You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

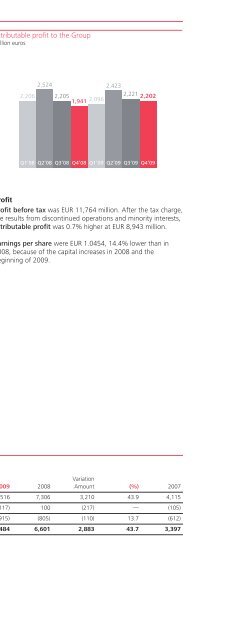

181All of this enables the Group to respond to a spectrum ofpotential, adverse circumstances, anticipating the correspondingcontingency plans.These actions are in line with the practices being fomented fromthe Basel Committee in order to strengthen the liquidity ofbanks, whose objective is to define a framework of principlesand metrics that is still being analysed and discussed.Analysis of the balance sheet and measurementof liquidity risk1.Groupstrategy2.Currentsituationof liquidityLastly, the Bank has a large capacity of recourse to central banksto obtain immediate liquidity. At the end of <strong>2009</strong>, total eligibleassets which could be discounted in the various central banks towhich the Group has access via its subsidiaries amounted tomore than EUR 100,000 million, more than double the shorttermfinancing.We now set out the framework of the balance of liquidity,consolidated as the main metrics for monitoring the structuralposition of liquidity:Grupo <strong>Santander</strong>’s balance sheet of liquidity at the end of<strong>2009</strong>*AssetsLiabilities5.Financingmarketsin stressconditionsAnalysisof liquidity3.Projectionof the balancesheet and needfor liquidityCustomer loans79%83%Deposits4.Balance sheetin stress conditionsFixed assetsFinancial assets8%13%12%5%Medium andlong-term financingShareholders’ fundand other liabilitiesShort-term financingB3.2. Current state of liquidityThe Group has an excellent structural position, with the capacityto meet the new conditions of stress in the markets. This isunderscored by:a. The robust balance sheetb. The dynamics of financinga. Robust balance sheetThe balance sheet at the end of <strong>2009</strong> was solid, as befits theGroup’s retail nature. Lending, which accounted for 79% of netassets, was entirely financed by customer deposits and mediumand long-term financing. Equally, the structural needs ofliquidity, represented by loans and fixed assets, were also totallyfinanced by structural funds (deposits, medium and long-termfinancing and capital).As regards financing in wholesale markets, the Group’s structureis largely based on medium and long-term instruments (81% ofthe total).(*) Balance sheet for the purposes of liquidity management: total balance sheet net of tradingderivatives and interbank balances.Monitoring metricsMetrics <strong>2009</strong> 2008Loans/net assets 79% 79%Customer deposits, insurance and mediumand long-term financing/loans 106% 104%Customer deposits, insurance and mediumand long-term financing, shareholders’ fundsand other liabilities/total loans and fixed assets 110% 103%Short-term financing/net liabilities 5% 7%As in the Group, the balance sheets of the units of convertiblecurrencies and of Latin America maintain the same principles,within the philosophy of independence and responsibility in theirfinancing.Short-term financing is a marginal part of the structure (5% oftotal funds) and is amply covered by liquid assets. Of note is thatthe parent bank, probably the unit most demanding in liquidity,comfortably meets the recommendations of liquidity horizonspointed out by CEBS.Risk management <strong>Annual</strong> Report <strong>2009</strong>