The sharing economy

New opportunities, new questions Global Investor, 02/2015 Credit Suisse

New opportunities, new questions

Global Investor, 02/2015

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 2.15 — 21<br />

1,000 clubs across England. We nevertheless believe that the <strong>sharing</strong><br />

<strong>economy</strong> will not have a disrupting impact on the retail industry in the<br />

foreseeable future, and are not aware of any upcoming IPOs.<br />

Julie Saussier<br />

Research Analyst<br />

+41 44 333 12 56<br />

julie.saussier-clement@credit-suisse.com<br />

Conclusion<br />

<strong>The</strong> <strong>sharing</strong> <strong>economy</strong> is a reality. Over time, we can expect one or<br />

two successful platforms per market to emerge. Following the IPOs<br />

of small players, such as HomeAway and Zipcar in 2011, investors<br />

are now waiting for some of the <strong>sharing</strong>-<strong>economy</strong> companies that<br />

have built massive valuations in private markets to be the next to go<br />

public. Many start-ups remain private, raising huge sums in private<br />

deals. <strong>The</strong> best way to invest in these platforms remains the venture<br />

capital market. Valuations already appear to be on the high side for<br />

the bigger players as compared to Internet companies. But less-hyped<br />

smaller IPOs could come at more reasonable valuations.<br />

For the next five years, we expect only limited impact on market<br />

incumbents. Longer term, however, the <strong>sharing</strong> <strong>economy</strong> is likely to<br />

start having an impact, and established market players will need to find<br />

new ways to create value for customers. We conclude that the impact<br />

of the <strong>sharing</strong> <strong>economy</strong> will be highest for global automakers, while it<br />

is now having a positive effect on the recorded music industry.<br />

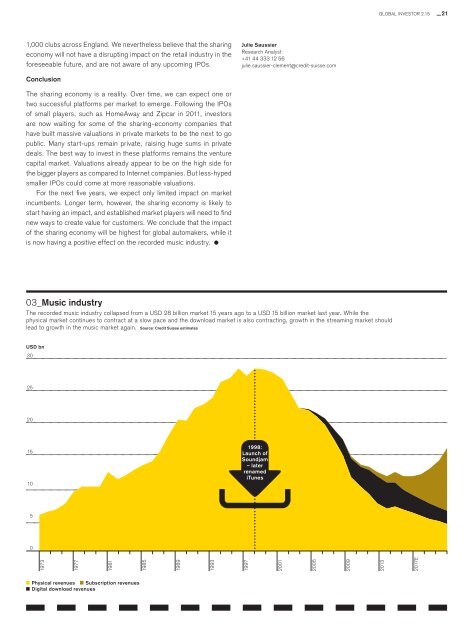

03_Music industry<br />

<strong>The</strong> recorded music industry collapsed from a USD 28 billion market 15 years ago to a USD 15 billion market last year. While the<br />

physical market continues to contract at a slow pace and the download market is also contracting, growth in the streaming market should<br />

lead to growth in the music market again. Source: Credit Suisse estimates<br />

USD bn<br />

30<br />

25<br />

20<br />

15<br />

10<br />

1998:<br />

Launch of<br />

Soundjam<br />

– later<br />

renamed<br />

iTunes<br />

5<br />

0<br />

1973<br />

1977<br />

1981<br />

1985<br />

1989<br />

1993<br />

1997<br />

2001<br />

2005<br />

2009<br />

2013<br />

2017E<br />

Physical revenues Subscription revenues<br />

Digital download revenues