Valueat-Risk

Forecasting the Return Distribution Using High-Frequency Volatility ...

Forecasting the Return Distribution Using High-Frequency Volatility ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

τ=0.25<br />

τ=0.75<br />

−1.6 −1.4 −1.2 −1.0 −0.8 −0.6 −0.4<br />

rv t , rv t w , rv t<br />

m<br />

GARCH(1,1)−EDF<br />

GJR−EDF<br />

1.0 1.5 2.0<br />

rv t , rv t w , rv t<br />

m<br />

GARCH(1,1)−EDF<br />

GJR−EDF<br />

−4 −2 0 2 4<br />

r t+1<br />

−4 −2 0 2 4<br />

r t+1<br />

(a)<br />

(b)<br />

τ=0.025<br />

τ=0.975<br />

rv t , rv t w , rv t<br />

m<br />

GARCH(1,1)−EDF<br />

GJR−EDF<br />

rv t , rv t w , rv t<br />

m<br />

GARCH(1,1)−EDF<br />

GJR−EDF<br />

−6 −5 −4 −3 −2<br />

2 3 4 5<br />

−4 −2 0 2 4<br />

−4 −2 0 2 4<br />

r t+1<br />

r t+1<br />

(c)<br />

(d)<br />

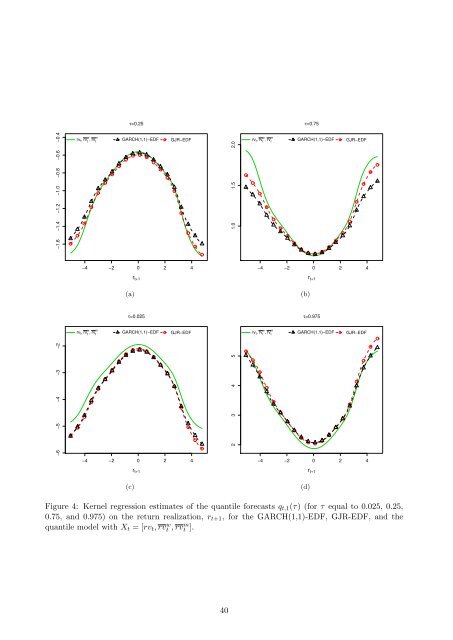

Figure 4: Kernel regression estimates of the quantile forecasts q t,1 (τ) (for τ equal to 0.025, 0.25,<br />

0.75, and 0.975) on the return realization, r t+1 , for the GARCH(1,1)-EDF, GJR-EDF, and the<br />

quantile model with X t = [rv t , rv w t , rv m t ].<br />

40