Truckload Authority - Winter 2014/15

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Truckload</strong> trends crucial to you and your business @ DAT.com<br />

T<br />

he latest news on the economic<br />

front shows 3.9% GDP growth<br />

in the 3rd quarter, the second<br />

consecutive quarter of the strongest<br />

economic growth since the recent<br />

recession. The economy is also<br />

recovering from last year’s disastrous<br />

winter, when truck shortages led to<br />

market rate increases of more than<br />

10%. Contract rates also rose after a<br />

long period of stability.<br />

Far-Reaching Regulatory Changes<br />

in 2013 – New EPA regulations and<br />

ultra-low sulfur diesel hurt fuel economy<br />

and engine manufacturing expenses<br />

rose, while costs soared for tires and<br />

other supplies. Hours of Service (HOS)<br />

changes in mid-2013 also hampered<br />

driver productivity, leading to wage<br />

increases that may or may not stabilize<br />

the outflow of experienced drivers from<br />

the industry.<br />

Impact of Pre-Existing Regulations<br />

- Driver recruitment and retention<br />

were also affected by CSA safety<br />

scoring. CSA considerations helped to<br />

boost driver turnover levels back above<br />

100%, as companies seek to shed<br />

drivers with poor scores and recruit<br />

drivers with above-average scores.<br />

Environmental regulations from the<br />

California Air Resources Board (CARB)<br />

increased operating costs on trips to/<br />

from and within California, home to the<br />

country’s two largest ports, its largest<br />

agricultural centers and many important<br />

freight markets. As the economy<br />

improved, drivers and prospective<br />

drivers sought work in the higherpaying<br />

sectors of construction and<br />

energy exploration. Driver shortages<br />

plague fleets of all sizes, making it<br />

difficult to expand when currently<br />

owned equipment lacks drivers.<br />

Freight Rates Become<br />

Unpredictable - Most transportation<br />

and logistics professionals pride<br />

themselves on their ability to set<br />

pricing and anticipate costs. Recent<br />

events, including changes in the<br />

regulatory and economic environment,<br />

as well as weather, have confounded<br />

the most sophisticated pricing models,<br />

however, as they depend on extended<br />

trends in historic data. DAT has been<br />

In partnership with<br />

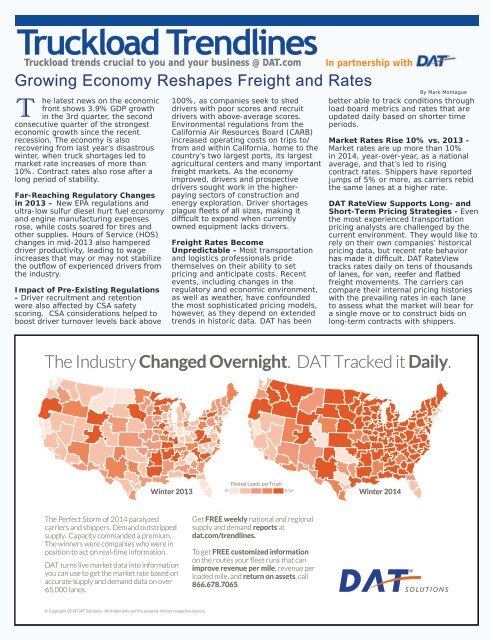

Growing Economy Reshapes Freight and Rates<br />

By Mark Montague<br />

better able to track conditions through<br />

load board metrics and rates that are<br />

updated daily based on shorter time<br />

periods.<br />

Market Rates Rise 10% vs. 2013 -<br />

Market rates are up more than 10%<br />

in <strong>2014</strong>, year-over-year, as a national<br />

average, and that’s led to rising<br />

contract rates. Shippers have reported<br />

jumps of 5% or more, as carriers rebid<br />

the same lanes at a higher rate.<br />

DAT RateView Supports Long- and<br />

Short-Term Pricing Strategies - Even<br />

the most experienced transportation<br />

pricing analysts are challenged by the<br />

current environment. They would like to<br />

rely on their own companies’ historical<br />

pricing data, but recent rate behavior<br />

has made it difficult. DAT RateView<br />

tracks rates daily on tens of thousands<br />

of lanes, for van, reefer and flatbed<br />

freight movements. The carriers can<br />

compare their internal pricing histories<br />

with the prevailing rates in each lane<br />

to assess what the market will bear for<br />

a single move or to construct bids on<br />

long-term contracts with shippers.