Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

44 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

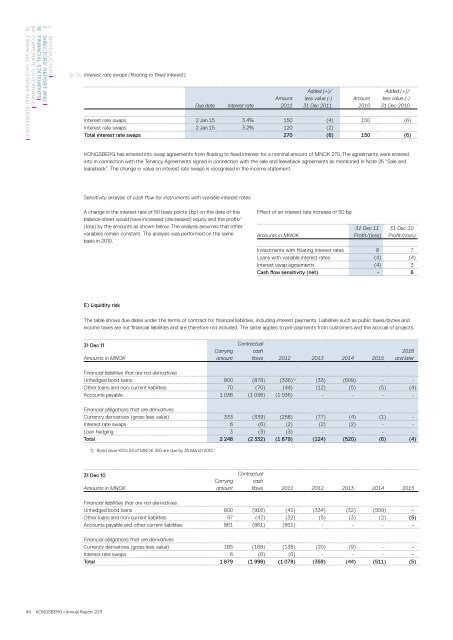

Interest rate swaps (floating to fixed interest)<br />

A change in the interest rate of 50 basis points (bp) on the date of the<br />

balance sheet would have increased (decreased) equity and the profit/<br />

(loss) by the amounts as shown below. The analysis assumes that other<br />

variables remain constant. The analysis was performed on the same<br />

basis in 2010.<br />

E) Liquidity risk<br />

Effect of an interest rate increase of 50 bp:<br />

Amounts in MNOK<br />

31 Dec 11<br />

Profit/(loss)<br />

31 Dec 10<br />

Profit/(loss)<br />

Investments with floating interest rates 8 7<br />

Loans with variable interest rates (4) (4)<br />

Interest swap agreements (4) 3<br />

Cash flow sensitivity (net) - 6<br />

The table shows due dates under the terms of contract for financial liabilities, including interest payments. Liabilities such as public taxes/duties and<br />

income taxes are not financial liabilities and are therefore not included. The same applies to pre-payments from customers and the accrual of projects.<br />

31 Dec 11<br />

Amounts in MNOK<br />

Carrying<br />

amount<br />

Contractual<br />

cash<br />

flows 2012 2013 2014 2015<br />

2016<br />

and later<br />

Financial liabilities that are not derivatives<br />

Unhedged bond loans 800 (878) (336) 1) (33) (509) - -<br />

Other loans and non-current liabilities 70 (70) (44) (12) (5) (5) (4)<br />

Accounts payable 1 036 (1 036) (1 036) - - - -<br />

Financial obligations that are derivatives<br />

Currency derivatives (gross less value) 333 (339) (258) (77) (4) (1) -<br />

Interest rate swaps 6 (6) (2) (2) (2) - -<br />

Loan hedging 3 (3) (3) - - - -<br />

Total 2 248 (2 332) (1 679) (124) (520) (6) (4)<br />

1) Bond issue KOG 04 of MNOK 300 are due by 30 March 2012.<br />

31 Dec 10<br />

Amounts in MNOK<br />

Due date Interest rate<br />

Carrying<br />

amount<br />

Amount<br />

<strong>2011</strong><br />

Added (+)/<br />

less value (-)<br />

31 Dec <strong>2011</strong><br />

Amount<br />

2010<br />

Added (+)/<br />

less value (-)<br />

31 Dec 2010<br />

Interest rate swaps 2 Jan 15 3.4% 150 (4) 150 (6)<br />

Interest rate swaps 2 Jan 15 3.2% 120 (2)<br />

Total interest rate swaps 270 (6) 150 (6)<br />

KONGSBERG has entered into swap agreements from floating to fixed interest for a nominal amount of MNOK 270. The agreements were entered<br />

into in connection with the Tenancy Agreements signed in connection with the sale and leaseback agreements as mentioned in Note 26 “Sale and<br />

leaseback”. The change in value on interest rate swaps is recognised in the income statement.<br />

Sensitivity analysis of cash flow for instruments with variable interest rates<br />

Contractual<br />

cash<br />

flows <strong>2011</strong> 2012 2013 2014 2015<br />

Financial liabilities that are not derivatives<br />

Unhedged bond loans 800 (916) (41) (334) (32) (509) -<br />

Other loans and non-current liabilities 47 (47) (32) (5) (3) (2) (5)<br />

Accounts payable and other current liabilities 861 (861) (861) - - - -<br />

Financial obligations that are derivatives<br />

Currency derivatives (gross less value) 165 (168) (138) (20) (9) - -<br />

Interest rate swaps 6 (6) (6) - - - -<br />

Total 1 879 (1 998) (1 078) (359) (44) (511) (5)