Wealden Times | WT165 | November 2015 | Gift supplement inside

Wealden Times - The lifestyle magazine for the Weald

Wealden Times - The lifestyle magazine for the Weald

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

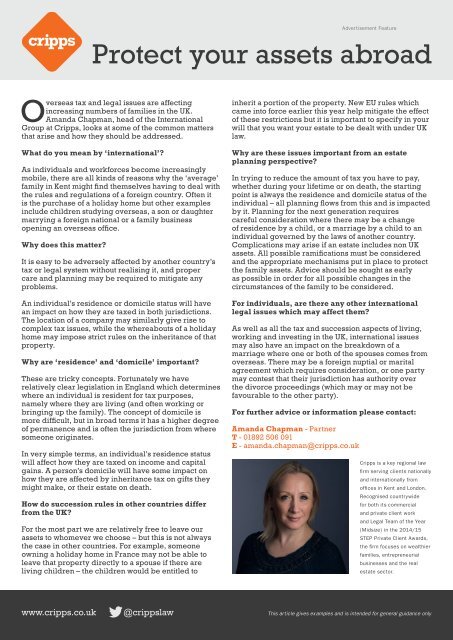

Advertisement Feature<br />

Protect your assets abroad<br />

Overseas tax and legal issues are affecting<br />

increasing numbers of families in the UK.<br />

Amanda Chapman, head of the International<br />

Group at Cripps, looks at some of the common matters<br />

that arise and how they should be addressed.<br />

What do you mean by ‘international’?<br />

As individuals and workforces become increasingly<br />

mobile, there are all kinds of reasons why the ‘average’<br />

family in Kent might find themselves having to deal with<br />

the rules and regulations of a foreign country. Often it<br />

is the purchase of a holiday home but other examples<br />

include children studying overseas, a son or daughter<br />

marrying a foreign national or a family business<br />

opening an overseas office.<br />

Why does this matter?<br />

It is easy to be adversely affected by another country’s<br />

tax or legal system without realising it, and proper<br />

care and planning may be required to mitigate any<br />

problems.<br />

An individual’s residence or domicile status will have<br />

an impact on how they are taxed in both jurisdictions.<br />

The location of a company may similarly give rise to<br />

complex tax issues, while the whereabouts of a holiday<br />

home may impose strict rules on the inheritance of that<br />

property.<br />

Why are ‘residence’ and ‘domicile’ important?<br />

These are tricky concepts. Fortunately we have<br />

relatively clear legislation in England which determines<br />

where an individual is resident for tax purposes,<br />

namely where they are living (and often working or<br />

bringing up the family). The concept of domicile is<br />

more difficult, but in broad terms it has a higher degree<br />

of permanence and is often the jurisdiction from where<br />

someone originates.<br />

In very simple terms, an individual’s residence status<br />

will affect how they are taxed on income and capital<br />

gains. A person’s domicile will have some impact on<br />

how they are affected by inheritance tax on gifts they<br />

might make, or their estate on death.<br />

How do succession rules in other countries differ<br />

from the UK?<br />

For the most part we are relatively free to leave our<br />

assets to whomever we choose – but this is not always<br />

the case in other countries. For example, someone<br />

owning a holiday home in France may not be able to<br />

leave that property directly to a spouse if there are<br />

living children – the children would be entitled to<br />

inherit a portion of the property. New EU rules which<br />

came into force earlier this year help mitigate the effect<br />

of these restrictions but it is important to specify in your<br />

will that you want your estate to be dealt with under UK<br />

law.<br />

Why are these issues important from an estate<br />

planning perspective?<br />

In trying to reduce the amount of tax you have to pay,<br />

whether during your lifetime or on death, the starting<br />

point is always the residence and domicile status of the<br />

individual – all planning flows from this and is impacted<br />

by it. Planning for the next generation requires<br />

careful consideration where there may be a change<br />

of residence by a child, or a marriage by a child to an<br />

individual governed by the laws of another country.<br />

Complications may arise if an estate includes non UK<br />

assets. All possible ramifications must be considered<br />

and the appropriate mechanisms put in place to protect<br />

the family assets. Advice should be sought as early<br />

as possible in order for all possible changes in the<br />

circumstances of the family to be considered.<br />

For individuals, are there any other international<br />

legal issues which may affect them?<br />

As well as all the tax and succession aspects of living,<br />

working and investing in the UK, international issues<br />

may also have an impact on the breakdown of a<br />

marriage where one or both of the spouses comes from<br />

overseas. There may be a foreign nuptial or marital<br />

agreement which requires consideration, or one party<br />

may contest that their jurisdiction has authority over<br />

the divorce proceedings (which may or may not be<br />

favourable to the other party).<br />

For further advice or information please contact:<br />

Amanda Chapman - Partner<br />

T - 01892 506 091<br />

E - amanda.chapman@cripps.co.uk<br />

Cripps is a key regional law<br />

firm serving clients nationally<br />

and internationally from<br />

offices in Kent and London.<br />

Recognised countrywide<br />

for both its commercial<br />

and private client work<br />

and Legal Team of the Year<br />

(Midsize) in the 2014/15<br />

STEP Private Client Awards,<br />

the firm focuses on wealthier<br />

families, entrepreneurial<br />

businesses and the real<br />

estate sector.<br />

www.cripps.co.uk @crippslaw This article gives examples and is intended for general guidance only