Supervisory Banking Statistics

supervisorybankingstatistics_third_quarter_2016_201701.en

supervisorybankingstatistics_third_quarter_2016_201701.en

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

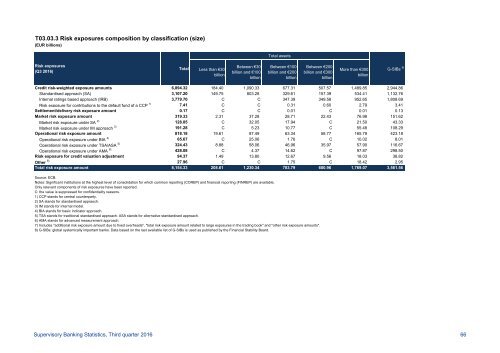

T03.03.3 Risk exposures composition by classification (size)<br />

(EUR billions)<br />

Total assets<br />

Risk exposures<br />

(Q3 2016)<br />

Total<br />

Less than €30<br />

billion<br />

Between €30<br />

billion and €100<br />

billion<br />

Between €100<br />

billion and €200<br />

billion<br />

Between €200<br />

billion and €300<br />

billion<br />

More than €300<br />

billion<br />

G-SIBs 8)<br />

Credit risk-weighted exposure amounts 6,894.32 184.40 1,090.33 677.31 507.57 1,489.85 2,944.86<br />

Standardised approach (SA) 3,107.20 149.75 803.28 329.61 157.39 534.41 1,132.76<br />

Internal ratings based approach (IRB) 3,779.70 C C 347.39 349.58 952.65 1,808.69<br />

Risk exposure for contributions to the default fund of a CCP 1) 7.41 C C 0.31 0.60 2.79 3.41<br />

Settlement/delivery risk exposure amount 0.17 C C 0.01 C 0.01 0.13<br />

Market risk exposure amount 319.33 2.31 37.28 28.71 22.43 76.98 151.62<br />

Market risk exposure under SA 2) 128.05 C 32.05 17.94 C 21.50 43.33<br />

Market risk exposure under IM approach 3) 191.28 C 5.23 10.77 C 55.48 108.29<br />

Operational risk exposure amount 818.18 19.61 87.49 63.34 58.77 165.79 423.18<br />

Operational risk exposure under BIA 4) 65.67 C 25.06 1.76 C 10.02 8.01<br />

Operational risk exposure under TSA/ASA 5) 324.43 8.88 58.06 46.96 35.97 57.90 116.67<br />

Operational risk exposure under AMA 6) 428.08 C 4.37 14.62 C 97.87 298.50<br />

Risk exposure for credit valuation adjustment 94.37 1.49 13.80 12.67 9.56 18.03 38.82<br />

Other 7) 27.96 C C 1.75 C 18.42 2.95<br />

Total risk exposure amount 8,154.33 208.61 1,230.34 783.79 600.96 1,769.07 3,561.56<br />

Source: ECB.<br />

Notes: Significant institutions at the highest level of consolidation for which common reporting (COREP) and financial reporting (FINREP) are available.<br />

Only relevant components of risk exposures have been reported.<br />

C: the value is suppressed for confidentiality reasons.<br />

1) CCP stands for central counterparty.<br />

2) SA stands for standardised appraoch.<br />

3) IM stands for internal model.<br />

4) BIA stands for basic indicator approach.<br />

5) TSA stands for traditional standardised approach. ASA stands for alternative standardised approach.<br />

6) AMA stands for advanced measurement approach.<br />

7) Includes "additional risk exposure amount due to fixed overheads", "total risk exposure amount related to large exposures in the trading book" and "other risk exposure amounts".<br />

8) G-SIBs: global systemically important banks. Data based on the last available list of G-SIBs is used as published by the Financial Stability Board.<br />

<strong>Supervisory</strong> <strong>Banking</strong> <strong>Statistics</strong>, Third quarter 2016 66