Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

15<br />

38 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

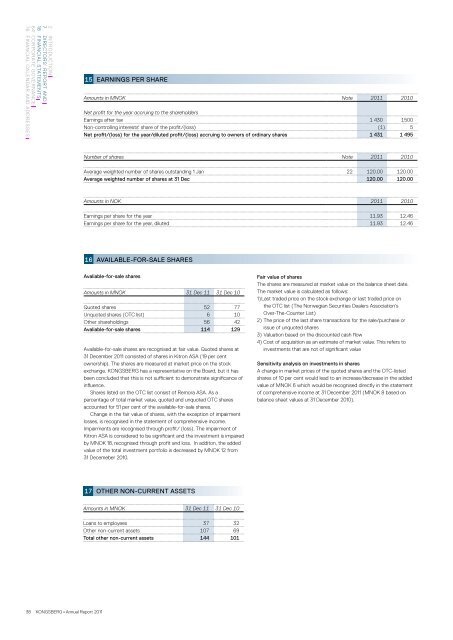

EARNINGS PER SHARE<br />

Amounts in MNOK Note <strong>2011</strong> 2010<br />

Net profit for the year accruing to the shareholders<br />

Earnings after tax 1 430 1500<br />

Non-controlling interests' share of the profit/(loss) (1) 5<br />

Net profit/(loss) for the year/diluted profit/(loss) accruing to owners of ordinary shares 1 431 1 495<br />

Number of shares Note <strong>2011</strong> 2010<br />

Average weighted number of shares outstanding 1 Jan 22 120.00 120.00<br />

Average weighted number of shares at 31 Dec 120.00 120.00<br />

Amounts in NOK <strong>2011</strong> 2010<br />

Earnings per share for the year 11.93 12.46<br />

Earnings per share for the year, diluted 11.93 12.46<br />

16<br />

AVAILABLE-FOR-SALE SHARES<br />

Avaliable-for-sale shares<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

Quoted shares 52 77<br />

Unquoted shares (OTC list) 6 10<br />

Other shareholdings 56 42<br />

Avaliable-for-sale shares 114 129<br />

Available-for-sale shares are recognised at fair value. Quoted shares at<br />

31 December <strong>2011</strong> consisted of shares in Kitron ASA (19 per cent<br />

ownership). The shares are measured at market price on the stock<br />

exchange. KONGSBERG has a representative on the Board, but it has<br />

been concluded that this is not sufficient to demonstrate significance of<br />

influence.<br />

Shares listed on the OTC list consist of Remora ASA. As a<br />

percentage of total market value, quoted and unquoted OTC shares<br />

accounted for 51 per cent of the available-for-sale shares.<br />

Change in the fair value of shares, with the exception of impairment<br />

losses, is recognised in the statement of comprehensive income.<br />

Impairments are recognised through profit/ (loss). The impairment of<br />

Kitron ASA is considered to be significant and the investment is impaired<br />

by MNOK 18, recognised through profit and loss. In additon, the added<br />

value of the total investment portfolio is decreased by MNOK 12 from<br />

31 Decemeber 2010.<br />

17<br />

OTHER NON-CURRENT ASSETS<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

Loans to employees 37 32<br />

Other non-current assets 107 69<br />

Total other non-current assets 144 101<br />

Fair value of shares<br />

The shares are measured at market value on the balance sheet date.<br />

The market value is calculated as follows:<br />

1) Last traded price on the stock exchange or last traded price on<br />

the OTC list (The Norwegian Securities Dealers Association’s<br />

Over-The-Counter List)<br />

2) The price of the last share transactions for the sale/purchase or<br />

issue of unquoted shares<br />

3) Valuation based on the discounted cash flow<br />

4) Cost of acquisition as an estimate of market value. This refers to<br />

investments that are not of significant value<br />

Sensitivity analysis on investments in shares<br />

A change in market prices of the quoted shares and the OTC-listed<br />

shares of 10 per cent would lead to an increase/decrease in the added<br />

value of MNOK 6 which would be recognised directly in the statement<br />

of comprehensive income at 31 December <strong>2011</strong> (MNOK 8 based on<br />

balance sheet values at 31 December 2010).