Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

46 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

The different levels have been defined as follows<br />

* Level 1: Fair value is measured by using quoted prices in active<br />

markets for identical financial instruments. No adjustments is made<br />

related to these prices.<br />

* Level 2: The fair value of financial instruments that are not traded on<br />

an active market is determined using valuation methods. These<br />

valuation methods maximise the use of observable data where they<br />

are available, and rely as little as possible on the Group’s own<br />

estimates. Classification at level 2 requires that all significant data<br />

required to determine fair value are observable data.<br />

* Level 3: Fair value is measured using significant data that are not<br />

based on observable market data.<br />

21<br />

22<br />

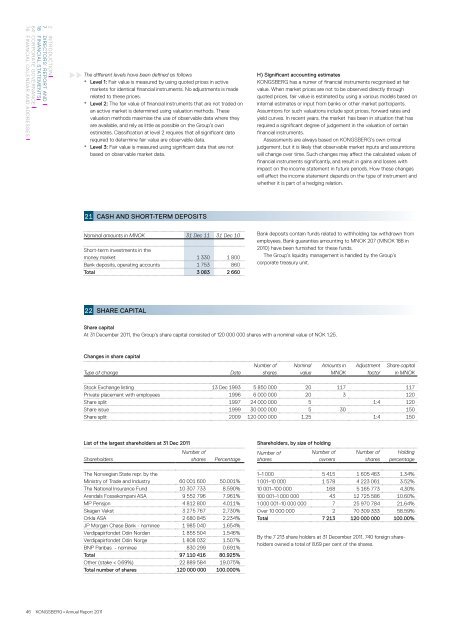

CASH AND SHORT-TERM DEPOSITS<br />

Nominal amounts in MNOK 31 Dec 11 31 Dec 10<br />

Short-term investments in the<br />

money market 1 330 1 800<br />

Bank deposits, operating accounts 1 753 860<br />

Total 3 083 2 660<br />

SHARE CAPITAL<br />

List of the largest shareholders at 31 Dec <strong>2011</strong><br />

Number of<br />

Shareholders<br />

shares Percentage<br />

The Norwegian State repr. by the<br />

Ministry of Trade and Industry 60 001 600 50.001%<br />

The National Insurance Fund 10 307 733 8.590%<br />

Arendals Fossekompani ASA 9 552 796 7.961%<br />

MP Pensjon 4 812 800 4.011%<br />

Skagen Vekst 3 275 767 2.730%<br />

Orkla ASA 2 680 845 2.234%<br />

JP Morgan Chase Bank - nominee 1 985 040 1.654%<br />

Verdipapirfondet Odin Norden 1 855 504 1.546%<br />

Verdipapirfondet Odin Norge 1 808 032 1.507%<br />

BNP Paribas - nominee 830 299 0.691%<br />

Total 97 110 416 80.925%<br />

Other (stake < 0.69%) 22 889 584 19.075%<br />

Total number of shares 120 000 000 100.000%<br />

H) Significant accounting estimates<br />

KONGSBERG has a numer of financial instruments recgonised at fair<br />

value. When market prices are not to be observed directly through<br />

quoted prices, fair value is estimated by using a various models based on<br />

internal estimates or input from banks or other market participants.<br />

Assumtions for such valuations include spot prices, forward rates and<br />

yield curves. In recent years, the market has been in situation that has<br />

required a significant degree of judgement in the valuation of certain<br />

financial instruments.<br />

Assessments are always based on KONGSBERG’s own critical<br />

judgement, but it is likely that observable market inputs and assumtions<br />

will change over time. Such changes may affect the calculated values of<br />

financial instruments significantly, and result in gains and losses with<br />

impact on the income statement in future periods. How these changes<br />

will affect the income statement depends on the type of instrument and<br />

whether it is part of a hedging relation.<br />

Bank deposits contain funds related to withholding tax withdrawn from<br />

employees. Bank guaranties amounting to MNOK 207 (MNOK 188 in<br />

2010) have been furnished for these funds.<br />

The Group’s liquidity management is handled by the Group’s<br />

corporate treasury unit.<br />

Share capital<br />

At 31 December <strong>2011</strong>, the Group’s share capital consisted of 120 000 000 shares with a nominal value of NOK 1.25.<br />

Changes in share capital<br />

Type of change Date<br />

Number of<br />

shares<br />

Shareholders, by size of holding<br />

Number of<br />

shares<br />

Nominal<br />

value<br />

Amounts in<br />

MNOK<br />

Number of<br />

owners<br />

Adjustment<br />

factor<br />

Number of<br />

shares<br />

Share capital<br />

in MNOK<br />

Stock Exchange listing 13 Dec 1993 5 850 000 20 117 117<br />

Private placement with employees 1996 6 000 000 20 3 120<br />

Share split 1997 24 000 000 5 1:4 120<br />

Share issue 1999 30 000 000 5 30 150<br />

Share split 2009 120 000 000 1.25 1:4 150<br />

Holding<br />

percentage<br />

1–1 000 5 415 1 605 463 1.34%<br />

1 001–10 000 1 578 4 223 061 3.52%<br />

10 001–100 000 168 5 165 773 4.30%<br />

100 001–1 000 000 43 12 725 586 10.60%<br />

1 000 001–10 000 000 7 25 970 784 21.64%<br />

Over 10 000 000 2 70 309 333 58.59%<br />

Total 7 213 120 000 000 100.00%<br />

By the 7 213 share holders at 31 December <strong>2011</strong>, 740 foreign shareholders<br />

owned a total of 8.69 per cent of the shares.