Building Competitive Green Industries

green-industries

green-industries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

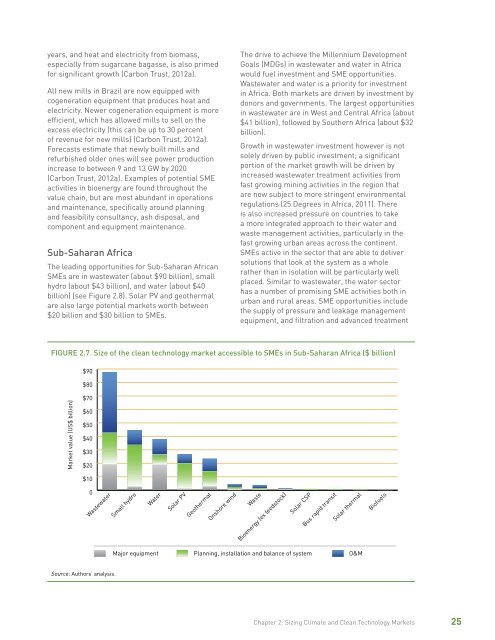

years, and heat and electricity from biomass,especially from sugarcane bagasse, is also primedfor significant growth (Carbon Trust, 2012a).All new mills in Brazil are now equipped withcogeneration equipment that produces heat andelectricity. Newer cogeneration equipment is moreefficient, which has allowed mills to sell on theexcess electricity (this can be up to 30 percentof revenue for new mills) (Carbon Trust, 2012a).Forecasts estimate that newly built mills andrefurbished older ones will see power productionincrease to between 9 and 13 GW by 2020(Carbon Trust, 2012a). Examples of potential SMEactivities in bioenergy are found throughout thevalue chain, but are most abundant in operationsand maintenance, specifically around planningand feasibility consultancy, ash disposal, andcomponent and equipment maintenance.Sub-Saharan AfricaThe leading opportunities for Sub-Saharan AfricanSMEs are in wastewater (about $90 billion), smallhydro (about $43 billion), and water (about $40billion) (see Figure 2.8). Solar PV and geothermalare also large potential markets worth between$20 billion and $30 billion to SMEs.The drive to achieve the Millennium DevelopmentGoals (MDGs) in wastewater and water in Africawould fuel investment and SME opportunities.Wastewater and water is a priority for investmentin Africa. Both markets are driven by investment bydonors and governments. The largest opportunitiesin wastewater are in West and Central Africa (about$41 billion), followed by Southern Africa (about $32billion).Growth in wastewater investment however is notsolely driven by public investment; a significantportion of the market growth will be driven byincreased wastewater treatment activities fromfast growing mining activities in the region thatare now subject to more stringent environmentalregulations (25 Degrees in Africa, 2011). Thereis also increased pressure on countries to takea more integrated approach to their water andwaste management activities, particularly in thefast growing urban areas across the continent.SMEs active in the sector that are able to deliversolutions that look at the system as a wholerather than in isolation will be particularly wellplaced. Similar to wastewater, the water sectorhas a number of promising SME activities both inurban and rural areas. SME opportunities includethe supply of pressure and leakage managementequipment, and filtration and advanced treatmentFIGURE 2.7. Size of the clean technology market accessible to SMEs in Sub-Saharan Africa ($ billion)$90$80Market value (US$ billion)$70$60$50$40$30$20$100WastewaterSmall hydroWaterSolar PVGeothermalOnshore windWasteBioenergy (ex feedstock)Solar CSPBus rapid transitSolar thermalBiofuelsMajor equipment Planning, installation and balance of system O&MSource: Authors’ analysis.Chapter 2: Sizing Climate and Clean Technology Markets25