Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

Annual Report 2011 - Kongsberg Maritime - Kongsberg Gruppen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 INTRODUCTION<br />

7 DIRECTORS’ REPORT AND<br />

18 FINANCIAL STATEMENTS<br />

64 CORPORATE GOVERNANCE<br />

76 FINANCIAL CALENDAR AND ADDRESSES<br />

12<br />

36 KONGSBERG <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

Significant accounting estimates<br />

Capitalised development projects are amortised according to the<br />

esti mated volume production or lifetime. Both estimated volume<br />

pro duction or lifetime could change over time. When testing the value<br />

of capitalised developement costs the Group applies the same principles<br />

and methods as used in impairment tests conducted. To estimate the<br />

uncertainity associated to this matter, see note 12 “Impairment test of<br />

goodwill”.<br />

IMPAIRMENT OF GOODWILL<br />

Goodwill<br />

Goodwill obtained through acquisitions is allocated to the Group’s<br />

operating segments and followed up and tested collectively for the<br />

group of cash-generating units that constitute the operating segment.<br />

Goodwill is followed up for groups of cash-generating units that are<br />

similar to what is defined as the operating segment pursuant to note 6<br />

“Segment information”.<br />

Goodwill is assigned to operating segments as follows:<br />

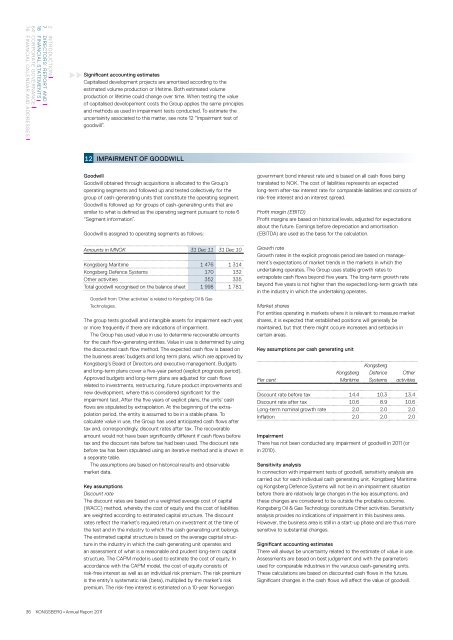

Amounts in MNOK 31 Dec 11 31 Dec 10<br />

<strong>Kongsberg</strong> <strong>Maritime</strong> 1 476 1 314<br />

<strong>Kongsberg</strong> Defence Systems 170 132<br />

Other activities 352 335<br />

Total goodwill recognised on the balance sheet 1 998 1 781<br />

Goodwill from ‘Other activities’ is related to <strong>Kongsberg</strong> Oil & Gas<br />

Technologies.<br />

The group tests goodwill and intangible assets for impairment each year,<br />

or more frequently if there are indications of impairment.<br />

The Group has used value in use to determine recoverable amounts<br />

for the cash flow-generating entities. Value in use is determined by using<br />

the discounted cash flow method. The expected cash flow is based on<br />

the business areas’ budgets and long term plans, which are approved by<br />

<strong>Kongsberg</strong>’s Board of Directors and executive management. Budgets<br />

and long-term plans cover a five-year period (explicit prognosis period).<br />

Approved budgets and long-term plans are adjusted for cash flows<br />

related to investments, restructuring, future product improvements and<br />

new development, where this is considered significant for the<br />

impairment test. After the five years of explicit plans, the units’ cash<br />

flows are stipulated by extrapolation. At the beginning of the extrapolation<br />

period, the entity is assumed to be in a stable phase. To<br />

calculate value in use, the Group has used anticipated cash flows after<br />

tax and, correspondingly, discount rates after tax. The recoverable<br />

amount would not have been significantly different if cash flows before<br />

tax and the discount rate before tax had been used. The discount rate<br />

before tax has been stipulated using an iterative method and is shown in<br />

a separate table.<br />

The assumptions are based on historical results and observable<br />

market data.<br />

Key assumptions<br />

Discount rate<br />

The discount rates are based on a weighted average cost of capital<br />

(WACC) method, whereby the cost of equity and the cost of liabilities<br />

are weighted according to estimated capital structure. The discount<br />

rates reflect the market’s required return on investment at the time of<br />

the test and in the industry to which the cash generating unit belongs.<br />

The estimated capital structure is based on the average capital structure<br />

in the industry in which the cash generating unit operates and<br />

an assessment of what is a reasonable and prudent long-term capital<br />

structure. The CAPM model is used to estimate the cost of equity. In<br />

accordance with the CAPM model, the cost of equity consists of<br />

risk-free interest as well as an individual risk premium. The risk premium<br />

is the entity’s systematic risk (beta), multiplied by the market’s risk<br />

premium. The risk-free interest is estimated on a 10-year Norwegian<br />

government bond interest rate and is based on all cash flows being<br />

translated to NOK. The cost of liabilities represents an expected<br />

long-term after-tax interest rate for comparable liabilities and consists of<br />

risk-free interest and an interest spread.<br />

Profit margin (EBITD)<br />

Profit margins are based on historical levels, adjusted for expectations<br />

about the future. Earnings before depreciation and amortisation<br />

(EBITDA) are used as the basis for the calculation.<br />

Growth rate<br />

Growth rates in the explicit prognosis period are based on management’s<br />

expectations of market trends in the markets in which the<br />

undertaking operates. The Group uses stable growth rates to<br />

extrapolate cash flows beyond five years. The long-term growth rate<br />

beyond five years is not higher than the expected long-term growth rate<br />

in the industry in which the undertaking operates.<br />

Market shares<br />

For entities operating in markets where it is relevant to measure market<br />

shares, it is expected that established positions will generally be<br />

maintained, but that there might occure increases and setbacks in<br />

certain areas.<br />

Key assumptions per cash generating unit<br />

Per cent<br />

<strong>Kongsberg</strong><br />

<strong>Maritime</strong><br />

<strong>Kongsberg</strong><br />

Defence<br />

Systems<br />

Other<br />

activities<br />

Discount rate before tax 14.4 10.3 13.4<br />

Discount rate after tax 10.6 8.9 10.6<br />

Long-term nominal growth rate 2.0 2.0 2.0<br />

Inflation 2.0 2.0 2.0<br />

Impairment<br />

There has not been conducted any impairment of goodwill in <strong>2011</strong> (or<br />

in 2010).<br />

Sensitivity analysis<br />

In connection with impairment tests of goodwill, sensitivity analysis are<br />

carried out for each individual cash generating unit. <strong>Kongsberg</strong> <strong>Maritime</strong><br />

og <strong>Kongsberg</strong> Defence Systems will not be in an impairment situation<br />

before there are relatively large changes in the key assumptions, and<br />

these changes are considered to be outside the probable outcome.<br />

<strong>Kongsberg</strong> Oil & Gas Technology constitute Other activities. Sensitivity<br />

analysis provides no indications of impairment in this business area.<br />

However, the business area is still in a start-up phase and are thus more<br />

sensitive to substantial changes.<br />

Significant accounting estimates<br />

There will always be uncertainty related to the estimate of value in use.<br />

Assessments are based on best judgement and with the parameters<br />

used for comparable industries in the varuious cash-generating units.<br />

These calculations are based on discounted cash flows in the future.<br />

Significant changes in the cash flows will affect the value of goodwill.