170c) Market value of equity sensitivity (MVE)This is an additional measure to the sensitivity of the netinterest margin.It measures the interest risk implicit in net worth (equity) onthe basis of the impact of a change in interest rates on thecurrent values of financial assets and liabilities.d) Value at risk (VaR)The Value at risk for balance sheet activity and investmentportfolios is calculated with the same standard as for trading:historic simulation with a confidence level of 99% and a timeframe of one day. Statistical adjustments are made whichincorporate effectively and quickly the latest developmentsthat condition the risk levels assumed.e) Analysis of scenariosTwo scenarios for the performance of interest rates areestablished: maximum volatility and severe crisis. Thesescenarios are applied to the balance sheet, obtaining theimpact on net worth as well as the projections of net interestmargin for the year.Liquidity riskLiquidity risk is associated with the Group’s capacity to financeits commitments, at reasonable market prices, as well as carryout its business plans with stable sources of funding. The Grouppermanently monitors maximum gap profiles.The measures used for liquidity risk control in balance sheetmanagement are the liquidity gap, liquidity ratios, stressscenarios and contingency plans.a) Liquidity gapThe liquidity gap provides information on contractual andexpected cash inflows and outflows for a certain period oftime, for each of the currencies in which the Group operates.The gap measures the net need or excess of funds at aparticular date, and reflects the level of liquidity maintainedunder normal market conditions.Two types of liquidity gap analysis are made, on the basis ofthe balance sheet item:1. Contractual liquidity gap: All on-and off-balance sheetitems are analysed provided they contribute cash flowsplaced in the point of contractual maturity. For those assetsand liabilities without a contractual maturity, an internalanalysis model is used, based on statistical research of thehistorical series of products, and which determines whatwe call the stability and instability impact on liquidity.2. Operational liquidity gap: This is a scenario in normalconditions of liquidity profile, as the flows of the balancesheet items are placed in the point of probable liquidityand not in the point of contractual maturity. In this analysisdefining the behaviour scenario –renewal of liabilities,discounts in sales of portfolios, renewal of assets– is thefundamental point.b) Liquidity ratiosThe liquidity coefficient compares liquid assets available forsale (after applying the relevant discounts and adjustments)with total liabilities to be settled, including contingencies. Thiscoefficient shows, for currencies that cannot be consolidated,the level of immediate response to firm commitments.Net accumulated illiquidity is defined as the 30-dayaccumulated gap obtained from the modified liquidity gap.The modified contractual liquidity gap is drawn up on thebasis of the contractual liquidity gap and placing liquid assetsin the point of settlement or repos and not in their point ofmaturity.In addition, other ratios or metric regarding the structuralposition of liquidity are followed:• Loans/net assets.• Customer deposits, insurance and medium and long-termfinancing/lending.• Customer deposits, insurance and medium and long-termfinancing, shareholders’ funds and other liabilities/the sum ofcredits and fixed assets.• Short-term financing/net liabilities.c) Analysis of scenarios/contingency planThe Group’s liquidity management focuses on taking all thenecessary measures to prevent a crisis. Liquidity crises, andtheir immediate causes, cannot always be predicted.Consequently, the Group’s contingency plans concentrate oncreating models of potential crises by analyzing differentscenarios, identifying crisis types, internal and externalcommunications and individual responsibilities.The contingency plan covers the sphere of activity of a localunit and of central headquarters. It specifies clear lines ofcommunication at the first sign of crisis and suggests a widerange of responses to different levels of crisis.As a crisis can occur locally or globally, each local unit mustprepare a contingency financing plan, indicating the amountit