Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

42 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

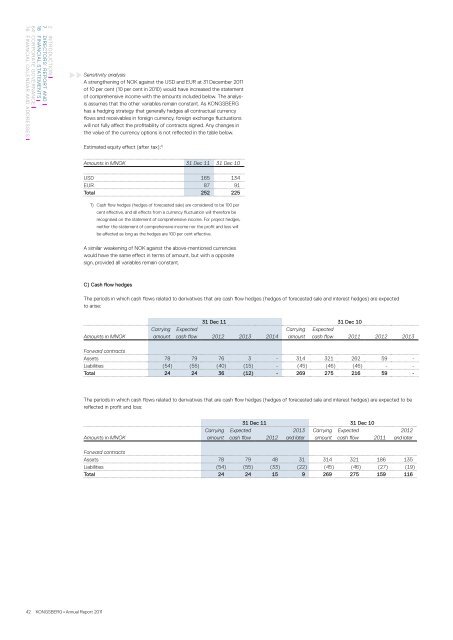

Sensitivity analysis<br />

A strengthening of NOK against the USD and EUR at 31 December <strong>2011</strong><br />

of 10 per cent (10 per cent in 2010) would have increased the statement<br />

of comprehensive income with the amounts included below. The analysis<br />

assumes that the other variables remain constant. As KONGSBERG<br />

has a hedging strategy that generally hedges all contractual currency<br />

flows and receivables in foreign currency, foreign exchange fluctuations<br />

will not fully affect the profitability of contracts signed. Any changes in<br />

the value of the currency options is not reflected in the table below.<br />

Estimated equity effect (after tax): 1)<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

USD 165 134<br />

EUR 87 91<br />

Total 252 225<br />

1) Cash flow hedges (hedges of forecasted sale) are considered to be 100 per<br />

cent effective, and all effects from a currency fluctuation will therefore be<br />

recognised on the statement of comprehensive income. For project hedges,<br />

neither the statement of comprehensive income nor the profit and loss will<br />

be affected as long as the hedges are 100 per cent effective.<br />

A similar weakening of NOK against the above-mentioned currencies<br />

would have the same effect in terms of amount, but with a opposite<br />

sign, provided all variables remain constant.<br />

C) Cash flow hedges<br />

The periods in which cash flows related to derivatives that are cash flow hedges (hedges of forecasted sale and interest hedges) are expected<br />

to arise:<br />

Amounts in MNOK<br />

Carrying<br />

amount<br />

31 Dec 11 31 Dec 10<br />

Expected<br />

cash flow 2012 2013 2014<br />

Carrying<br />

amount<br />

Expected<br />

cash flow <strong>2011</strong> 2012 2013<br />

Forward contracts<br />

Assets 78 79 76 3 - 314 321 262 59 -<br />

Liabilities (54) (55) (40) (15) - (45) (46) (46) - -<br />

Total 24 24 36 (12) - 269 275 216 59 -<br />

The periods in which cash flows related to derivatives that are cash flow hedges (hedges of forecasted sale and interest hedges) are expected to be<br />

reflected in profit and loss:<br />

Amounts in MNOK<br />

Carrying<br />

amount<br />

31 Dec 11 31 Dec 10<br />

Expected<br />

cash flow 2012<br />

2013<br />

and later<br />

Carrying<br />

amount<br />

Expected<br />

cash flow <strong>2011</strong><br />

2012<br />

and later<br />

Forward contracts<br />

Assets 78 79 48 31 314 321 186 135<br />

Liabilities (54) (55) (33) (22) (45) (46) (27) (19)<br />

Total 24 24 15 9 269 275 159 116