Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

19<br />

40 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

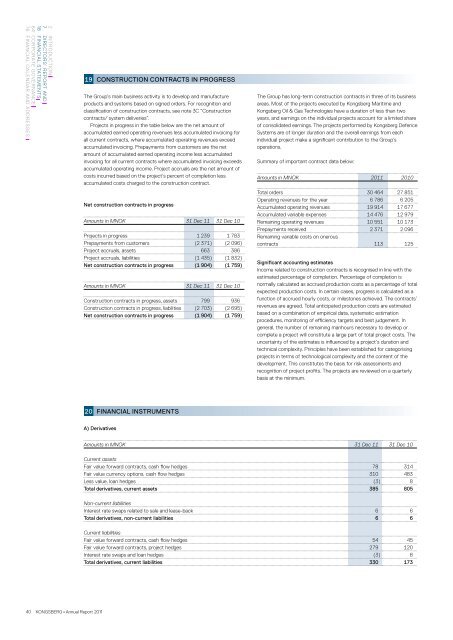

CONSTRUCTION CONTRACTS IN PROGRESS<br />

The Group’s main business activity is to develop and manufacture<br />

products and systems based on signed orders. For recognition and<br />

classification of construction contracts, see note 3C “Construction<br />

contracts/ system deliveries”.<br />

Projects in progress in the table below are the net amount of<br />

accumulated earned operating revenues less accumulated invoicing for<br />

all current contracts, where accumulated operating revenues exceed<br />

accumulated invoicing. Prepayments from customers are the net<br />

amount of accumulated earned operating income less accumulated<br />

invoicing for all current contracts where accumulated invoicing exceeds<br />

accumulated operating income. Project accruals are the net amount of<br />

costs incurred based on the project’s percent of completion less<br />

accumulated costs charged to the construction contract.<br />

Net construction contracts in progress<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

Projects in progress 1 239 1 783<br />

Prepayments from customers (2 371) (2 096)<br />

Project accruals, assets 663 386<br />

Project accruals, liabilities (1 435) (1 832)<br />

Net construction contracts in progress (1 904) (1 759)<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

Construction contracts in progress, assets 799 936<br />

Construction contracts in progress, liabilities (2 703) (2 695)<br />

Net construction contracts in progress (1 904) (1 759)<br />

20<br />

FINANCIAL INSTRUMENTS<br />

A) Derivatives<br />

The Group has long-term construction contracts in three of its business<br />

areas. Most of the projects executed by <strong>Kongsberg</strong> <strong>Maritime</strong> and<br />

<strong>Kongsberg</strong> Oil & Gas Technologies have a duration of less than two<br />

years, and earnings on the individual projects account for a limited share<br />

of consolidated earnings. The projects performed by <strong>Kongsberg</strong> Defence<br />

Systems are of longer duration and the overall earnings from each<br />

individual project make a significant contribution to the Group’s<br />

operations.<br />

Summary of important contract data below:<br />

Amounts in MNOK <strong>2011</strong> 2010<br />

Total orders 30 464 27 851<br />

Operating revenues for the year 6 786 6 205<br />

Accumulated operating revenues 19 914 17 677<br />

Accumulated variable expenses 14 476 12 979<br />

Remaining operating revenues 10 551 10 173<br />

Prepayments received 2 371 2 096<br />

Remaining variable costs on onerous<br />

contracts 113 125<br />

Significant accounting estimates<br />

Income related to construction contracts is recognised in line with the<br />

estimated percentage of completion. Percentage of completion is<br />

normally calculated as accrued production costs as a percentage of total<br />

expected production costs. In certain cases, progress is calculated as a<br />

function of accrued hourly costs, or milestones achieved. The contracts’<br />

revenues are agreed. Total anticipated production costs are estimated<br />

based on a combination of empirical data, systematic estimation<br />

procedures, monitoring of efficiency targets and best judgement. In<br />

general, the number of remaining manhours necessary to develop or<br />

complete a project will constitute a large part of total project costs. The<br />

uncertainty of the estimates is influenced by a project’s duration and<br />

technical complexity. Principles have been established for categorising<br />

projects in terms of technological complexity and the content of the<br />

development. This constitutes the basis for risk assessments and<br />

recognition of project profits. The projects are reviewed on a quarterly<br />

basis at the minimum.<br />

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

Current assets<br />

Fair value forward contracts, cash flow hedges 78 314<br />

Fair value currency options, cash flow hedges 310 483<br />

Less value, loan hedges (3) 8<br />

Total derivatives, current assets 385 805<br />

Non-current liabilities<br />

Interest rate swaps related to sale and lease-back 6 6<br />

Total derivatives, non-current liabilities 6 6<br />

Current liabilities<br />

Fair value forward contracts, cash flow hedges 54 45<br />

Fair value forward contracts, project hedges 279 120<br />

Interest rate swaps and loan hedges (3) 8<br />

Total derivatives, current liabilities 330 173