Supervisory Banking Statistics

supervisorybankingstatistics_third_quarter_2016_201701.en

supervisorybankingstatistics_third_quarter_2016_201701.en

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

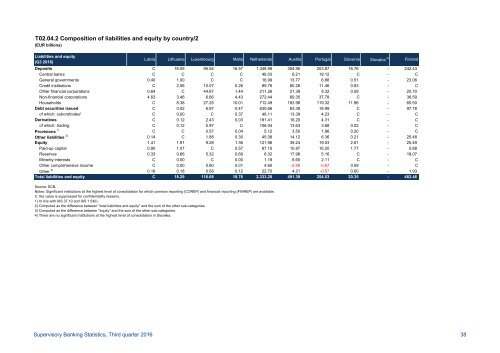

T02.04.2 Composition of liabilities and equity by country/2<br />

(EUR billions)<br />

Liabilities and equity<br />

(Q3 2016)<br />

Latvia Lithuania Luxembourg Malta Netherlands Austria Portugal Slovenia Slovakia 4) Finland<br />

Deposits C 16.05 95.54 16.57 1,348.98 354.95 203.87 16.76 - 242.43<br />

Central banks C C C C 46.03 6.21 19.12 C - C<br />

General governments 0.40 1.00 C C 16.99 13.77 6.86 0.51 - 23.06<br />

Credit institutions C 2.56 10.07 0.26 89.76 60.26 11.46 0.83 - C<br />

Other financial corporations 0.64 C 44.67 1.44 211.26 21.39 9.32 0.59 - 20.70<br />

Non-financial corporations 4.63 3.46 6.66 4.43 272.44 69.35 37.78 C - 36.59<br />

Households C 8.38 27.25 10.01 712.49 183.98 119.32 11.96 - 65.50<br />

Debt securities issued C 0.02 6.97 0.47 630.66 63.38 18.99 C - 97.78<br />

of which: subordinated C 0.00 C 0.37 46.11 13.39 4.23 C - C<br />

Derivatives C 0.12 2.43 0.03 181.41 16.20 4.31 C - C<br />

of which: trading C 0.12 0.97 C 106.04 13.63 3.68 0.02 - C<br />

Provisions 1) C C 0.57 0.04 5.12 3.50 1.96 0.20 - C<br />

Other liabilities 2) 0.14 C 1.88 0.30 45.08 14.12 6.36 0.21 - 25.48<br />

Equity 1.41 1.91 9.28 1.36 121.96 39.24 19.03 2.81 - 25.49<br />

Paid-up capital 0.90 1.07 C 0.57 87.15 10.87 16.20 1.77 - 5.88<br />

Reserves 0.33 0.66 5.32 0.66 6.32 17.98 5.16 C - 18.07<br />

Minority interests C 0.00 C 0.00 1.18 8.65 2.11 C - C<br />

Other comprehensive income C 0.00 0.80 0.01 4.60 -2.48 -3.87 0.09 - C<br />

Other 3) 0.18 0.18 0.58 0.12 22.70 4.21 -0.57 0.60 - 1.93<br />

Total liabilities and equity C 18.29 116.68 18.76 2,333.20 491.39 254.53 20.35 - 482.46<br />

Source: ECB.<br />

Notes: Significant institutions at the highest level of consolidation for which common reporting (COREP) and financial reporting (FINREP) are available.<br />

C: the value is suppressed for confidentiality reasons.<br />

1) In line with IAS 37.10 and IAS 1.54(l).<br />

2) Computed as the difference between "total liabilities and equity" and the sum of the other sub-categories.<br />

3) Computed as the difference between "equity" and the sum of the other sub-categories.<br />

4) There are no significant institutions at the highest level of consolidation in Slovakia.<br />

<strong>Supervisory</strong> <strong>Banking</strong> <strong>Statistics</strong>, Third quarter 2016 38