would potentially require as aid or financing fromheadquarters during a crisis. Each unit must inform the centralunit of its plan at least every six months so that it can bereviewed and updated. These plans, however, must beupdated more frequently if market circumstances make itadvisable.Lastly, Grupo <strong>Santander</strong> is actively participating in the processopened by the Basel committee to strengthen the liquidity ofbanks 3 , with a two-pronged approach: on the one hand,participating in the analysis of the impact of the regulatorychanges raised –basically, the introduction of two new ratios:liquidity coverage ratio (LCR) and net stable funding ratio(NSFR)– and, on the other, being present in the different forumsto discuss and make suggestions on the issue (European BankingFederation, etc), maintaining in both cases close co-operationwith the Bank of Spain.(3) International framework for liquidity risk measurement, standards and monitoring(Basel Committee on Banking Supervision, Consultative Document, December <strong>2009</strong>)<strong>Annual</strong> Report <strong>2009</strong> Risk management

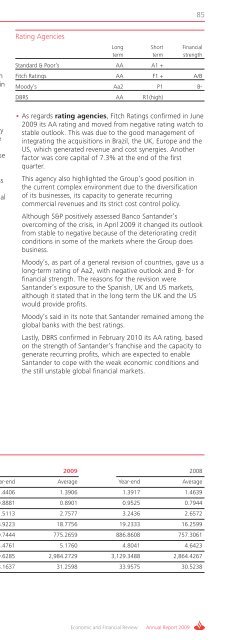

171C. Structural exchange-rate risk/ Hedging of results/Structural equityThese activities are monitored by position measures, VaR andresults.D. Additional measuresBack-testingBack-testing is an a posteriori comparative analysis betweenValue at Risk (VaR) estimates and the “clean” daily resultsactually generated (results of the portfolios at the end of the dayvalued at the next day’s prices). The purpose of these tests is toverify and measure the precision of the models used to calculateVaR.The back-testing analysis carried out by Grupo <strong>Santander</strong>complies, as a minimum, with the BIS recommendationsregarding the verification of the internal systems used tomeasure and manage market risks. In addition, back-testingincludes the hypothesis test: tests of excess, normality,Spearman rank correlation, measures of average excess, etc.The valuation models are fine-tuned and tested regularly by aspecialized unit.Coordination with other areasEvery day work is carried out jointly with other areas to offsetthe operational risk. This entails the conciliation of positions,risks and results.4.3 Control systemA. Definition of limitsThe process of setting limits takes place after the year-endbudgeting process, and is the means used by the Group toestablish the level of equity that each activity has available. Theprocess of definition of limits is dynamic, and responds to thelevel of risk appetite considered acceptable by seniormanagement.B. Objectives of the structure of limitsThe structure of limits require a process that takes into accountthe following aspects, among others:• Identify and define, efficiently and comprehensively, the maintypes of risk incurred so that they are consistent with themanagement of business and with the strategy.• Quantify and inform the business areas of the risk levels andprofile that senior management believes can be assumed, inorder to avoid undesired risks.• Give flexibility to the business areas to build risk positionsefficiently and opportunely according to changes in themarket, and in the business strategies, and always within therisk levels regarded as acceptable by the Entity.• Allow the generators of business to take prudent risks butsufficient to attain the budgeted results.• Define the range of products and underlying assets with whicheach unit of Treasury can operate, bearing in mind featuressuch as the model and valuation systems, the liquidity of thetools used, etc.4.4 Risks and results in <strong>2009</strong>A. Trading activityQuantitative analysis of var in <strong>2009</strong>The Group’s risk 4 performance with regard to trading activity infinancial markets during <strong>2009</strong>, as measured by VaR, was asfollows:VaR performance in <strong>2009</strong>Million euros48,044,040,0max (45,1)36,032,028,024,020,0 min (21,9)1 Jan. 0927 Jan. 0922 Feb. 0920 Mar. 0915 Apr. 0911 May. 096 Jun. 092 Jul. 0928 Jul. 0923 Aug. 0918 Sep. 0914 Oct. 099 Nov. 095 Dec. 0931 Dec. 09(4) Including Banesto and Sovereign. Venezuela stopped being included in the perimeter as of April 1.Risk management <strong>Annual</strong> Report <strong>2009</strong>