Financial Guide for SMEs - SME Corporation Malaysia

Financial Guide for SMEs - SME Corporation Malaysia

Financial Guide for SMEs - SME Corporation Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

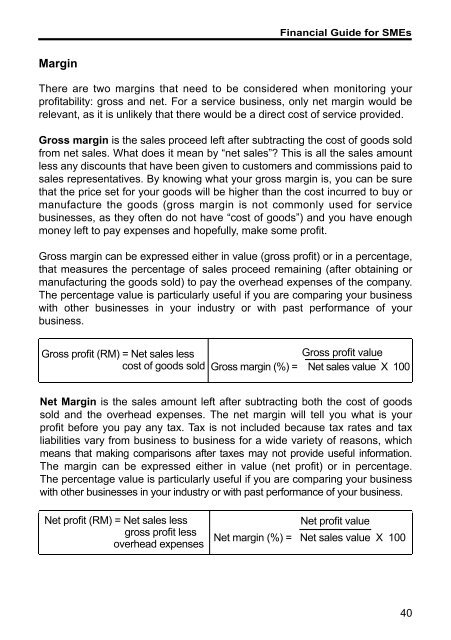

<strong>Financial</strong> <strong>Guide</strong> <strong>for</strong> <strong><strong>SME</strong>s</strong>MarginThere are two margins that need to be considered when monitoring yourprofi tability: gross and net. For a service business, only net margin would berelevant, as it is unlikely that there would be a direct cost of service provided.Gross margin is the sales proceed left after subtracting the cost of goods soldfrom net sales. What does it mean by “net sales”? This is all the sales amountless any discounts that have been given to customers and commissions paid tosales representatives. By knowing what your gross margin is, you can be surethat the price set <strong>for</strong> your goods will be higher than the cost incurred to buy ormanufacture the goods (gross margin is not commonly used <strong>for</strong> servicebusinesses, as they often do not have “cost of goods”) and you have enoughmoney left to pay expenses and hopefully, make some profi t.Gross margin can be expressed either in value (gross profit) or in a percentage,that measures the percentage of sales proceed remaining (after obtaining ormanufacturing the goods sold) to pay the overhead expenses of the company.The percentage value is particularly useful if you are comparing your businesswith other businesses in your industry or with past per<strong>for</strong>mance of yourbusiness.Gross profit (RM) = Net sales lesscost of goods soldGross profit valueGross margin (%) = Net sales value X 100Net Margin is the sales amount left after subtracting both the cost of goodssold and the overhead expenses. The net margin will tell you what is yourprofi t be<strong>for</strong>e you pay any tax. Tax is not included because tax rates and taxliabilities vary from business to business <strong>for</strong> a wide variety of reasons, whichmeans that making comparisons after taxes may not provide useful in<strong>for</strong>mation.The margin can be expressed either in value (net profi t) or in percentage.The percentage value is particularly useful if you are comparing your businesswith other businesses in your industry or with past per<strong>for</strong>mance of your business.Net profit (RM) = Net sales lessgross profit lessoverhead expensesNet profit valueNet margin (%) = Net sales value X 10040Chapter 2-5 p22-65 Eng.indd 408/15/11 5:01:55 PM