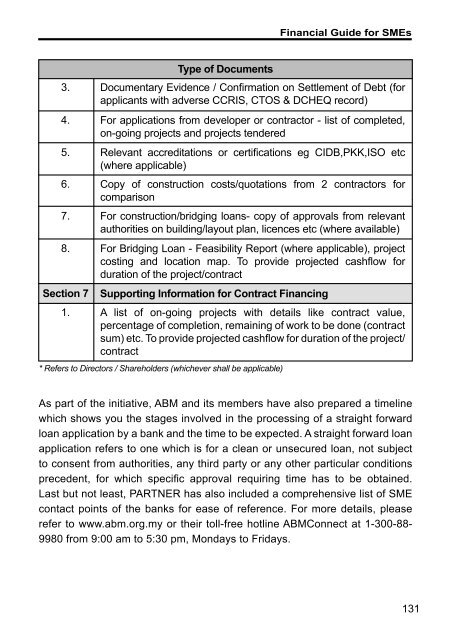

<strong>Financial</strong> <strong>Guide</strong> <strong>for</strong> <strong><strong>SME</strong>s</strong>3.4.5.6.7.8.Section 71.Type of DocumentsDocumentary Evidence / Confirmation on Settlement of Debt (<strong>for</strong>applicants with adverse CCRIS, CTOS & DCHEQ record)For applications from developer or contractor - list of completed,on-going projects and projects tenderedRelevant accreditations or certifications eg CIDB,PKK,ISO etc(where applicable)Copy of construction costs/quotations from 2 contractors <strong>for</strong>comparisonFor construction/bridging loans- copy of approvals from relevantauthorities on building/layout plan, licences etc (where available)For Bridging Loan - Feasibility Report (where applicable), projectcosting and location map. To provide projected cashflow <strong>for</strong>duration of the project/contractSupporting In<strong>for</strong>mation <strong>for</strong> Contract FinancingA list of on-going projects with details like contract value,percentage of completion, remaining of work to be done (contractsum) etc. To provide projected cashfl ow <strong>for</strong> duration of the project/contract* Refers to Directors / Shareholders (whichever shall be applicable)As part of the initiative, ABM and its members have also prepared a timelinewhich shows you the stages involved in the processing of a straight <strong>for</strong>wardloan application by a bank and the time to be expected. A straight <strong>for</strong>ward loanapplication refers to one which is <strong>for</strong> a clean or unsecured loan, not subjectto consent from authorities, any third party or any other particular conditionsprecedent, <strong>for</strong> which specifi c approval requiring time has to be obtained.Last but not least, PARTNER has also included a comprehensive list of <strong>SME</strong>contact points of the banks <strong>for</strong> ease of reference. For more details, pleaserefer to www.abm.org.my or their toll-free hotline ABMConnect at 1-300-88-9980 from 9:00 am to 5:30 pm, Mondays to Fridays.131chapter 7-13 p79-181 Eng.indd 1318/15/11 5:03:03 PM