Building Competitive Green Industries

green-industries

green-industries

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

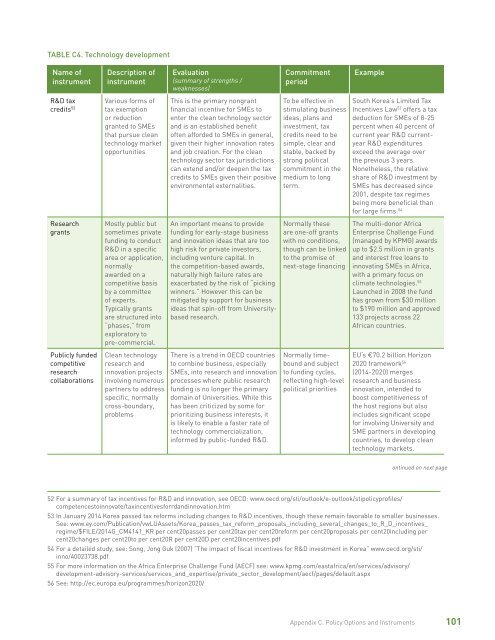

52 53 54 55 56TABLE C4. Technology developmentName ofinstrumentDescription ofinstrumentEvaluation .(summary of strengths /weaknesses)CommitmentperiodExampleR&D taxcredits 52Various forms oftax exemptionor reductiongranted to SMEsthat pursue cleantechnology marketopportunitiesThis is the primary nongrantfinancial incentive for SMEs toenter the clean technology sectorand is an established benefitoften afforded to SMEs in general,given their higher innovation ratesand job creation. For the cleantechnology sector tax jurisdictionscan extend and/or deepen the taxcredits to SMEs given their positiveenvironmental externalities.To be effective instimulating businessideas, plans andinvestment, taxcredits need to besimple, clear andstable, backed bystrong politicalcommitment in themedium to longterm.South Korea‘s Limited TaxIncentives Law 53 offers a taxdeduction for SMEs of 8-25percent when 40 percent ofcurrent year R&D currentyearR&D expendituresexceed the average overthe previous 3 years.Nonetheless, the relativeshare of R&D investment bySMEs has decreased since2001, despite tax regimesbeing more beneficial thanfor large firms. 54ResearchgrantsMostly public butsometimes privatefunding to conductR&D in a specificarea or application,normallyawarded on acompetitive basisby a committeeof experts.Typically grantsare structured into“phases,” fromexploratory topre-commercial.An important means to providefunding for early-stage businessand innovation ideas that are toohigh risk for private investors,including venture capital. Inthe competition-based awards,naturally high failure rates areexacerbated by the risk of “pickingwinners.” However this can bemitigated by support for businessideas that spin-off from Universitybasedresearch.Normally theseare one-off grantswith no conditions,though can be linkedto the promise ofnext-stage financingThe multi-donor AfricaEnterprise Challenge Fund(managed by KPMG) awardsup to $2.5 million in grantsand interest free loans toinnovating SMEs in Africa,with a primary focus onclimate technologies. 55Launched in 2008 the fundhas grown from $30 millionto $190 million and approved133 projects across 22African countries.Publicly fundedcompetitiveresearchcollaborationsClean technologyresearch andinnovation projectsinvolving numerouspartners to addressspecific, normallycross-boundary,problemsThere is a trend in OECD countriesto combine business, especiallySMEs, into research and innovationprocesses where public researchfunding is no longer the primarydomain of Universities. While thishas been criticized by some forprioritizing business interests, itis likely to enable a faster rate oftechnology commercialization,informed by public-funded R&D.Normally timeboundand subjectto funding cycles,reflecting high-levelpolitical prioritiesEU‘s €70.2 billion Horizon2020 framework 56(2014-2020) mergesresearch and businessinnovation, intended toboost competitiveness ofthe host regions but alsoincludes significant scopefor involving University andSME partners in developingcountries, to develop cleantechnology markets.ontinued on next page52 For a summary of tax incentives for R&D and innovation, see OECD: www.oecd.org/sti/outlook/e-outlook/stipolicyprofiles/competencestoinnovate/taxincentivesforrdandinnovation.htm53 In January 2014 Korea passed tax reforms including changes to R&D incentives, though these remain favorable to smaller businesses.See: www.ey.com/Publication/vwLUAssets/Korea_passes_tax_reform_proposals_including_several_changes_to_R_D_incentives_regime/$FILE/2014G_CM4141_KR per cent20passes per cent20tax per cent20reform per cent20proposals per cent20including percent20changes per cent20to per cent20R per cent20D per cent20incentives.pdf54 For a detailed study, see: Song, Jong Guk (2007) “The impact of fiscal incentives for R&D investment in Korea” www.oecd.org/sti/inno/40023738.pdf55 For more information on the Africa Enterprise Challenge Fund (AECF) see: www.kpmg.com/eastafrica/en/services/advisory/development-advisory-services/services_and_expertise/private_sector_development/aecf/pages/default.aspx56 See: http://ec.europa.eu/programmes/horizon2020/Appendix C. Policy Options and Instruments101