Supervisory Banking Statistics

supervisorybankingstatistics_third_quarter_2016_201701.en

supervisorybankingstatistics_third_quarter_2016_201701.en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

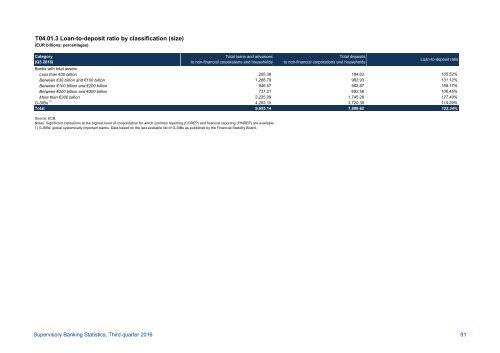

T04.01.3 Loan-to-deposit ratio by classification (size)<br />

(EUR billions; percentages)<br />

Category<br />

(Q3 2016)<br />

Total loans and advances<br />

to non-financial corporations and households<br />

Total deposits<br />

to non-financial corporations and households<br />

Loan-to-deposit ratio<br />

Banks with total assets<br />

Less than €30 billion 205.39 194.63 105.52%<br />

Between €30 billion and €100 billion 1,288.79 982.93 131.12%<br />

Between €100 billion and €200 billion 946.57 562.87 168.17%<br />

Between €200 billion and €300 billion 737.21 692.56 106.45%<br />

More than €300 billion 2,225.09 1,745.28 127.49%<br />

G-SIBs 1) 4,252.10 3,720.35 114.29%<br />

Total 9,655.14 7,898.62 122.24%<br />

Source: ECB.<br />

Notes: Significant institutions at the highest level of consolidation for which common reporting (COREP) and financial reporting (FINREP) are available.<br />

1) G-SIBs: global systemically important banks. Data based on the last available list of G-SIBs as published by the Financial Stability Board.<br />

<strong>Supervisory</strong> <strong>Banking</strong> <strong>Statistics</strong>, Third quarter 2016 91