Valueat-Risk

Forecasting the Return Distribution Using High-Frequency Volatility ...

Forecasting the Return Distribution Using High-Frequency Volatility ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

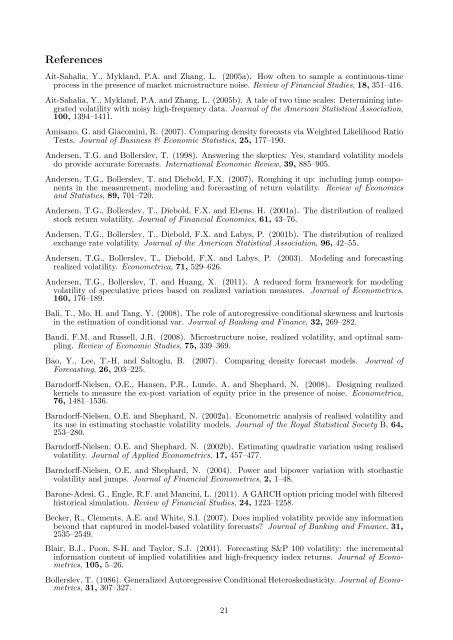

References<br />

Ait-Sahalia, Y., Mykland, P.A. and Zhang, L. (2005a). How often to sample a continuous-time<br />

process in the presence of market microstructure noise. Review of Financial Studies, 18, 351–416.<br />

Ait-Sahalia, Y., Mykland, P.A. and Zhang, L. (2005b). A tale of two time scales: Determining integrated<br />

volatility with noisy high-frequency data. Journal of the American Statistical Association,<br />

100, 1394–1411.<br />

Amisano, G. and Giacomini, R. (2007). Comparing density forecasts via Weighted Likelihood Ratio<br />

Tests. Journal of Business & Economic Statistics, 25, 177–190.<br />

Andersen, T.G. and Bollerslev, T. (1998). Answering the skeptics: Yes, standard volatility models<br />

do provide accurate forecasts. International Economic Review, 39, 885–905.<br />

Andersen, T.G., Bollerslev, T. and Diebold, F.X. (2007). Roughing it up: including jump components<br />

in the measurement, modeling and forecasting of return volatility. Review of Economics<br />

and Statistics, 89, 701–720.<br />

Andersen, T.G., Bollerslev, T., Diebold, F.X. and Ebens, H. (2001a). The distribution of realized<br />

stock return volatility. Journal of Financial Economics, 61, 43–76.<br />

Andersen, T.G., Bollerslev, T., Diebold, F.X. and Labys, P. (2001b). The distribution of realized<br />

exchange rate volatility. Journal of the American Statistical Association, 96, 42–55.<br />

Andersen, T.G., Bollerslev, T., Diebold, F.X. and Labys, P. (2003). Modeling and forecasting<br />

realized volatility. Econometrica, 71, 529–626.<br />

Andersen, T.G., Bollerslev, T. and Huang, X. (2011). A reduced form framework for modeling<br />

volatility of speculative prices based on realized variation measures. Journal of Econometrics,<br />

160, 176–189.<br />

Bali, T., Mo, H. and Tang, Y. (2008). The role of autoregressive conditional skewness and kurtosis<br />

in the estimation of conditional var. Journal of Banking and Finance, 32, 269–282.<br />

Bandi, F.M. and Russell, J.R. (2008). Microstructure noise, realized volatility, and optimal sampling.<br />

Review of Economic Studies, 75, 339–369.<br />

Bao, Y., Lee, T.-H. and Saltoglu, B. (2007). Comparing density forecast models. Journal of<br />

Forecasting, 26, 203–225.<br />

Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A. and Shephard, N. (2008). Designing realized<br />

kernels to measure the ex-post variation of equity price in the presence of noise. Econometrica,<br />

76, 1481–1536.<br />

Barndorff-Nielsen, O.E. and Shephard, N. (2002a). Econometric analysis of realised volatility and<br />

its use in estimating stochastic volatility models. Journal of the Royal Statistical Society B, 64,<br />

253–280.<br />

Barndorff-Nielsen, O.E. and Shephard, N. (2002b). Estimating quadratic variation using realised<br />

volatility. Journal of Applied Econometrics, 17, 457–477.<br />

Barndorff-Nielsen, O.E. and Shephard, N. (2004). Power and bipower variation with stochastic<br />

volatility and jumps. Journal of Financial Econometrics, 2, 1–48.<br />

Barone-Adesi, G., Engle, R.F. and Mancini, L. (2011). A GARCH option pricing model with filtered<br />

historical simulation. Review of Financial Studies, 24, 1223–1258.<br />

Becker, R., Clements, A.E. and White, S.I. (2007). Does implied volatility provide any information<br />

beyond that captured in model-based volatility forecasts? Journal of Banking and Finance, 31,<br />

2535–2549.<br />

Blair, B.J., Poon, S-H. and Taylor, S.J. (2001). Forecasting S&P 100 volatility: the incremental<br />

information content of implied volatilities and high-frequency index returns. Journal of Econometrics,<br />

105, 5–26.<br />

Bollerslev, T. (1986). Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics,<br />

31, 307–327.<br />

21