Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

11<br />

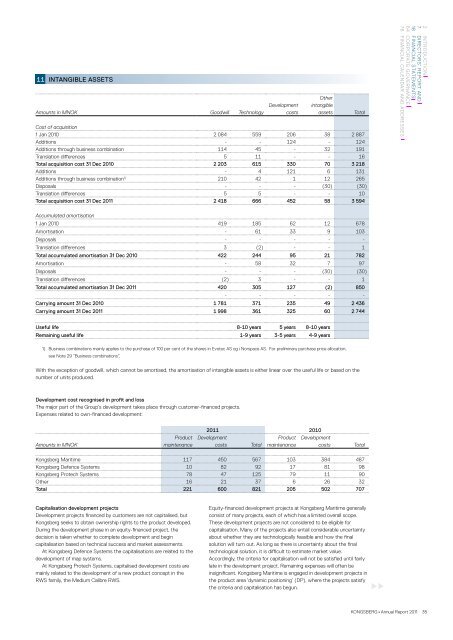

INTANGIBLE ASSETS<br />

Amounts in MNOK Goodwill Technology<br />

Development<br />

costs<br />

Other<br />

intangible<br />

assets Total<br />

Cost of acquisition<br />

1 Jan 2010 2 084 559 206 38 2 887<br />

Additions - - 124 - 124<br />

Additions through business combination 114 45 - 32 191<br />

Translation differences 5 11 - - 16<br />

Total acquisition cost 31 Dec 2010 2 203 615 330 70 3 218<br />

Additions - 4 121 6 131<br />

Additions through business combination 1) 210 42 1 12 265<br />

Disposals - - - (30) (30)<br />

Translation differences 5 5 - - 10<br />

Total acquisition cost 31 Dec <strong>2011</strong> 2 418 666 452 58 3 594<br />

Accumulated amortisation<br />

1 Jan 2010 419 185 62 12 678<br />

Amortisation - 61 33 9 103<br />

Disposals - - - - -<br />

Translation differences 3 (2) - - 1<br />

Total accumulated amortisation 31 Dec 2010 422 244 95 21 782<br />

Amortisation - 58 32 7 97<br />

Disposals - - - (30) (30)<br />

Translation differences (2) 3 - - 1<br />

Total accumulated amortisation 31 Dec <strong>2011</strong> 420 305 127 (2) 850<br />

- - - - -<br />

Carrying amount 31 Dec 2010 1 781 371 235 49 2 436<br />

Carrying amount 31 Dec <strong>2011</strong> 1 998 361 325 60 2 744<br />

Useful life 8-10 years 5 years 8-10 years<br />

Remaining useful life 1-9 years 3-5 years 4-9 years<br />

1) Business combinations mainly applies to the purchase of 100 per cent of the shares in Evotec AS og i Norspace AS. For preliminary purchase price allocation,<br />

see Note 29 “Business combinations”.<br />

With the exception of goodwill, which cannot be amortised, the amortisation of intangible assets is either linear over the useful life or based on the<br />

number of units produced.<br />

Development cost recognised in profit and loss<br />

The major part of the Group’s development takes place through customer-financed projects.<br />

Expenses related to own-financed development:<br />

Amounts in MNOK<br />

Product<br />

maintenance<br />

<strong>2011</strong> 2010<br />

Development<br />

costs Total<br />

Product<br />

maintenance<br />

Development<br />

costs Total<br />

<strong>Kongsberg</strong> <strong>Maritime</strong> 117 450 567 103 384 487<br />

<strong>Kongsberg</strong> Defence Systems 10 82 92 17 81 98<br />

<strong>Kongsberg</strong> Protech Systems 78 47 125 79 11 90<br />

Other 16 21 37 6 26 32<br />

Total 221 600 821 205 502 707<br />

Capitalisation development projects<br />

Development projects financed by customers are not capitalised, but<br />

<strong>Kongsberg</strong> seeks to obtain ownership rights to the product developed.<br />

During the development phase in an equity-financed project, the<br />

decision is taken whether to complete development and begin<br />

capitalisation based on technical success and market assessments.<br />

At <strong>Kongsberg</strong> Defence Systems the capitalisations are related to the<br />

development of map systems.<br />

At <strong>Kongsberg</strong> Protech Systems, capitalised development costs are<br />

mainly related to the development of a new product concept in the<br />

RWS family, the Medium Calibre RWS.<br />

Equity-financed development projects at <strong>Kongsberg</strong> <strong>Maritime</strong> generally<br />

consist of many projects, each of which has a limited overall scope.<br />

These development projects are not considered to be eligible for<br />

capitalisation. Many of the projects also entail considerable uncertainty<br />

about whether they are technologically feasible and how the final<br />

solution will turn out. As long as there is uncertainty about the final<br />

technological solution, it is difficult to estimate market value.<br />

Accordingly, the criteria for capitalisation will not be satisfied until fairly<br />

late in the development project. Remaining expenses will often be<br />

insignificant. <strong>Kongsberg</strong> <strong>Maritime</strong> is engaged in development projects in<br />

the product area ‘dynamic positioning’ (DP), where the projects satisfy<br />

the criteria and capitalisation has begun.<br />

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 35