Valueat-Risk

Forecasting the Return Distribution Using High-Frequency Volatility ...

Forecasting the Return Distribution Using High-Frequency Volatility ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

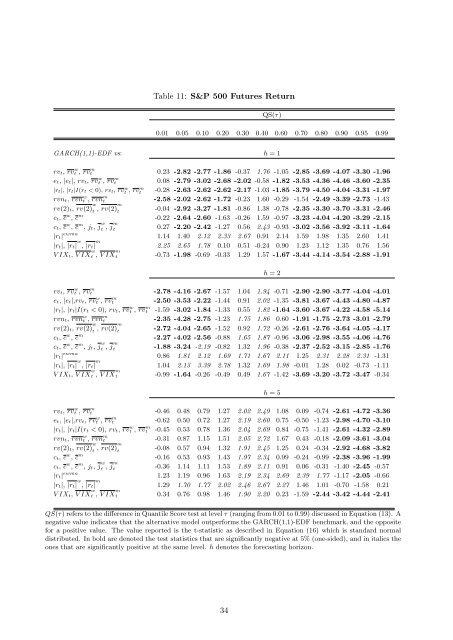

Table 11: S&P 500 Futures Return<br />

QS(τ)<br />

0.01 0.05 0.10 0.20 0.30 0.40 0.60 0.70 0.80 0.90 0.95 0.99<br />

GARCH(1,1)-EDF vs: h = 1<br />

rv t, rv w t , rv m t 0.23 -2.82 -2.77 -1.86 -0.37 1.76 -1.05 -2.85 -3.69 -4.07 -3.30 -1.96<br />

e t, |e t|, rv t, rv w t , rv m t 0.08 -2.79 -3.02 -2.68 -2.02 -0.58 -1.82 -3.53 -4.36 -4.46 -3.60 -2.35<br />

|r t|, |r t|I(r t < 0), rv t, rv w t , rvm t -0.28 -2.63 -2.62 -2.62 -2.17 -1.03 -1.85 -3.79 -4.50 -4.04 -3.31 -1.97<br />

rvn t, rvn w t , rvn m t -2.58 -2.02 -2.62 -1.72 -0.23 1.60 -0.29 -1.54 -2.49 -3.39 -2.73 -1.43<br />

rv(2) t, rv(2) w t , rv(2)m t<br />

-0.04 -2.92 -3.27 -1.81 -0.86 1.38 -0.78 -2.35 -3.30 -3.70 -3.31 -2.46<br />

c t, c w , c m -0.22 -2.64 -2.60 -1.63 -0.26 1.59 -0.97 -3.23 -4.04 -4.20 -3.29 -2.15<br />

c t, c w , c m , j t, j w t , jm t 0.27 -2.20 -2.42 -1.27 0.56 2.43 -0.93 -3.02 -3.56 -3.92 -3.11 -1.64<br />

|r t| ewma 1.14 1.40 2.12 2.33 2.67 0.91 2.14 1.59 1.98 1.35 2.60 1.41<br />

|r t|, |r t| w , |r t| m 2.25 2.65 1.78 0.10 0.51 -0.24 0.90 1.23 1.12 1.35 0.76 1.56<br />

V IX t, V IX w t , V IX m t -0.73 -1.98 -0.69 -0.33 1.29 1.57 -1.67 -3.44 -4.14 -3.54 -2.88 -1.91<br />

rv t, rv w t , rv m t -2.78 -4.16 -2.67 -1.57 1.04 1.94 -0.71 -2.90 -2.90 -3.77 -4.04 -4.01<br />

e t, |e t|,rv t, rv w t , rv m t -2.50 -3.53 -2.22 -1.44 0.91 2.02 -1.35 -3.81 -3.67 -4.43 -4.80 -4.87<br />

|r t|, |r t|I(r t < 0), rv t, rv w t , rv m t -1.59 -3.02 -1.84 -1.33 0.55 1.82 -1.64 -3.60 -3.67 -4.22 -4.58 -5.14<br />

rvn t, rvn w t , rvn m t -2.35 -4.28 -2.75 -1.23 1.75 1.86 0.60 -1.91 -1.75 -2.73 -3.01 -2.79<br />

rv(2) t, rv(2) w t , rv(2)m t<br />

-2.72 -4.04 -2.65 -1.52 0.92 1.72 -0.26 -2.61 -2.76 -3.64 -4.05 -4.17<br />

c t, c w , c m -2.27 -4.02 -2.56 -0.88 1.65 1.87 -0.96 -3.06 -2.98 -3.55 -4.06 -4.76<br />

c t, c w , c m , j t, j w t , jm t -1.88 -3.24 -2.19 -0.82 1.32 1.96 -0.38 -2.37 -2.52 -3.15 -2.85 -1.76<br />

|r t| ewma 0.86 1.81 2.12 1.69 1.71 1.67 2.11 1.25 2.31 2.28 2.31 -1.31<br />

|r t|, |r t| w , |r t| m 1.04 2.13 3.39 2.78 1.32 1.69 1.98 -0.01 1.28 0.02 -0.73 -1.11<br />

V IX t, V IX w t , V IX m t -0.99 -1.64 -0.26 -0.49 0.49 1.67 -1.42 -3.69 -3.20 -3.72 -3.47 -0.34<br />

rv t, rv w t , rv m t -0.46 0.48 0.79 1.27 2.02 2.49 1.08 0.09 -0.74 -2.61 -4.72 -3.36<br />

e t, |e t|,rv t, rv w t , rv m t -0.62 0.50 0.72 1.27 2.19 2.60 0.75 -0.50 -1.23 -2.98 -4.70 -3.10<br />

|r t|, |r t|I(r t < 0), rv t, rv w t , rv m t -0.45 0.53 0.78 1.36 2.04 2.69 0.84 -0.75 -1.41 -2.61 -4.32 -2.89<br />

rvn t, rvn w t , rvn m t -0.31 0.87 1.15 1.51 2.05 2.72 1.67 0.43 -0.18 -2.09 -3.61 -3.04<br />

rv(2) t, rv(2) w t , rv(2)m t<br />

-0.08 0.57 0.94 1.32 1.91 2.45 1.25 0.24 -0.34 -2.92 -4.68 -3.82<br />

c t, c w , c m -0.16 0.53 0.93 1.43 1.97 2.34 0.99 -0.24 -0.99 -2.38 -3.96 -1.99<br />

c t, c w , c m , j t, j w t , jm t -0.36 1.14 1.11 1.53 1.89 2.11 0.91 0.06 -0.31 -1.40 -2.45 -0.57<br />

|r t| ewma 1.23 1.19 0.96 1.63 2.19 2.34 2.69 2.39 1.77 -1.17 -2.05 -0.66<br />

|r t|, |r t| w , |r t| m 1.29 1.70 1.77 2.02 2.46 2.67 2.27 1.46 1.01 -0.70 -1.58 0.21<br />

V IX t, V IX w t , V IX m t 0.34 0.76 0.98 1.46 1.90 2.20 0.23 -1.59 -2.44 -3.42 -4.44 -2.41<br />

h = 2<br />

h = 5<br />

QS(τ) refers to the difference in Quantile Score test at level τ (ranging from 0.01 to 0.99) discussed in Equation (13). A<br />

negative value indicates that the alternative model outperforms the GARCH(1,1)-EDF benchmark, and the opposite<br />

for a positive value. The value reported is the t-statistic as described in Equation (16) which is standard normal<br />

distributed. In bold are denoted the test statistics that are significantly negative at 5% (one-sided), and in italics the<br />

ones that are significantly positive at the same level. h denotes the forecasting horizon.<br />

34