Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

25<br />

Amounts in MNOK<br />

48 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

Year of<br />

disposal<br />

Statement on the Group CEO and Executive Management<br />

Remuneration<br />

The Board proposes that the following guidelines are applied for 2012.<br />

<strong>Annual</strong> lease<br />

payments<br />

2012<br />

The main principles of the company’s remuneration policy for the<br />

Group CEO and Executive Management<br />

The principles that apply to remuneration of executive management are<br />

adopted by the Board. Each year, the Board of Directors assesses the<br />

CEO’s remuneration and other compensation conditions, as well as the<br />

Group’s performance-based salary plan for executives. The Board’s<br />

Compensation Committee prepares the cases on the agenda for the<br />

Board of Directors. The CEO stipulates compensation for the other<br />

members of corporate executive management in consultation with the<br />

Chairman of the Board.<br />

Management remuneration at <strong>Kongsberg</strong> <strong>Gruppen</strong> ASA and Group<br />

companies (“KONGSBERG”) are based on the following main principles:<br />

- Management remuneration is to be competitive, but not leading; the<br />

Lease<br />

payments<br />

2013<br />

–2017<br />

Lease<br />

payments<br />

beyond<br />

2017<br />

Remaining<br />

term<br />

of lease<br />

Lease<br />

payments<br />

– sublease<br />

2012<br />

Weighted<br />

average<br />

subleasing<br />

period<br />

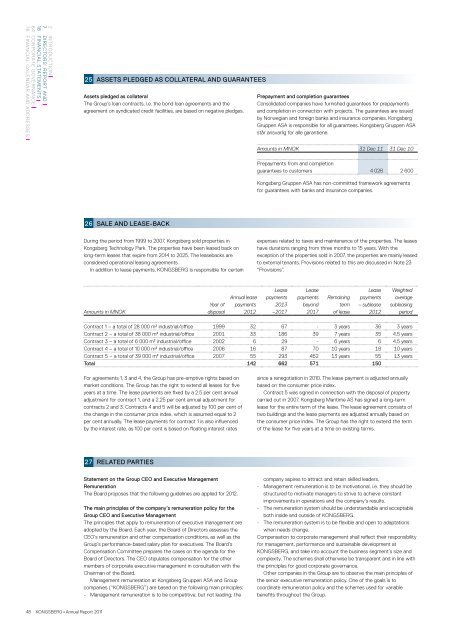

Contract 1 – a total of 28 000 m² industrial/office 1999 32 67 - 3 years 36 3 years<br />

Contract 2 – a total of 38 000 m² industrial/office 2001 33 186 39 7 years 35 4.5 years<br />

Contract 3 – a total of 6 000 m² industrial/office 2002 6 29 - 6 years 6 4.5 years<br />

Contract 4 – a total of 10 000 m² industrial/office 2006 16 87 70 10 years 18 10 years<br />

Contract 5 – a total of 39 000 m² industrial/office 2007 55 293 462 13 years 55 13 years<br />

Total 142 662 571 150<br />

27<br />

ASSETS PLEDGED AS COLLATERAL AND GUARANTEES<br />

Assets pledged as collateral<br />

The Group’s loan contracts, i.e. the bond loan agreements and the<br />

agreement on syndicated credit facilities, are based on negative pledges.<br />

26<br />

SALE AND LEASE-BACK<br />

During the period from 1999 to 2007, <strong>Kongsberg</strong> sold properties in<br />

<strong>Kongsberg</strong> Technology Park. The properties have been leased back on<br />

long-term leases that expire from 2014 to 2025. The leasebacks are<br />

considered operational leasing agreements.<br />

In addition to lease payments, KONGSBERG is responsible for certain<br />

For agreements 1, 3 and 4, the Group has pre-emptive rights based on<br />

market conditions. The Group has the right to extend all leases for five<br />

years at a time. The lease payments are fixed by a 2.5 per cent annual<br />

adjustment for contract 1, and a 2.25 per cent annual adjustment for<br />

contracts 2 and 3. Contracts 4 and 5 will be adjusted by 100 per cent of<br />

the change in the consumer price index, which is assumed equal to 2<br />

per cent annually. The lease payments for contract 1 is also influenced<br />

by the interest rate, as 100 per cent is based on floating interest rates<br />

RELATED PARTIES<br />

Prepayment and completion guarantees<br />

Consolidated companies have furnished guarantees for prepayments<br />

and completion in connection with projects. The guarantees are issued<br />

by Norwegian and foreign banks and insurance companies. <strong>Kongsberg</strong><br />

<strong>Gruppen</strong> ASA is responsible for all guarantees. <strong>Kongsberg</strong> <strong>Gruppen</strong> ASA<br />

står ansvarlig for alle garantiene.<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

Prepayments from and completion<br />

guarantees to customers 4 026 2 600<br />

<strong>Kongsberg</strong> <strong>Gruppen</strong> ASA has non-committed framework agreements<br />

for guarantees with banks and insurance companies.<br />

expenses related to taxes and maintenance of the properties. The leases<br />

have durations ranging from three months to 15 years. With the<br />

exception of the properties sold in 2007, the properties are mainly leased<br />

to external tenants. Provisions related to this are discussed in Note 23<br />

“Provisions”.<br />

since a renegotiation in 2010. The lease payment is adjusted annually<br />

based on the consumer price index.<br />

Contract 5 was signed in connection with the disposal of property<br />

carried out in 2007. <strong>Kongsberg</strong> <strong>Maritime</strong> AS has signed a long-term<br />

lease for the entire term of the lease. The lease agreement consists of<br />

two buildings and the lease payments are adjusted annually based on<br />

the consumer price index. The Group has the right to extend the term<br />

of the lease for five years at a time on existing terms.<br />

company aspires to attract and retain skilled leaders.<br />

- Management remuneration is to be motivational, i.e. they should be<br />

structured to motivate managers to strive to achieve constant<br />

improvements in operations and the company’s results.<br />

- The remuneration system should be understandable and acceptable<br />

both inside and outside of KONGSBERG.<br />

- The remuneration system is to be flexible and open to adaptations<br />

when needs change.<br />

Compensation to corporate management shall reflect their responsibility<br />

for management, performance and sustainable development at<br />

KONGSBERG, and take into account the business segment’s size and<br />

complexity. The schemes shall otherwise be transparent and in line with<br />

the principles for good corporate governance.<br />

Other companies in the Group are to observe the main principles of<br />

the senior executive remuneration policy. One of the goals is to<br />

coordinate remuneration policy and the schemes used for variable<br />

benefits throughout the Group.