<strong>Financial</strong> <strong>Guide</strong> <strong>for</strong> <strong><strong>SME</strong>s</strong>Step 1: AssumptionsThe assumptions used in the cash flow <strong>for</strong>ecast are the same as those used <strong>for</strong> theincome and expenditure budget process – refer to page 34.Step 2: Sales ForecastFor any business, sales are the key to business success. Whether you arestarting a new business or have an existing enterprise, estimating sales isoften one of the most difficult process in <strong>for</strong>ecasting. If you think about it, yoursales will be dependent on many variables, such as the types of customersyou have, the terms you offer your customers, economic events such asincrease in the interest rate or competitive influences. It is not possible to predict allthe events that may occur and have an impact on your sales over the time frameof the <strong>for</strong>ecast. This point is often the reason why many businesses do not do<strong>for</strong>ecasts. However, if you accept that your <strong>for</strong>ecast sales will most likely not matchyour actual sales, you can then focus on determining a ”realistic” figure <strong>for</strong> the salesof the business over the period <strong>for</strong> which the <strong>for</strong>ecast will be prepared.For existing businesses, the best starting point will be to look at last year’s salesfigures. Do you believe that you will continue to achieve these figures, or have youenhanced your business operations to increase sales over the coming year? Onceyou have determined the likely adjustment needed to your historical sales figures,you can then estimate the <strong>for</strong>ecast sales <strong>for</strong> the period.After you have determined the sales <strong>for</strong> the period, the next step is to break thesenumbers into ”sales receipts” – the actual timing of receipt of the cash from sales.Remember that we talked about the timing of cash as the key to the cash flow<strong>for</strong>ecasts. Again, this in<strong>for</strong>mation will be estimated, although existing businesseswill have some history to help estimate actual sales receipts.If the business is purely a cash business (<strong>for</strong> example a fruit stall at a market), thenthe sales will equal the ”sales receipts” number. However, as noted earlier, wherecredit terms are given to customers, there will be a delay in receiving the proceedsfrom the sale and this is where we need to estimate the timing of receipts. Applyingyour accounts receivable collection pattern from the past to your sales <strong>for</strong>ecast isthe best way to predict your cash receipts from the collection of accounts receivable.To see how this is done, we have provided an example on how to calculate thetiming of cash receipts.After reviewing his sales collection history, Adam has determined that the followingsales receipt pattern had occurred in year one.Percentage of Cash Sales 40%Percentage of Credit Sales60%Applying these percentages to the estimated sales <strong>for</strong> year two, Adam completesthe following tables:72Chapter 6 p66-78 Eng.indd 728/15/11 5:02:24 PM

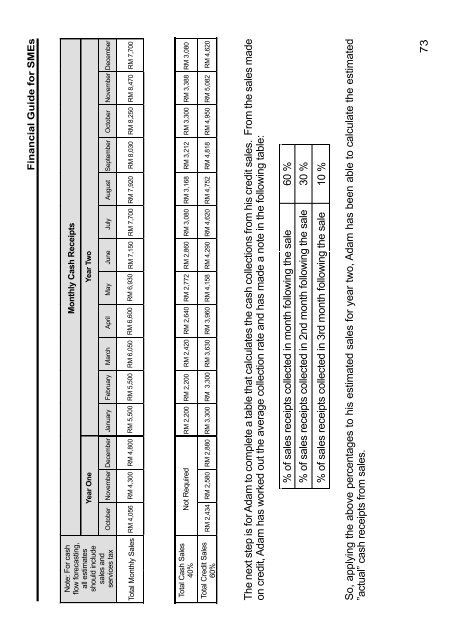

<strong>Financial</strong> <strong>Guide</strong> <strong>for</strong> <strong><strong>SME</strong>s</strong><strong>Financial</strong> <strong>Guide</strong> <strong>for</strong> <strong><strong>SME</strong>s</strong>Note: For cashflow <strong>for</strong>ecasting,all estimatesshould includesales andservices taxOctoberYear OneMonthly Cash ReceiptsYear TwoNovember December January February March April May JuneJuly August September October November DecemberTotal Monthly SalesRM 4,056RM 4,300 RM 4,800 RM 5,500 RM 5,500 RM 6,050 RM 6,600 RM 6,930 RM 7,150 RM 7,700 RM 7,920 RM 8,030 RM 8,250 RM 8,470 RM 7,700Total Cash Sales40%Not RequiredRM 2,200 RM 2,200 RM 2,420 RM 2,640 RM 2,772 RM 2,860 RM 3,080 RM 3,168 RM 3,212 RM 3,300 RM 3,388 RM 3,080Total Credit Sales60%RM 2,434 RM 2,580 RM 2,880 RM 3,300 RM 3,300 RM 3,630 RM 3,960 RM 4,158 RM 4,290 RM 4,620 RM 4,752 RM 4,818 RM 4,950 RM 5,082 RM 4,620The next step is <strong>for</strong> Adam to complete a table that calculates the cash collections from his credit sales. From the sales madeon credit, Adam has worked out the average collection rate and has made a note in the following table:% of sales receipts collected in month following the sale% of sales receipts collected in 2nd month following the sale% of sales receipts collected in 3rd month following the sale60 %30 %10 %So, applying the above percentages to his estimated sales <strong>for</strong> year two, Adam has been able to calculate the estimated”actual” cash receipts from sales.7373Chapter 6 p66-78 Eng.indd 738/15/11 5:02:25 PM