Amparo Castelló-Climent, Universidad Carlos III de Madrid ... - Ivie

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

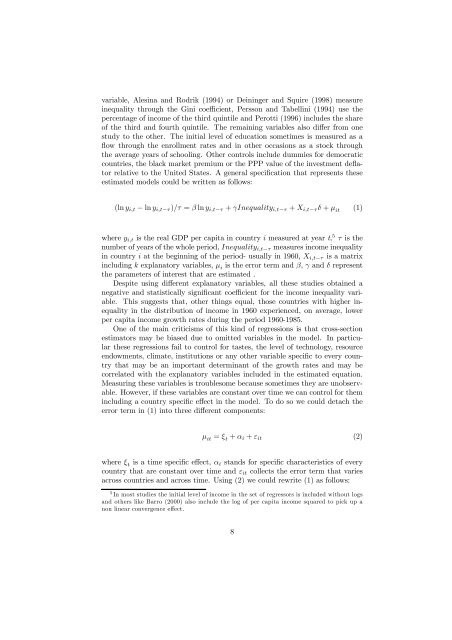

variable, Alesina and Rodrik (1994) or Deininger and Squire (1998) measure<br />

inequality through the Gini coefficient, Persson and Tabellini (1994) use the<br />

percentage of income of the third quintile and Perotti (1996) inclu<strong>de</strong>s the share<br />

of the third and fourth quintile. The remaining variables also differ from one<br />

study to the other. The initial level of education sometimes is measured as a<br />

flow through the enrollment rates and in other occasions as a stock through<br />

the average years of schooling. Other controls inclu<strong>de</strong> dummies for <strong>de</strong>mocratic<br />

countries, the black market premium or the PPP value of the investment <strong>de</strong>flator<br />

relative to the United States. A general specification that represents these<br />

estimated mo<strong>de</strong>ls could be written as follows:<br />

(ln y i,t − ln y i,t−τ )/τ = β ln y i,t−τ + γInequality i,t−τ + X i,t−τ δ + µ it (1)<br />

where y i,t is the real GDP per capita in country i measured at year t, 5 τ is the<br />

number of years of the whole period, Inequality i,t−τ measures income inequality<br />

in country i at the beginning of the period- usually in 1960, X i,t−τ is a matrix<br />

including k explanatory variables, µ i istheerrortermandβ, γ and δ represent<br />

the parameters of interest that are estimated .<br />

Despite using different explanatory variables, all these studies obtained a<br />

negative and statistically significant coefficient for the income inequality variable.<br />

This suggests that, other things equal, those countries with higher inequality<br />

in the distribution of income in 1960 experienced, on average, lower<br />

per capita income growth rates during the period 1960-1985.<br />

One of the main criticisms of this kind of regressions is that cross-section<br />

estimators may be biased due to omitted variables in the mo<strong>de</strong>l. In particular<br />

these regressions fail to control for tastes, the level of technology, resource<br />

endowments, climate, institutions or any other variable specific toeverycountry<br />

that may be an important <strong>de</strong>terminant of the growth rates and may be<br />

correlated with the explanatory variables inclu<strong>de</strong>d in the estimated equation.<br />

Measuring these variables is troublesome because sometimes they are unobservable.<br />

However, if these variables are constant over time we can control for them<br />

including a country specific effect in the mo<strong>de</strong>l. To do so we could <strong>de</strong>tach the<br />

error term in (1) into three different components:<br />

µ it = ξ t + α i + ε it (2)<br />

where ξ t is a time specific effect, α i stands for specific characteristics of every<br />

country that are constant over time and ε it collects the error term that varies<br />

across countries and across time. Using (2) we could rewrite (1) as follows:<br />

5 In most studies the initial level of income in the set of regressors is inclu<strong>de</strong>d without logs<br />

and others like Barro (2000) also inclu<strong>de</strong> the log of per capita income squared to pick up a<br />

non linear convergence effect.<br />

8