Supervisory Banking Statistics

supervisorybankingstatistics_third_quarter_2016_201701.en

supervisorybankingstatistics_third_quarter_2016_201701.en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

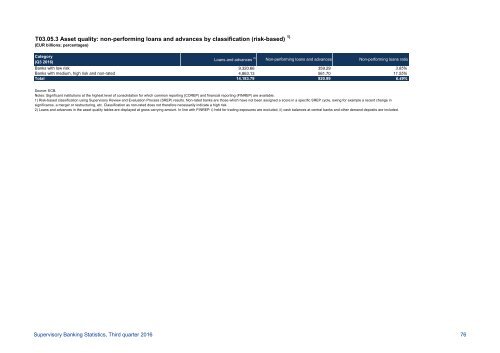

T03.05.3 Asset quality: non‐performing loans and advances by classification (risk-based) 1)<br />

(EUR billions; percentages)<br />

Category<br />

(Q3 2016)<br />

Loans and advances 2) Non-performing loans and advances Non-performing loans ratio<br />

Banks with low risk 9,320.66 359.29 3.85%<br />

Banks with medium, high risk and non-rated 4,863.13 561.70 11.55%<br />

Total 14,183.79 920.99 6.49%<br />

Source: ECB.<br />

Notes: Significant institutions at the highest level of consolidation for which common reporting (COREP) and financial reporting (FINREP) are available.<br />

1) Risk-based classification using <strong>Supervisory</strong> Review and Evaluation Process (SREP) results. Non-rated banks are those which have not been assigned a score in a specific SREP cycle, owing for example a recent change in<br />

significance, a merger or restructuring, etc. Classification as non-rated does not therefore necessarily indicate a high risk.<br />

2) Loans and advances in the asset quality tables are displayed at gross carrying amount. In line with FINREP: i) held for trading exposures are excluded, ii) cash balances at central banks and other demand deposits are included.<br />

<strong>Supervisory</strong> <strong>Banking</strong> <strong>Statistics</strong>, Third quarter 2016 76