1859 Spring 2010

1859 Spring 2010

1859 Spring 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Around Oregon<br />

sound off<br />

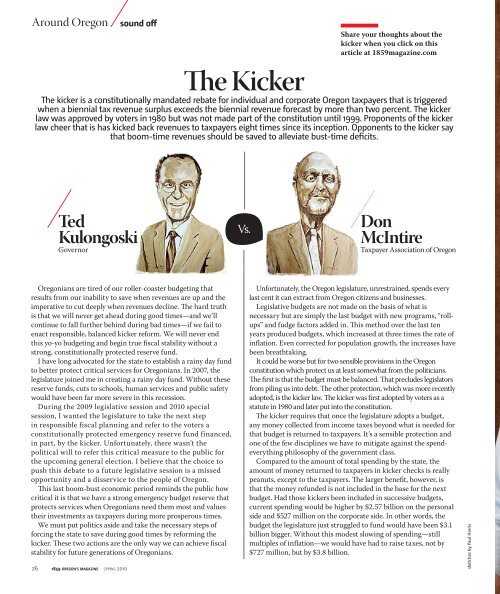

The Kicker<br />

Share your thoughts about the<br />

kicker when you click on this<br />

article at <strong>1859</strong>magazine.com<br />

The kicker is a constitutionally mandated rebate for individual and corporate Oregon taxpayers that is triggered<br />

when a biennial tax revenue surplus exceeds the biennial revenue forecast by more than two percent. The kicker<br />

law was approved by voters in 1980 but was not made part of the constitution until 1999. Proponents of the kicker<br />

law cheer that is has kicked back revenues to taxpayers eight times since its inception. Opponents to the kicker say<br />

that boom-time revenues should be saved to alleviate bust-time deficits.<br />

Ted<br />

Kulongoski<br />

Governor<br />

Vs.<br />

Don<br />

McIntire<br />

Taxpayer Association of Oregon<br />

Oregonians are tired of our roller-coaster budgeting that<br />

results from our inability to save when revenues are up and the<br />

imperative to cut deeply when revenues decline. The hard truth<br />

is that we will never get ahead during good times—and we’ll<br />

continue to fall further behind during bad times—if we fail to<br />

enact responsible, balanced kicker reform. We will never end<br />

this yo-yo budgeting and begin true fiscal stability without a<br />

strong, constitutionally protected reserve fund.<br />

I have long advocated for the state to establish a rainy day fund<br />

to better protect critical services for Oregonians. In 2007, the<br />

legislature joined me in creating a rainy day fund. Without these<br />

reserve funds, cuts to schools, human services and public safety<br />

would have been far more severe in this recession.<br />

During the 2009 legislative session and <strong>2010</strong> special<br />

session, I wanted the legislature to take the next step<br />

in responsible fiscal planning and refer to the voters a<br />

constitutionally protected emergency reserve fund financed,<br />

in part, by the kicker. Unfortunately, there wasn’t the<br />

political will to refer this critical measure to the public for<br />

the upcoming general election. I believe that the choice to<br />

push this debate to a future legislative session is a missed<br />

opportunity and a disservice to the people of Oregon.<br />

This last boom-bust economic period reminds the public how<br />

critical it is that we have a strong emergency budget reserve that<br />

protects services when Oregonians need them most and values<br />

their investments as taxpayers during more prosperous times.<br />

We must put politics aside and take the necessary steps of<br />

forcing the state to save during good times by reforming the<br />

kicker. These two actions are the only way we can achieve fiscal<br />

stability for future generations of Oregonians.<br />

26 <strong>1859</strong> oregon's magazine spring <strong>2010</strong><br />

Unfortunately, the Oregon legislature, unrestrained, spends every<br />

last cent it can extract from Oregon citizens and businesses.<br />

Legislative budgets are not made on the basis of what is<br />

necessary but are simply the last budget with new programs, “rollups”<br />

and fudge factors added in. This method over the last ten<br />

years produced budgets, which increased at three times the rate of<br />

inflation. Even corrected for population growth, the increases have<br />

been breathtaking.<br />

It could be worse but for two sensible provisions in the Oregon<br />

constitution which protect us at least somewhat from the politicians.<br />

The first is that the budget must be balanced. That precludes legislators<br />

from piling us into debt. The other protection, which was more recently<br />

adopted, is the kicker law. The kicker was first adopted by voters as a<br />

statute in 1980 and later put into the constitution.<br />

The kicker requires that once the legislature adopts a budget,<br />

any money collected from income taxes beyond what is needed for<br />

that budget is returned to taxpayers. It’s a sensible protection and<br />

one of the few disciplines we have to mitigate against the spendeverything<br />

philosophy of the government class.<br />

Compared to the amount of total spending by the state, the<br />

amount of money returned to taxpayers in kicker checks is really<br />

peanuts, except to the taxpayers. The larger benefit, however, is<br />

that the money refunded is not included in the base for the next<br />

budget. Had those kickers been included in successive budgets,<br />

current spending would be higher by $2.57 billion on the personal<br />

side and $527 million on the corporate side. In other words, the<br />

budget the legislature just struggled to fund would have been $3.1<br />

billion bigger. Without this modest slowing of spending—still<br />

multiples of inflation—we would have had to raise taxes, not by<br />

$727 million, but by $3.8 billion.<br />

sketches by Paul Harris